Revenues Tell The Story For Koenig & Bauer AG (ETR:SKB) As Its Stock Soars 32%

Despite an already strong run, Koenig & Bauer AG (ETR:SKB) shares have been powering on, with a gain of 32% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

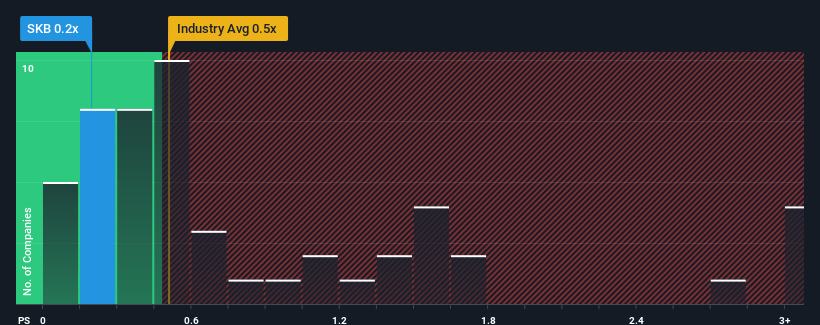

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Koenig & Bauer's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Germany is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Koenig & Bauer

What Does Koenig & Bauer's P/S Mean For Shareholders?

Koenig & Bauer could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Koenig & Bauer's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Koenig & Bauer's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 5.5% per annum as estimated by the six analysts watching the company. With the industry predicted to deliver 4.3% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Koenig & Bauer's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Koenig & Bauer's P/S

Koenig & Bauer's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Koenig & Bauer's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It is also worth noting that we have found 1 warning sign for Koenig & Bauer that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Koenig & Bauer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SKB

Koenig & Bauer

Develops and manufactures printing and postprint systems worldwide.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives