3 European Stocks Estimated To Be Undervalued By Up To 47.6%

Reviewed by Simply Wall St

As the European markets experience a modest upswing, with the pan-European STOXX Europe 600 Index rising by 1.77% following the reopening of the U.S. federal government, investor sentiment remains cautious due to cooling enthusiasm around artificial intelligence investments. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential value amidst broader market fluctuations and economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.03 | €5.98 | 49.4% |

| Stille (OM:STIL) | SEK170.50 | SEK334.56 | 49% |

| STEICO (XTRA:ST5) | €20.30 | €40.07 | 49.3% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.61 | 49.7% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.44 | €4.88 | 50% |

| NEUCA (WSE:NEU) | PLN785.00 | PLN1553.92 | 49.5% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.394 | €0.78 | 49.6% |

| eDreams ODIGEO (BME:EDR) | €7.29 | €14.42 | 49.4% |

| Bonesupport Holding (OM:BONEX) | SEK202.00 | SEK396.20 | 49% |

| Absolent Air Care Group (OM:ABSO) | SEK200.00 | SEK398.95 | 49.9% |

Let's explore several standout options from the results in the screener.

Ambu (CPSE:AMBU B)

Overview: Ambu A/S, along with its subsidiaries, engages in the research, development, manufacturing, marketing, and sale of medical technology solutions across North America, Europe, and other international markets with a market capitalization of DKK22.75 billion.

Operations: The company's revenue from Medical Technology Solutions amounts to DKK6.04 billion.

Estimated Discount To Fair Value: 35.5%

Ambu A/S is trading significantly below its estimated fair value, with a share price of DKK 85.35 compared to a fair value estimate of DKK 132.38. Recent earnings showed substantial growth, with net income rising to DKK 609 million from DKK 235 million year-over-year. Forecasts suggest robust annual profit growth of over 20%, outpacing the Danish market's average. Despite high share price volatility, analysts anticipate a potential price increase of around 35%.

- In light of our recent growth report, it seems possible that Ambu's financial performance will exceed current levels.

- Click here to discover the nuances of Ambu with our detailed financial health report.

NOBA Bank Group (OM:NOBA)

Overview: NOBA Bank Group AB (publ) offers financial and banking products and services across several European countries, including Sweden, Norway, Finland, Denmark, Germany, Spain, Ireland, and the Netherlands; it has a market cap of SEK51.90 billion.

Operations: The company's revenue segments include Secured loans at SEK667 million, Credit Cards at SEK1.91 billion, and Private Loans at SEK4.49 billion.

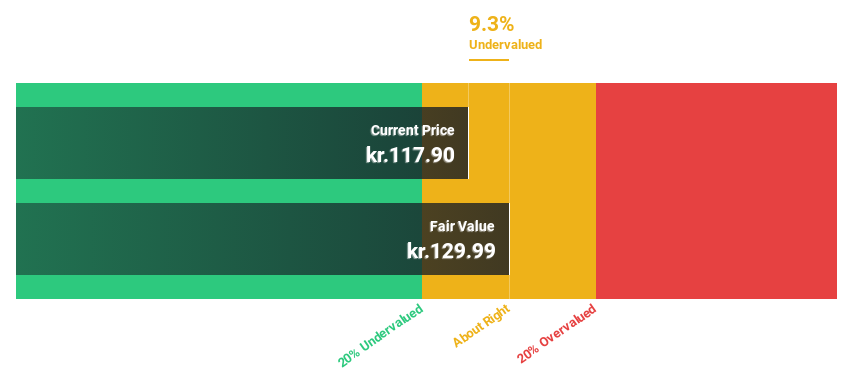

Estimated Discount To Fair Value: 47.6%

NOBA Bank Group is trading at SEK 103.8, significantly below its estimated fair value of SEK 198.22, suggesting it may be undervalued based on cash flows. The company reported strong earnings growth, with net income for Q3 rising to SEK 903 million from SEK 596 million year-over-year. Despite a high level of bad loans at 13.7%, NOBA's earnings are forecast to grow faster than the Swedish market, supported by recent IPO proceeds of approximately SEK 7.61 billion.

- Upon reviewing our latest growth report, NOBA Bank Group's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in NOBA Bank Group's balance sheet health report.

OHB (XTRA:OHB)

Overview: OHB SE is a space and technology company operating in Germany, Europe, and internationally, with a market cap of €2.04 billion.

Operations: The company's revenue is primarily derived from its space and technology operations across Germany, Europe, and international markets.

Estimated Discount To Fair Value: 19.5%

OHB SE, with its Q3 revenue rising to €300 million from €245.34 million year-over-year, is trading at €106.5, below its estimated fair value of €132.22. Although not significantly undervalued based on cash flows, it offers good relative value compared to peers and the industry. Despite a high debt level and volatile share price, OHB's earnings are forecasted to grow significantly at 51.8% annually over the next three years, outpacing the German market growth rate.

- Insights from our recent growth report point to a promising forecast for OHB's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of OHB.

Summing It All Up

- Get an in-depth perspective on all 198 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOBA Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOBA

NOBA Bank Group

Provides financial and banking products and services in Sweden, Norway, Finland, Denmark, Germany, Spain, Ireland, and the Netherlands.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives