- Germany

- /

- Electrical

- /

- XTRA:NDX1

The 16% return this week takes Nordex's (ETR:NDX1) shareholders three-year gains to 160%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For example, the Nordex SE (ETR:NDX1) share price has soared 160% in the last three years. Most would be happy with that. On top of that, the share price is up 17% in about a quarter.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

While Nordex made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Nordex saw its revenue grow at 12% per year. That's pretty nice growth. It's fair to say that the market has acknowledged the growth by pushing the share price up 38% per year. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! It would be worth thinking about when profits will flow, since that milestone will attract more attention.

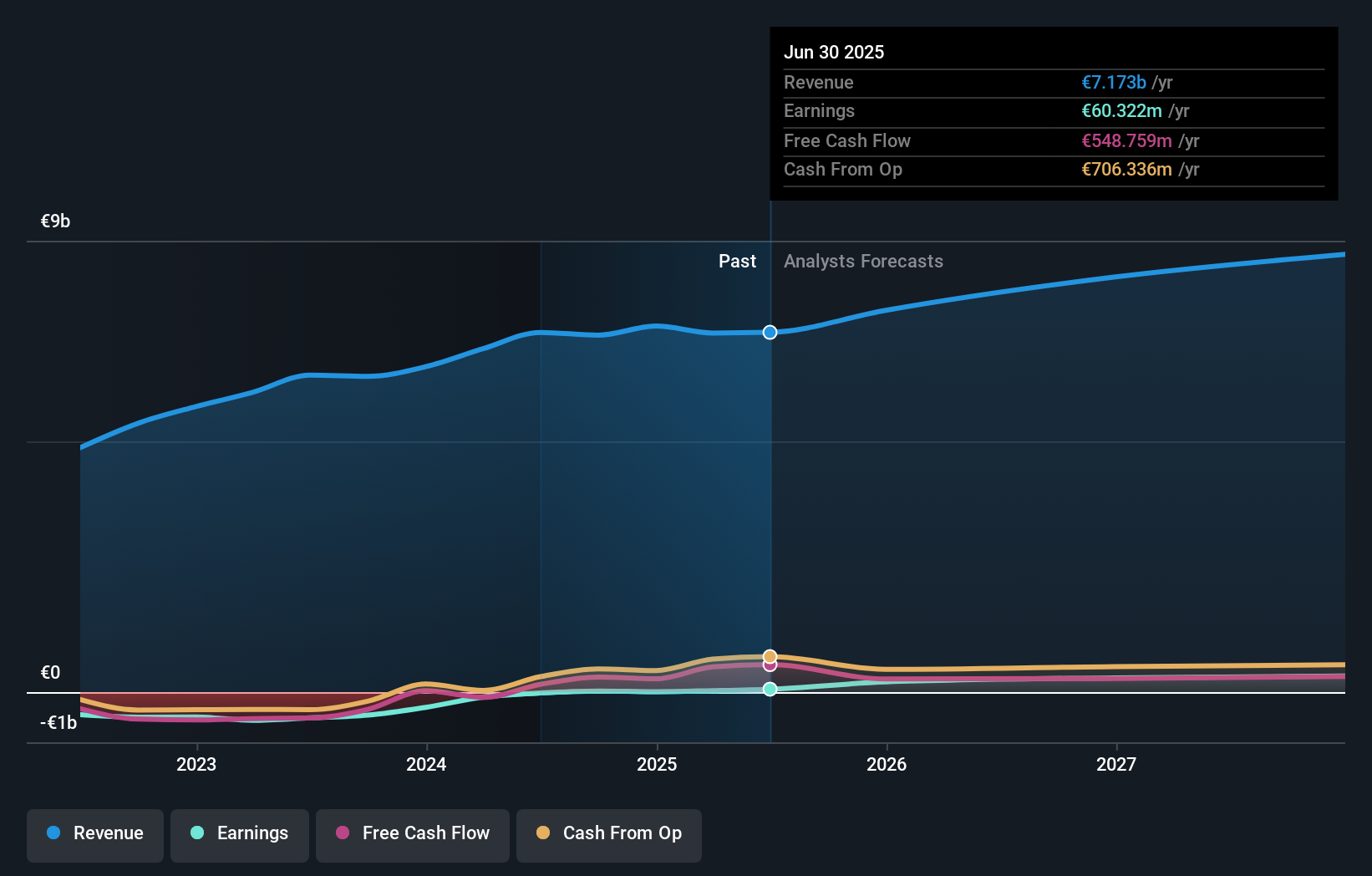

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Nordex is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Nordex will earn in the future (free analyst consensus estimates)

A Different Perspective

It's nice to see that Nordex shareholders have received a total shareholder return of 87% over the last year. That gain is better than the annual TSR over five years, which is 17%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Nordex better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Nordex you should be aware of.

Of course Nordex may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nordex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NDX1

Nordex

Develops, manufactures, and distributes multi-megawatt onshore wind turbines worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives