Stock Analysis

- Germany

- /

- Electrical

- /

- XTRA:NDX1

Shareholders in Nordex (ETR:NDX1) are in the red if they invested three years ago

If you love investing in stocks you're bound to buy some losers. But long term Nordex SE (ETR:NDX1) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 62% drop in the share price over that period. And over the last year the share price fell 35%, so we doubt many shareholders are delighted.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Nordex

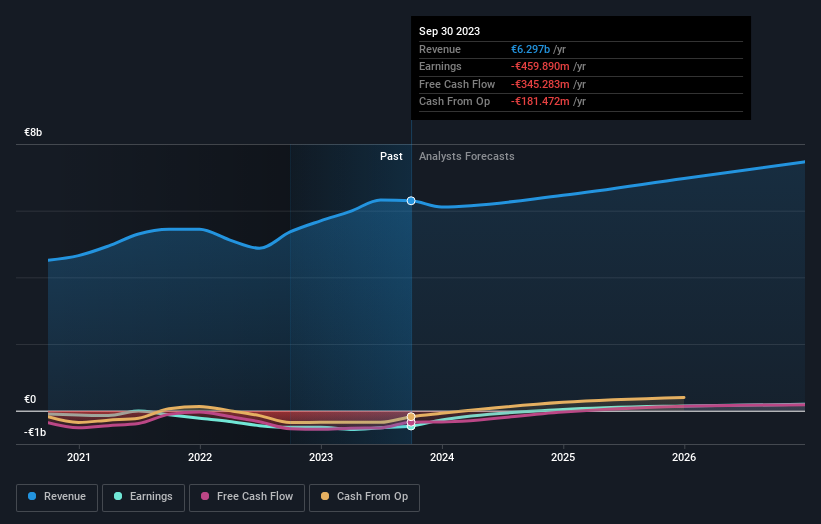

Because Nordex made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Nordex saw its revenue grow by 9.7% per year, compound. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 18% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. So this is one stock that might be worth investigating further, or even adding to your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Nordex is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Nordex stock, you should check out this free report showing analyst consensus estimates for future profits.

What About The Total Shareholder Return (TSR)?

We've already covered Nordex's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Nordex's TSR, at -57% is higher than its share price return of -62%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market gained around 2.8% in the last year, Nordex shareholders lost 35%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 1.4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Nordex you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Nordex is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NDX1

Nordex

Nordex SE, together with its subsidiaries, develops, manufactures, and distributes multi-megawatt onshore wind turbines worldwide.

Excellent balance sheet with reasonable growth potential.