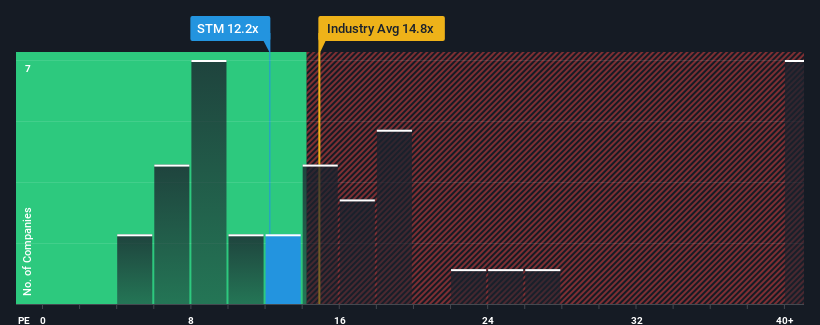

With a price-to-earnings (or "P/E") ratio of 12.2x Stabilus SE (ETR:STM) may be sending bullish signals at the moment, given that almost half of all companies in Germany have P/E ratios greater than 16x and even P/E's higher than 30x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Stabilus could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Stabilus

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Stabilus' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 23% over the next year. Meanwhile, the rest of the market is forecast to only expand by 20%, which is noticeably less attractive.

In light of this, it's peculiar that Stabilus' P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Stabilus' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Stabilus' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Stabilus (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:STM

Stabilus

Manufactures and sells gas springs, dampers, electromechanical damper opening systems, vibration isolation products, and industrial components in Europe, the Middle East, Africa, North and South America, the Asia-Pacific, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives