Exploring Three German Exchange Stocks Estimated To Trade At Intrinsic Discounts Ranging From 33.5% To 44%

Reviewed by Simply Wall St

Amid a generally positive week for European markets, with Germany's DAX index climbing 1.48%, investors are turning their attention to potential opportunities within undervalued stocks. In this context, identifying stocks that trade below their intrinsic value could be particularly compelling, especially when considering the broader market's upward trajectory and current economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kontron (XTRA:SANT) | €19.79 | €30.69 | 35.5% |

| Stabilus (XTRA:STM) | €44.80 | €79.98 | 44% |

| technotrans (XTRA:TTR1) | €17.50 | €29.27 | 40.2% |

| SAP (XTRA:SAP) | €180.58 | €282.01 | 36% |

| Stratec (XTRA:SBS) | €42.00 | €81.77 | 48.6% |

| SBF (DB:CY1K) | €2.90 | €5.71 | 49.3% |

| CHAPTERS Group (XTRA:CHG) | €24.40 | €46.31 | 47.3% |

| MTU Aero Engines (XTRA:MTX) | €245.90 | €420.24 | 41.5% |

| R. STAHL (XTRA:RSL2) | €18.20 | €28.97 | 37.2% |

| Your Family Entertainment (DB:RTV) | €2.56 | €4.54 | 43.6% |

Let's uncover some gems from our specialized screener.

adidas (XTRA:ADS)

Overview: Adidas AG is a global company that designs, develops, produces, and markets athletic and sports lifestyle products across various regions, with a market capitalization of approximately €41.57 billion.

Operations: The company generates revenue from several geographical segments, with €5.16 billion from North America, €3.20 billion from Greater China, and €2.31 billion from Latin America.

Estimated Discount To Fair Value: 33.5%

Adidas AG, priced at €232.8, is considered undervalued by 33.5% against a fair value estimate of €350.16 based on discounted cash flow analysis. Recently returning to profitability, the company posted a significant turnaround with Q1 sales rising to €5.46 billion from €5.27 billion year-over-year and net income reaching €170 million compared to a loss previously. Forecasted annual earnings growth is robust at 41%, outpacing the German market's 18.9%. Revenue growth projections stand at 8% annually, also above the national average of 5.2%.

- Our growth report here indicates adidas may be poised for an improving outlook.

- Take a closer look at adidas' balance sheet health here in our report.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG operates in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines and industrial gas turbines globally, with a market capitalization of approximately €13.24 billion.

Operations: The company's revenue is divided into two main segments: the Commercial Maintenance Business (MRO) generates €4.35 billion, and the Commercial and Military Engine Business (OEM) contributes €1.27 billion.

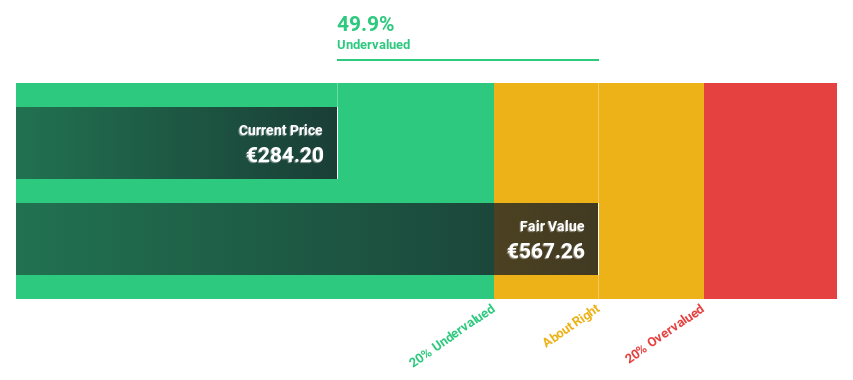

Estimated Discount To Fair Value: 41.5%

MTU Aero Engines, trading at €245.9, is significantly undervalued by 41.5% relative to its fair value of €420.24, per discounted cash flow metrics. Poised for profitability within three years, MTX anticipates robust earnings growth of 34.94% annually. Recent financials reveal a slight dip in net income from €134 million to €126 million year-over-year despite an increase in sales from €1.54 billion to €1.65 billion in Q1 2024, underscoring potential recovery and growth dynamics against a backdrop of operational challenges.

- Our comprehensive growth report raises the possibility that MTU Aero Engines is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of MTU Aero Engines.

Stabilus (XTRA:STM)

Overview: Stabilus SE operates globally, manufacturing and selling gas springs, dampers, vibration isolation products, and electric tailgate equipment with a market cap of approximately €1.11 billion.

Operations: Stabilus generates revenue primarily from three geographical segments: €548.37 million from Europe, the Middle East, and Africa, €465.72 million from the Americas, and €293.73 million from the Asia-Pacific region.

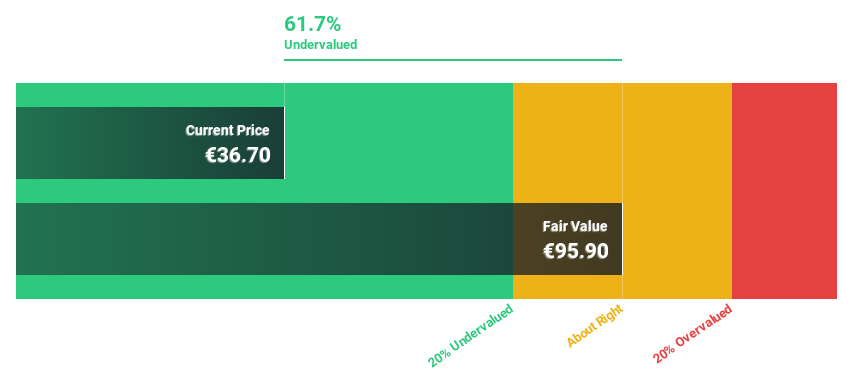

Estimated Discount To Fair Value: 44%

Stabilus SE, priced at €44.8, is significantly undervalued with a fair value of €79.98 based on discounted cash flow analysis, indicating a potential undervaluation by 44%. Despite recent adjustments to its fiscal year 2024 revenue forecasts down to between €1.3 billion and €1.35 billion from previous higher estimates due to weaker demand in key segments, the company's earnings are expected to grow substantially at 20.5% annually over the next three years, outpacing the German market growth rate of 18.9%. However, it faces challenges such as a high debt level and declining profit margins year-over-year from 9.8% to 6%.

- According our earnings growth report, there's an indication that Stabilus might be ready to expand.

- Dive into the specifics of Stabilus here with our thorough financial health report.

Taking Advantage

- Investigate our full lineup of 26 Undervalued German Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America.

High growth potential with excellent balance sheet.