- Germany

- /

- Electrical

- /

- XTRA:NDX1

Nordex SE (ETR:NDX1) Surges 31% Yet Its Low P/S Is No Reason For Excitement

Nordex SE (ETR:NDX1) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

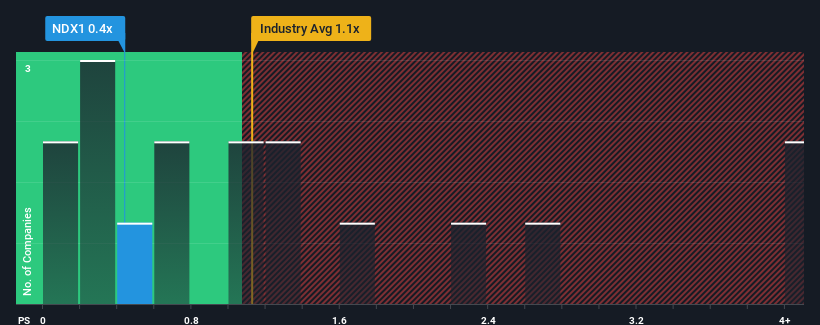

Even after such a large jump in price, given about half the companies operating in Germany's Electrical industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Nordex as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nordex

How Has Nordex Performed Recently?

Nordex certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nordex.How Is Nordex's Revenue Growth Trending?

In order to justify its P/S ratio, Nordex would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 7.2% per year as estimated by the ten analysts watching the company. With the industry predicted to deliver 9.3% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why Nordex is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Nordex's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nordex maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Nordex that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nordex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NDX1

Nordex

Develops, manufactures, and distributes multi-megawatt onshore wind turbines worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives