How KION GROUP's (XTRA:KGX) AI Omniverse Launch With NVIDIA and Accenture Reframes Its Investment Case

Reviewed by Sasha Jovanovic

- At the recent CeMAT Shanghai, KION GROUP unveiled an advanced AI-powered Omniverse warehouse automation solution, developed in collaboration with NVIDIA and Accenture, that integrates digital twins, autonomous mobile robots, and AI-driven industrial trucks.

- This demonstration signals KION's intent to shape global standards in adaptive material handling, highlighting a move toward more intelligent, efficient, and integrated warehouse solutions.

- We'll now explore how KION's latest AI-driven warehouse automation initiative could influence the company's competitive positioning and investment case.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

KION GROUP Investment Narrative Recap

If you’re considering KION GROUP as a shareholder, you need to believe that global warehouse automation and digitalization trends will keep translating into real order growth and margin opportunities for KION, especially as new AI-driven solutions like the one unveiled with NVIDIA and Accenture roll out. While the Shanghai announcement reinforces KION’s technology lead and partnership depth, the near-term catalyst remains actual SCS order intake and conversion into revenue, these tech showcases matter, but appear less material to resolving immediate demand volatility risks in non-e-commerce verticals.

The recent launch of KION’s €90 million automated Regional Distribution Center in Kahl am Main stands out as highly relevant in context. Alongside the AI warehouse demonstrations, this expansion reflects both an execution focus and a push to strengthen high-value service and automation revenues, which is central to future order stability and supports ambitions for margin recovery in the SCS segment.

However, beneath the innovation headlines, investors should keep in mind that persistent revenue lumpiness, especially outside of e-commerce, may continue to challenge ...

Read the full narrative on KION GROUP (it's free!)

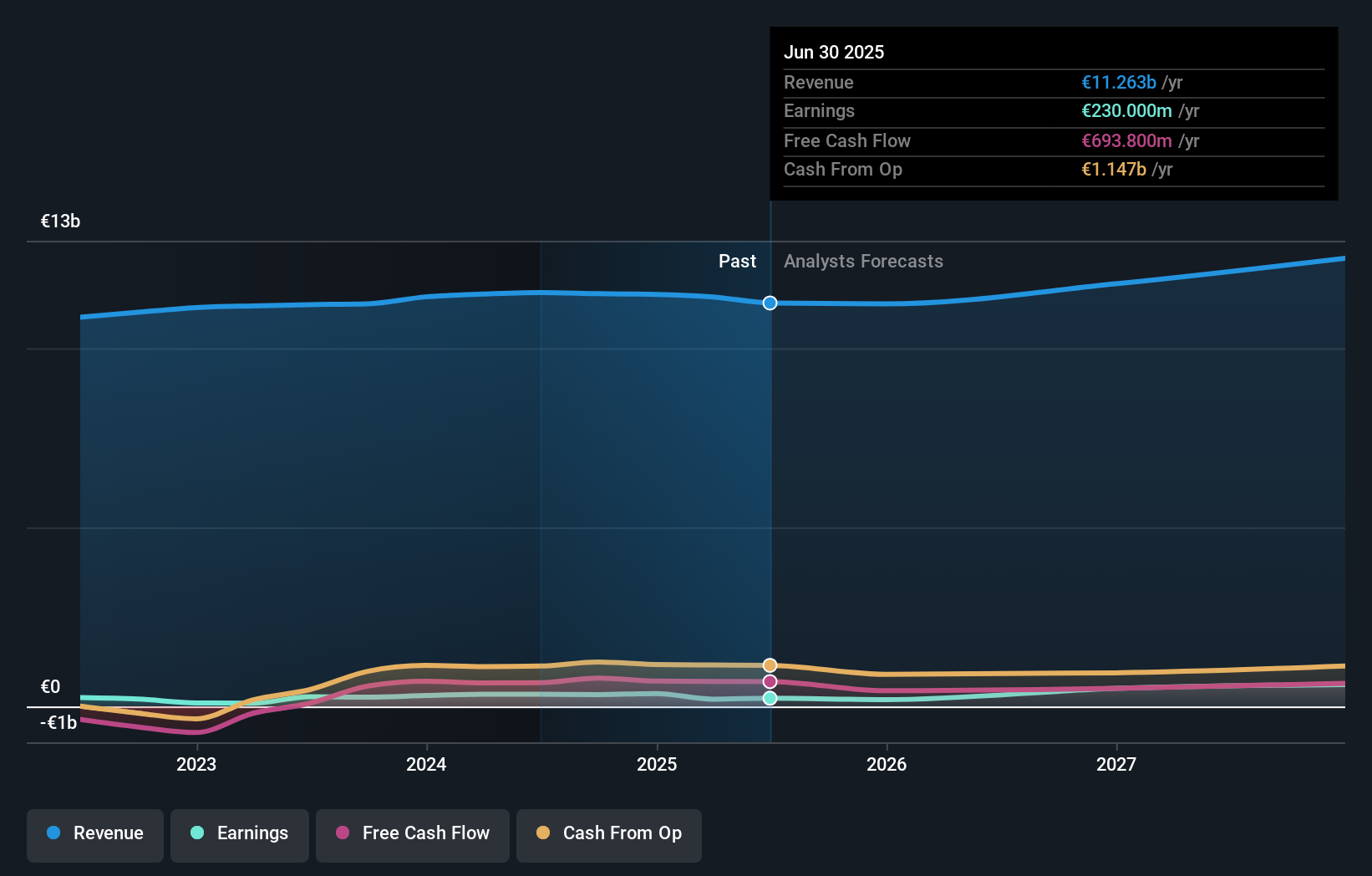

KION GROUP's outlook anticipates €12.9 billion in revenue and €802.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 4.7% and an increase in earnings of about €573 million from the current level of €230.0 million.

Uncover how KION GROUP's forecasts yield a €60.80 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided five fair value estimates for KION, ranging from €51.92 to €97.68 per share. As you weigh these varied opinions, remember that SCS order concentration in e-commerce remains a major risk to near-term revenue stability, consider how this may influence your own outlook and check out further analyses.

Explore 5 other fair value estimates on KION GROUP - why the stock might be worth 9% less than the current price!

Build Your Own KION GROUP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KION GROUP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KION GROUP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KION GROUP's overall financial health at a glance.

No Opportunity In KION GROUP?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KION GROUP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KGX

KION GROUP

Provides industrial trucks and supply chain solutions in Western and Eastern Europe, the Middle East, Africa, North America, Central and South America, China, and the rest of the Asia Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives