As global markets navigate a mixed start to the year, with key indices like the S&P 500 and Nasdaq Composite posting strong annual gains despite recent volatility, small-cap stocks are capturing attention due to their potential for growth amid economic shifts. In this dynamic environment, identifying promising small-cap stocks involves looking for companies with solid fundamentals and unique market positions that can thrive even as broader economic indicators fluctuate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shaanxi Panlong Pharmaceutical Group Limited By Share (SZSE:002864)

Simply Wall St Value Rating: ★★★★★☆

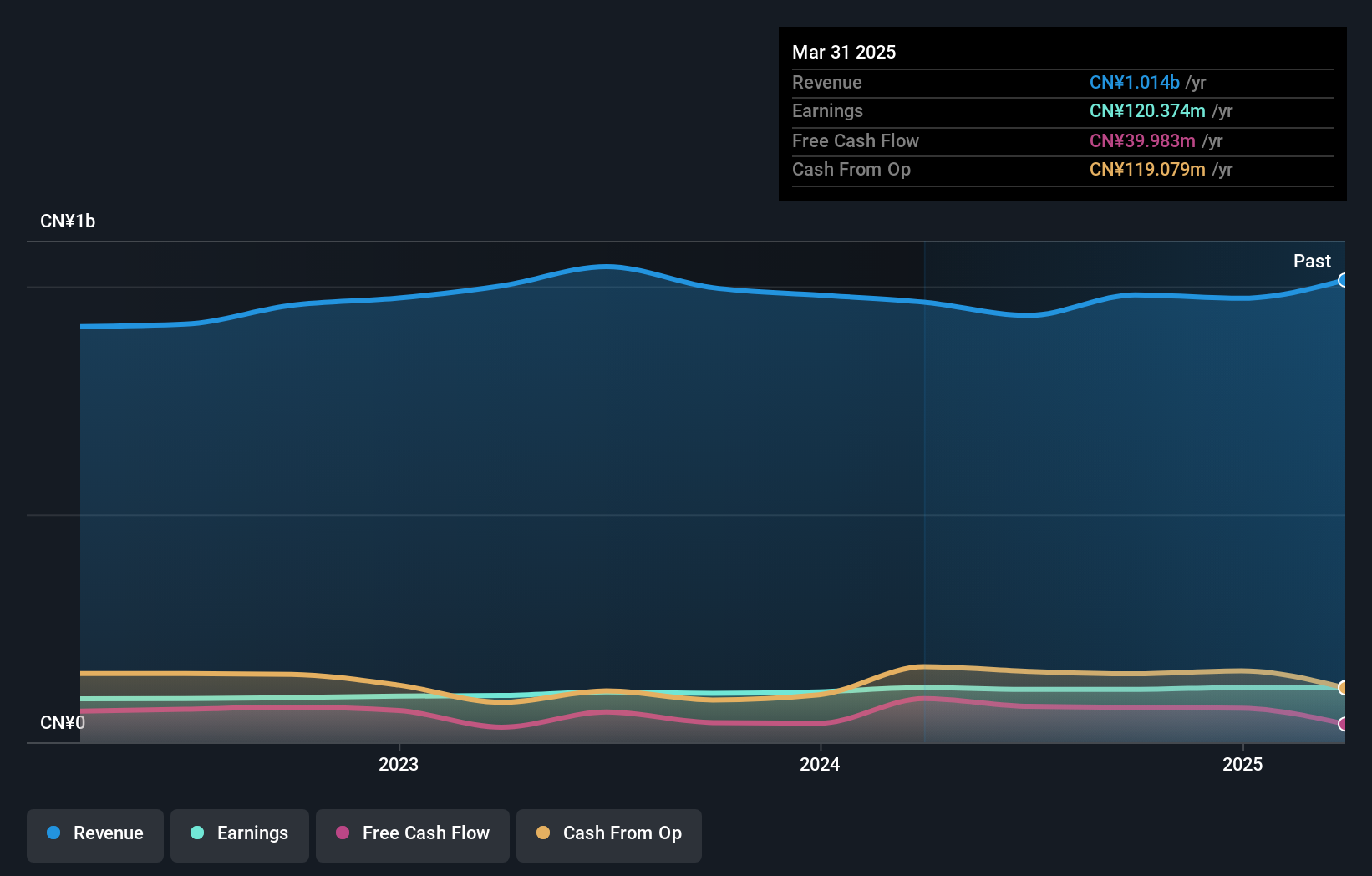

Overview: Shaanxi Panlong Pharmaceutical Group Limited By Share Ltd is engaged in the research, development, production, and sale of Chinese patent medicines in China with a market capitalization of CN¥3.25 billion.

Operations: The company's primary revenue stream is derived from the sale of Chinese patent medicines. It has a market capitalization of CN¥3.25 billion.

Shaanxi Panlong Pharmaceutical, a small cap player in the pharmaceutical industry, has shown resilience with earnings growth of 8% over the past year, outpacing the industry average of -2.5%. The company's debt to equity ratio rose from 0% to 9.3% over five years but remains manageable as it holds more cash than total debt. Its price-to-earnings ratio stands at a favorable 28x compared to the CN market's 34x. Recent performance highlights include net income of CNY 89.57 million for nine months ending September 2024 and a dividend proposal offering CNY 0.50 per ten shares announced recently.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Value Rating: ★★★★★☆

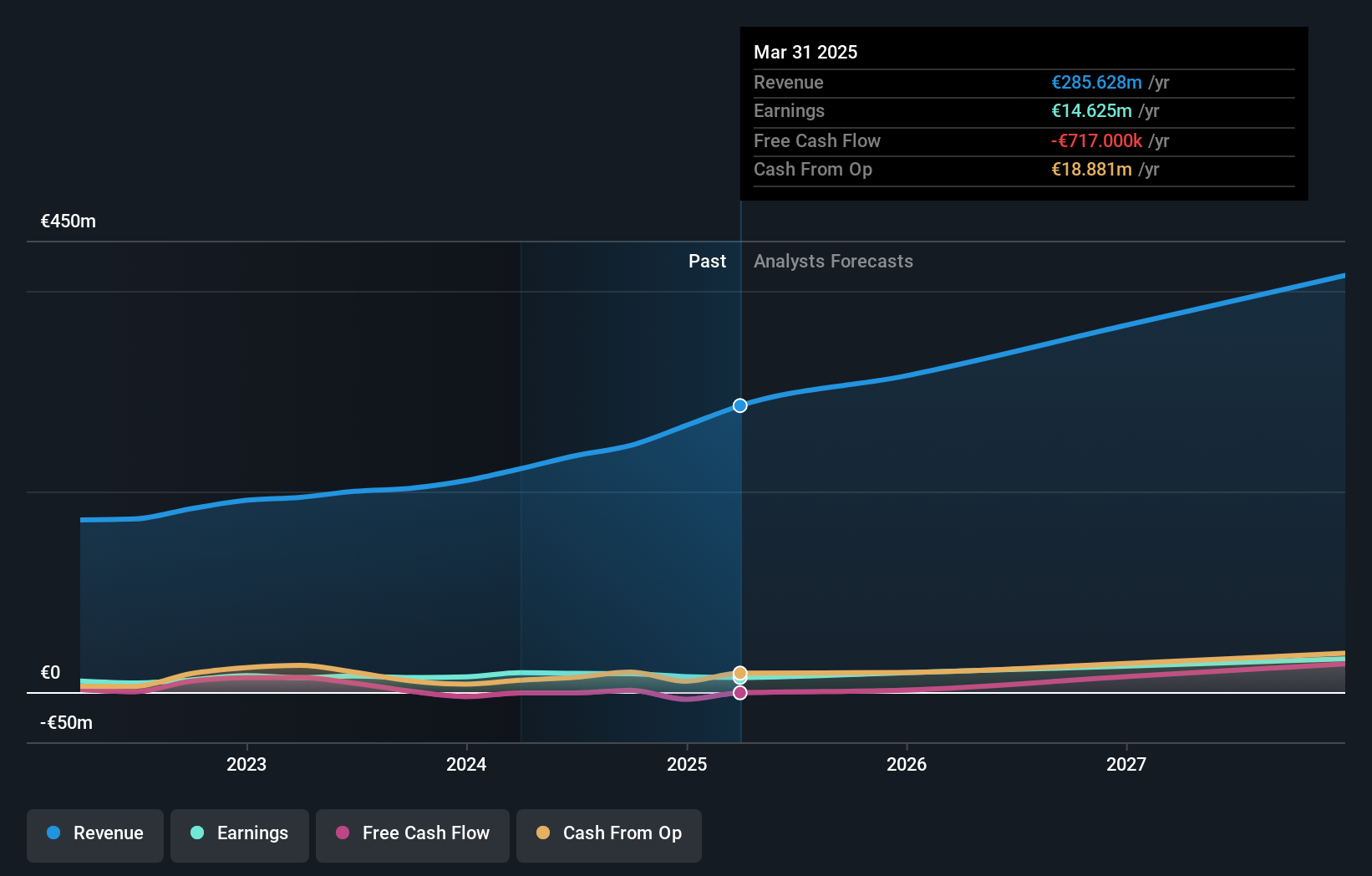

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market capitalization of approximately €363.44 million.

Operations: Init innovation in traffic systems SE generates revenue primarily from its wireless communications equipment segment, which accounts for €245.89 million. The company has a market capitalization of approximately €363.44 million.

With a solid footing in the traffic systems sector, Init Innovation has demonstrated impressive earnings growth of 25% over the past year, outpacing the software industry average. The company reported sales of €63.63 million for Q3 2024, up from €53.41 million last year, though net income saw a slight dip to €3.32 million compared to €3.7 million previously. Its net debt to equity ratio stands at a satisfactory 35.6%, and interest payments are comfortably covered by EBIT at ten times over, suggesting robust financial health despite increased leverage from 37% to 66.6% in five years.

Mühlbauer Holding (XTRA:MUB)

Simply Wall St Value Rating: ★★★★★★

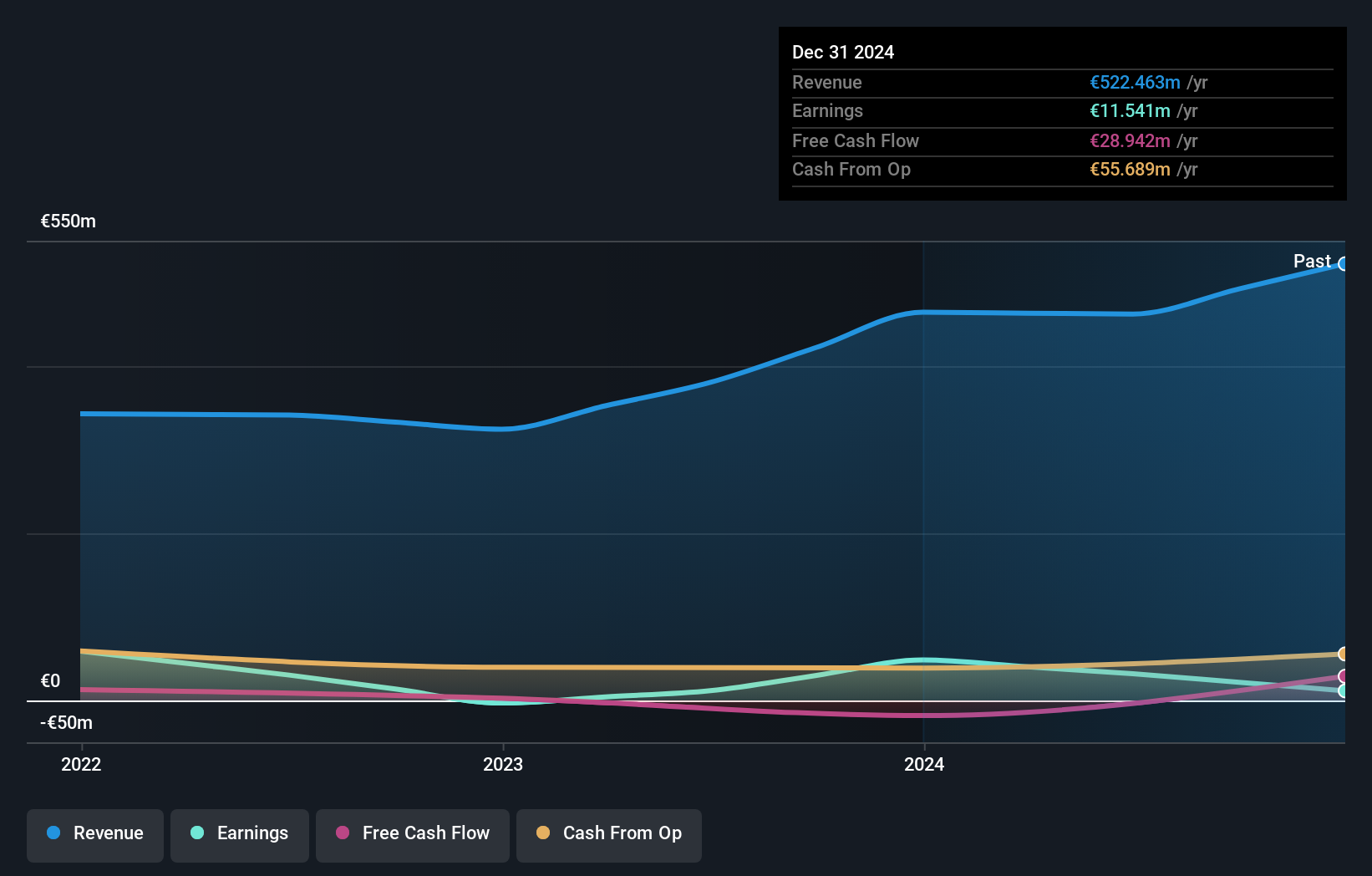

Overview: Mühlbauer Holding AG specializes in the production and personalization of smart cards, passports, solar cells, and RFID solutions across Germany, Europe, Asia, the United States, Africa, and internationally with a market capitalization of approximately €564.84 million.

Operations: Mühlbauer's primary revenue streams include Automation (€230.92 million), Tecurity® (€171.70 million), and Precision Parts & Systems (€53.76 million).

Mühlbauer Holding, a nimble player in the machinery sector, has demonstrated remarkable earnings growth of 174.9% over the past year, outpacing its industry peers who saw an 8.6% drop. Despite a challenging five-year period with earnings dipping by 12.7% annually, the company remains debt-free and boasts high-quality earnings. With no debt concerns to weigh it down, Mühlbauer's financial health seems robust even as free cash flow data remains elusive. This combination of strong recent performance and solid financial footing positions Mühlbauer as an intriguing prospect within its niche market space.

- Take a closer look at Mühlbauer Holding's potential here in our health report.

Evaluate Mühlbauer Holding's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 4656 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002864

Shaanxi Panlong Pharmaceutical Group Limited By Share

Researches and develops, produces, and sells Chinese patent medicines in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives