Knorr-Bremse (ETR:KBX) shareholders have endured a 32% loss from investing in the stock a year ago

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Knorr-Bremse Aktiengesellschaft (ETR:KBX) shareholders over the last year, as the share price declined 33%. That falls noticeably short of the market decline of around 7.8%. To make matters worse, the returns over three years have also been really disappointing (the share price is 32% lower than three years ago). The falls have accelerated recently, with the share price down 22% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 9.9% in the same timeframe.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Knorr-Bremse

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Knorr-Bremse share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

Knorr-Bremse managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

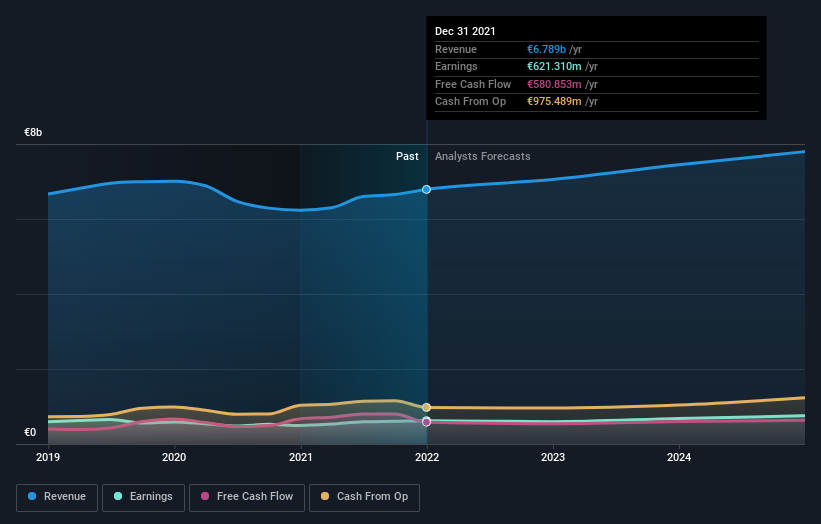

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Knorr-Bremse stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Knorr-Bremse shareholders are down 32% for the year (even including dividends), falling short of the market return. Meanwhile, the broader market slid about 7.8%, likely weighing on the stock. The three-year loss of 9% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Knorr-Bremse better, we need to consider many other factors. Take risks, for example - Knorr-Bremse has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:KBX

Knorr-Bremse

Develops, produces, and markets brake systems for rail and commercial vehicles and other safety-critical systems worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success