- Germany

- /

- Electrical

- /

- XTRA:PFSE

Exploring Undiscovered Gems in Europe This November 2025

Reviewed by Simply Wall St

As of November 2025, the European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 1.77%, buoyed by relief from the reopening of the U.S. federal government despite cooling sentiment on artificial intelligence. In this dynamic landscape, identifying promising stocks involves looking for companies that can navigate economic uncertainties and leverage opportunities within their sectors, making them potential undiscovered gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Inmocemento (BME:IMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inmocemento, S.A. operates in the cement and real estate sectors both within Spain and internationally, with a market capitalization of approximately €1.59 billion.

Operations: Inmocemento generates revenue primarily from its cement segment, which accounts for €651 million, and the real estate segment contributing €291 million. The company’s financial structure includes adjustments and eliminations that slightly affect overall revenue figures.

Inmocemento's earnings have surged by 62.6% over the past year, outpacing the Basic Materials industry's -2.5%. Trading at 60.7% below its estimated fair value, it presents a compelling opportunity for those seeking undervalued stocks. The company's net debt to equity ratio stands at a satisfactory 16.5%, indicating prudent financial management, while its interest payments are well covered with an EBIT coverage of 7.6 times. With high-quality earnings and positive free cash flow, Inmocemento appears to be in a strong position within its sector despite limited data on debt reduction over five years.

- Click here and access our complete health analysis report to understand the dynamics of Inmocemento.

Examine Inmocemento's past performance report to understand how it has performed in the past.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.09 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the Naturenergie brand in Switzerland and internationally.

Operations: Naturenergie generates revenue primarily from Customer-Oriented Energy Solutions (€912.90 million), Renewable Generation Infrastructure (€845.40 million), and System Relevant Infrastructure (€482.50 million).

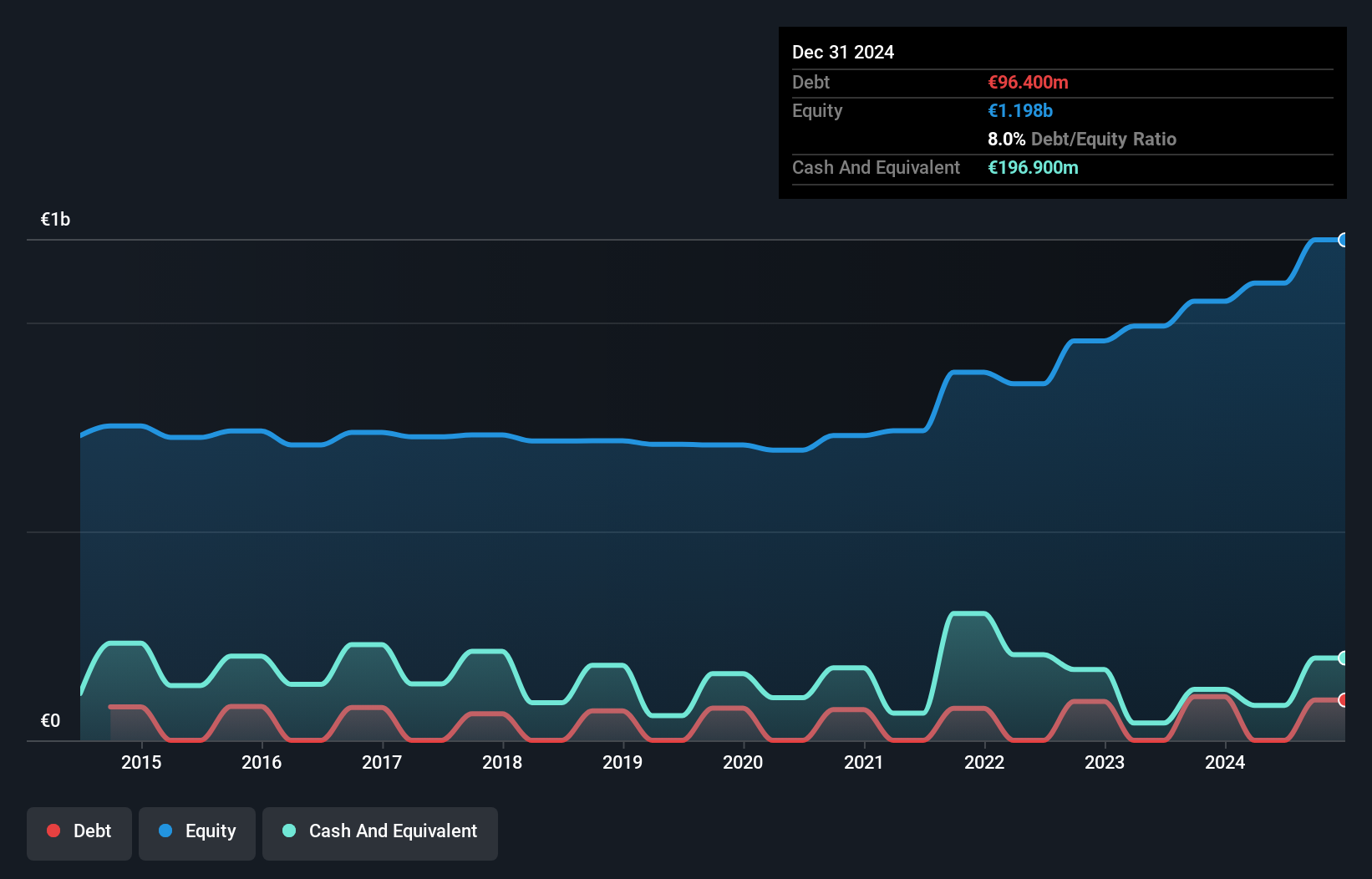

Naturenergie Holding, a small player in the European energy sector, showcases impressive financial health with no debt on its balance sheet. Its earnings surged by 48% over the past year, outpacing the broader Electric Utilities industry which saw a -3% performance. Despite this growth, future prospects appear tempered with forecasts suggesting an average annual earnings decline of 8.5% over three years. The company trades at a significant discount of 40% below estimated fair value compared to peers and industry standards, highlighting potential for value-seeking investors while maintaining high-quality earnings and positive free cash flow.

- Dive into the specifics of naturenergie holding here with our thorough health report.

Evaluate naturenergie holding's historical performance by accessing our past performance report.

PFISTERER Holding (XTRA:PFSE)

Simply Wall St Value Rating: ★★★★★☆

Overview: PFISTERER Holding SE specializes in manufacturing and selling cable fittings, insulators for overhead lines, and components for energy networks and renewable energy generation, with a market capitalization of €1.30 billion.

Operations: PFISTERER Holding SE generates revenue primarily from High Voltage Cable Accessories (€158.17 million) and Components (€102.73 million), with additional contributions from Overhead Lines (€86.46 million) and Medium Voltage Cable Accessories (€54.24 million).

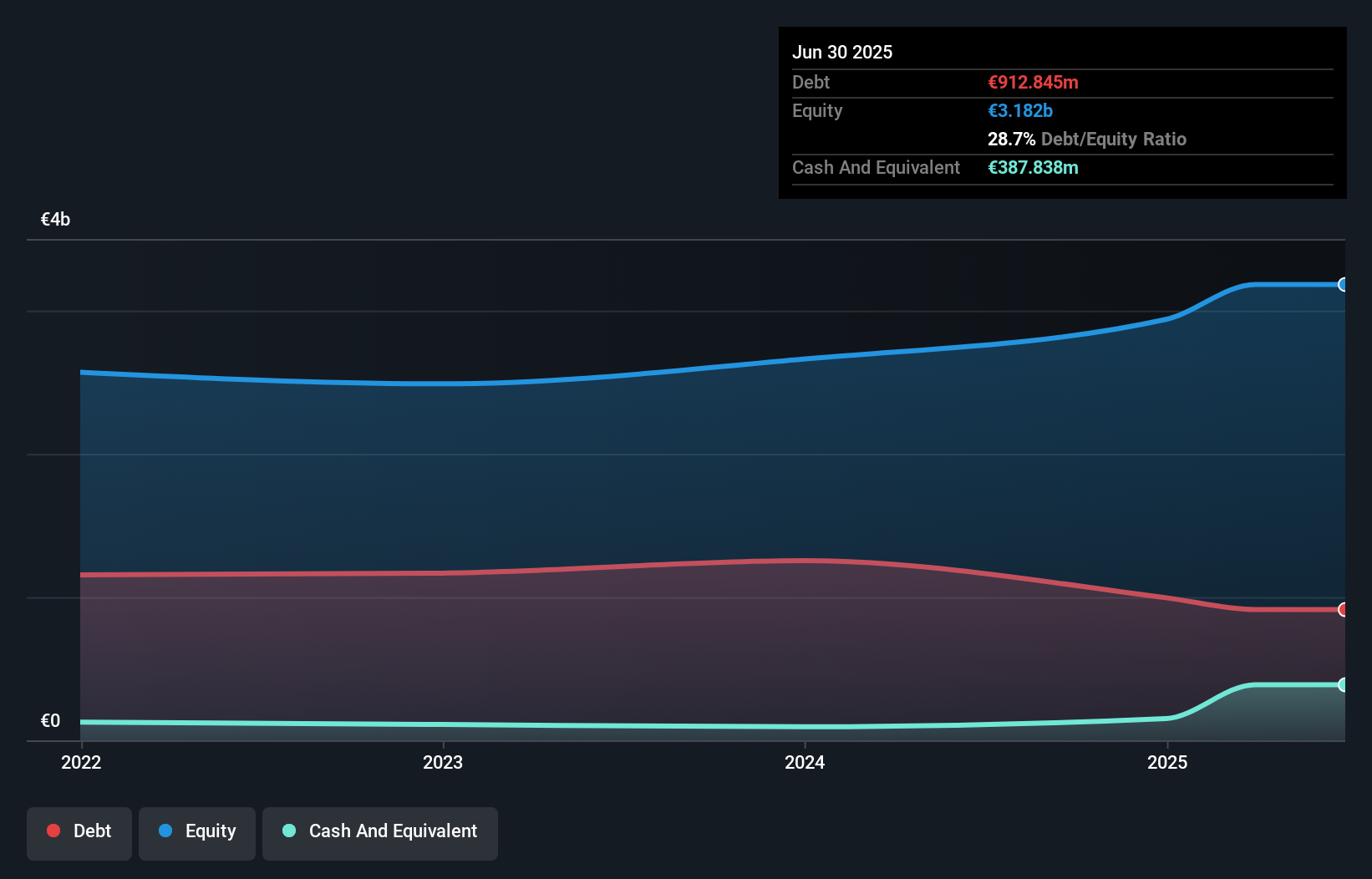

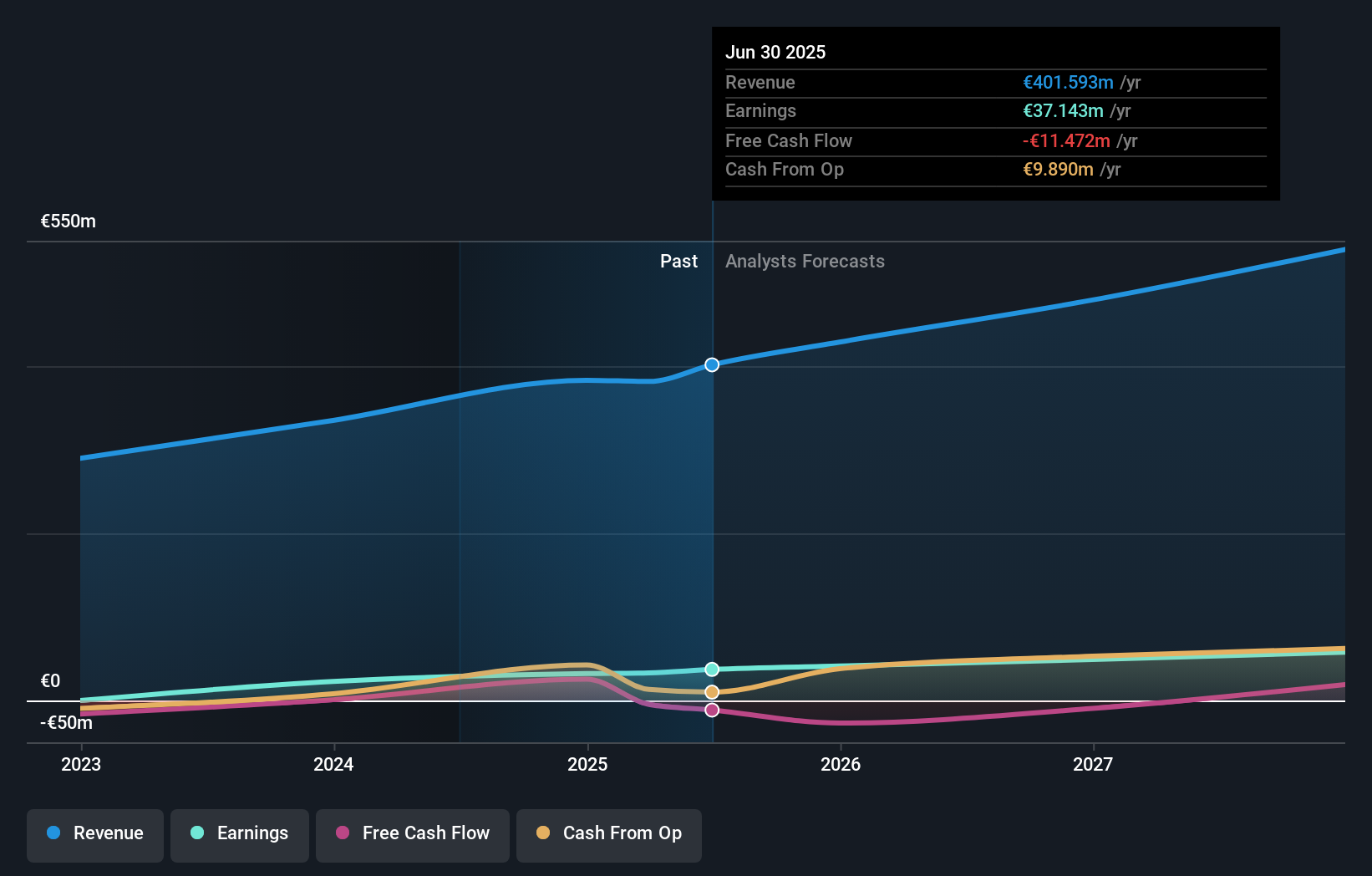

PFISTERER Holding, a notable name in the electrical industry, showcases a robust financial profile. The company reported an impressive 35.5% earnings growth over the past year, outpacing its industry peers. Its price-to-earnings ratio stands at 35x, which is attractive compared to the industry's average of 53.4x. With EBIT covering interest payments by 17.8 times, PFISTERER demonstrates solid debt management capabilities. Despite insufficient data on debt reduction over five years, it has more cash than total debt and maintains high-quality non-cash earnings. Earnings are projected to grow annually by 16%, indicating strong future prospects for this firm.

- Take a closer look at PFISTERER Holding's potential here in our health report.

Explore historical data to track PFISTERER Holding's performance over time in our Past section.

Summing It All Up

- Navigate through the entire inventory of 323 European Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PFSE

PFISTERER Holding

Manufactures and sells cable fittings, insulators for overhead lines, and associated components for sensitive interfaces in energy networks and renewable energy generation.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives