Strong Sales and Order Intake Could Be a Game Changer For KSB SE KGaA (XTRA:KSB)

Reviewed by Sasha Jovanovic

- KSB SE & Co. KGaA announced increased sales revenue of €2.23 billion and order intake of €2.45 billion for the first nine months of 2025, while reaffirming its earnings guidance for the year.

- This combination of top-line growth and maintained guidance signals continued operational momentum despite broader economic uncertainties.

- We'll assess how this steady growth in sales and orders shapes KSB SE & Co. KGaA's investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is KSB SE KGaA's Investment Narrative?

To be a shareholder in KSB SE & Co. KGaA, you have to trust in the company's steady operational execution against a backdrop of moderate growth expectations. The recent update, showing both increased sales revenue of €2.23 billion and order intake of €2.45 billion for the first nine months of 2025, confirms KSB’s resilience and reliable management. Their reaffirmed earnings guidance suggests no major change to the short-term outlook, which is reassuring given persistent economic headwinds and prior concerns about declining profit margins and slower growth compared to the broader German market. While this new data signals that near-term catalysts, such as robust order books and attractive valuations, remain firmly in place, risks like unstable dividend history and slower than market revenue and earnings growth remain important. The latest announcement doesn’t shift the key risks, but it does strengthen confidence in ongoing operational stability.

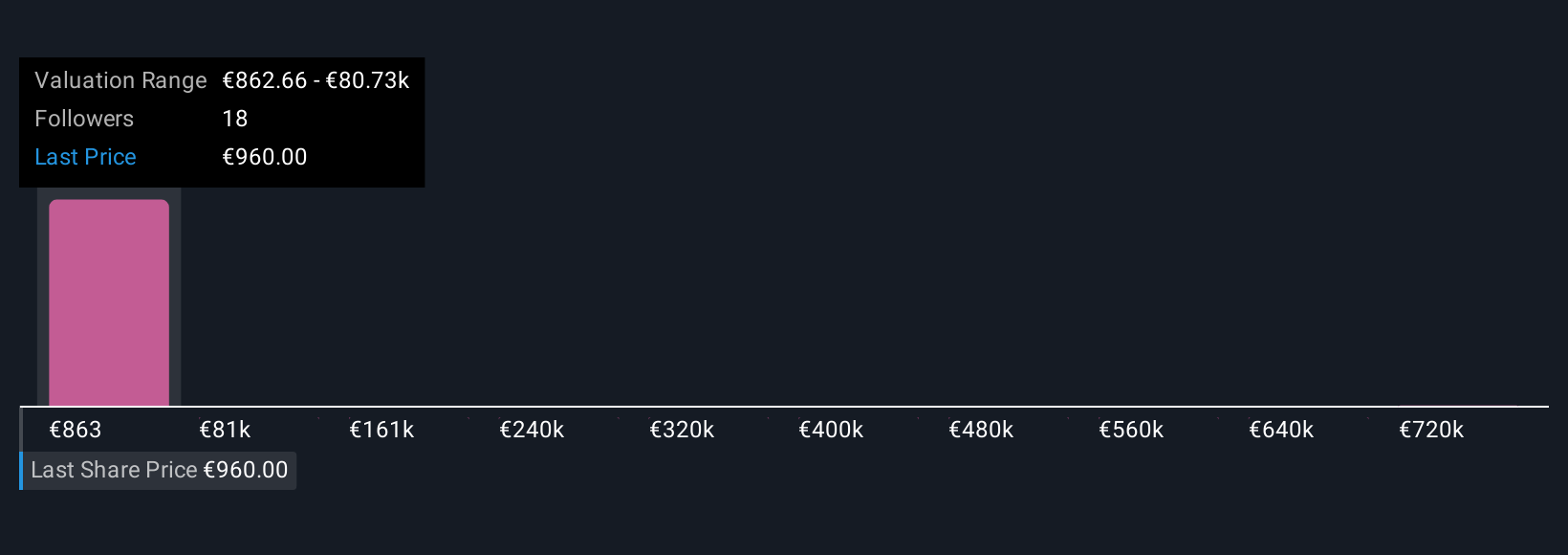

But with profit margins lower than last year, potential volatility remains crucial for investors to watch. KSB SE KGaA's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 8 other fair value estimates on KSB SE KGaA - why the stock might be worth 12% less than the current price!

Build Your Own KSB SE KGaA Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KSB SE KGaA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KSB SE KGaA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KSB SE KGaA's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives