- Germany

- /

- Aerospace & Defense

- /

- XTRA:TKMS

ThyssenKrupp Marine Systems (XTRA:TKMS): Valuation Spotlight Following Canadian Submarine Bid Progress

Reviewed by Simply Wall St

ThyssenKrupp Marine Systems (XTRA:TKMS) is drawing increased attention this week as it teams up with Kongsberg in a high-profile bid to supply Canada with a new fleet of Arctic-capable submarines. The project's momentum and its focus on long-term partnerships have fueled discussion among investors curious about its potential impact.

See our latest analysis for TKMS & Co KGaA.

After an early-year rally, momentum for TKMS & Co KGaA has faded. The stock has experienced a 21% decline in its 1-month share price return and is down 17.5% year-to-date. This recent volatility suggests that investors are recalibrating expectations as major contract negotiations progress and market sentiment shifts.

If major defense deals like this pique your interest, this is an ideal time to check out other promising names with our aerospace and defense stock screener: See the full list for free.

With shares now trading at a notable discount to analysts' targets and with impressive recent growth in both revenue and net income, investors are left to wonder: is TKMS undervalued, or has the market already accounted for future gains?

Most Popular Narrative: 44.2% Undervalued

TKMS & Co KGaA’s most-followed narrative sees the stock’s fair value far above its last close, which hints at substantial upside if its story plays out. This analysis is based on a discount rate of 10%, using detailed growth and margin assumptions provided by a defense-focused retail investor.

It can be said that TKMS has a dominant position in Europe, there is an arms boom underway, and the launch of a new arms company on the market is attractive; not many arms companies manufacture submarines. However, it is also necessary to bear in mind several limitations of this company, low margins, TKMS wants to reach an 8% margin in 2028, while, for example, the Rheinmetall arms manufacturer already has a 15% margin in 2025.

How does a stock command such a stark valuation gap? This narrative highlights aggressive operating margin expansion and dominant positioning in an exclusive defense niche. Want to uncover what drives the bold price target and see the full numbers behind the optimism? See what sets this valuation apart and why few defense peers can match the runway described here.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lower-than-expected contract wins or persistent margin pressure could quickly challenge the bullish outlook that is currently fueling TKMS investor optimism.

Find out about the key risks to this TKMS & Co KGaA narrative.

Another View: Multiples Tell a Different Story

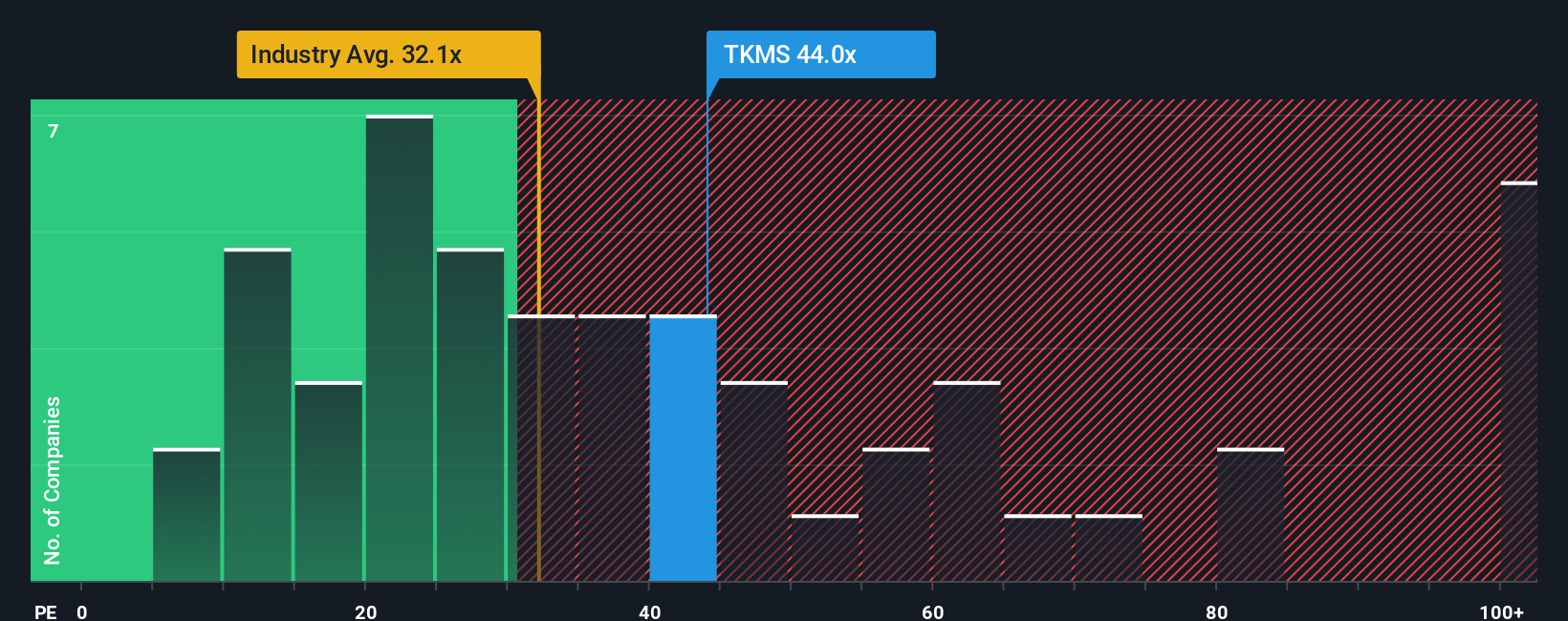

While the narrative points to deep value, the market’s favorite ratio tells investors to be cautious. TKMS currently trades at 44 times earnings, which is higher than the European defense industry average of 31.9x but lower than its peer average of 52.7x. This premium raises questions about how much future growth is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TKMS & Co KGaA Narrative

Readers who want to dig deeper or follow their own instincts can easily craft a TKMS valuation from the ground up in just a few minutes. Do it your way.

A great starting point for your TKMS & Co KGaA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that great opportunities rarely stay hidden. Give yourself an edge by checking out these dynamic stock ideas before the rest of the market catches on.

- Catch exciting breakthroughs and fresh momentum by sorting through these 25 AI penny stocks making waves in artificial intelligence and automation industries.

- Secure portfolio growth by tapping into these 933 undervalued stocks based on cash flows with high potential for upside that are trading below their intrinsic value right now.

- Grow your income stream by seeking out these 15 dividend stocks with yields > 3% offering reliable yields above 3% for investors who will not settle for ordinary returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKMS & Co KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKMS

TKMS & Co KGaA

Provides naval platforms and equipment in Germany, Brazil, Norway, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success