- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

Hensoldt (XTRA:HAG): Fresh Financial Results Spark New Look at 2025 Valuation

Reviewed by Simply Wall St

Hensoldt (XTRA:HAG) has just reported its earnings for the nine months ending September 30, 2025. The company saw sales rise to EUR 1,536 million, while net loss narrowed compared to last year.

See our latest analysis for Hensoldt.

Hensoldt’s 2025 update, revealing stronger sales and reduced net losses, comes after an extraordinary run for the stock. Total shareholder return has surged 146% over the past year, underscoring growing investor confidence in its long-term prospects and market positioning.

If you’re looking to spot more companies making waves in defense and aerospace, take the next step and see the full list with See the full list for free.

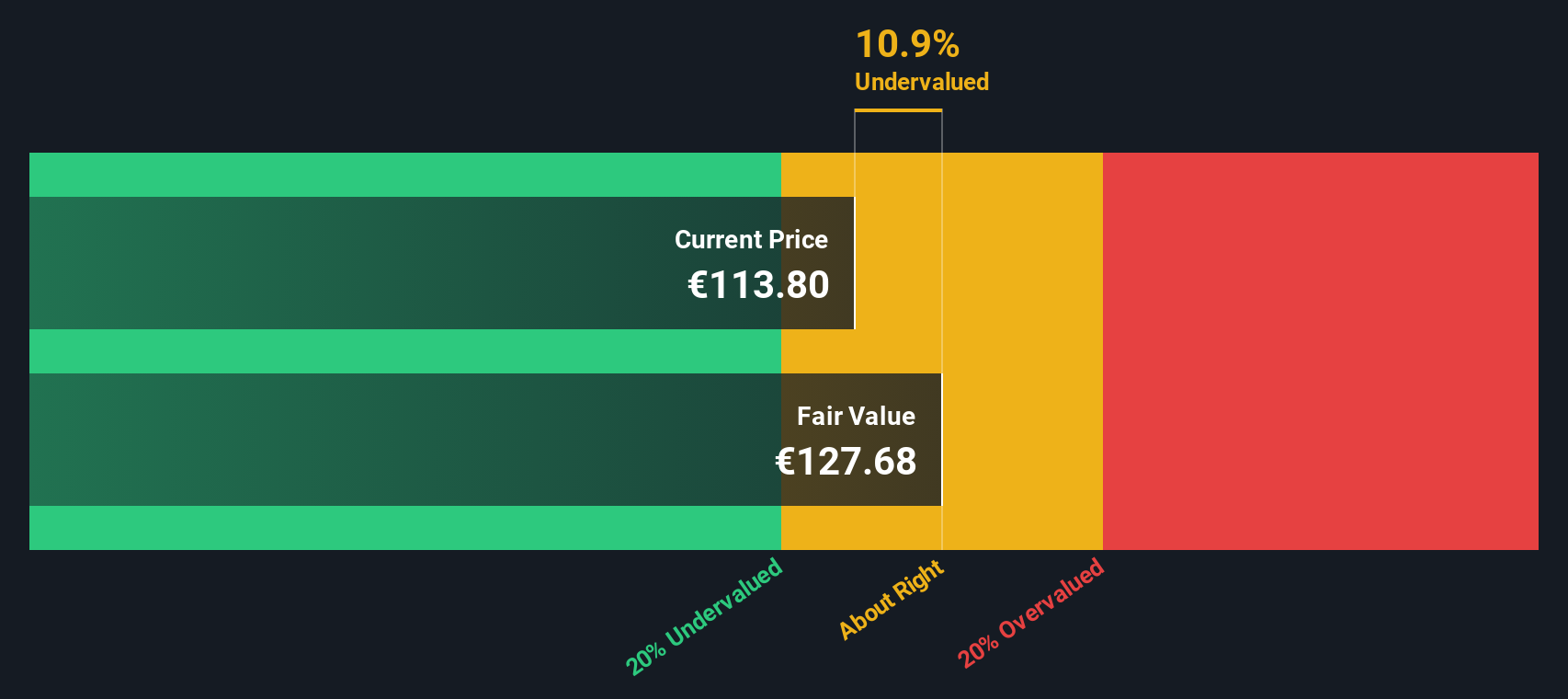

With recent gains and stronger fundamentals, investors now face a key question: Is Hensoldt’s surge leaving the stock undervalued and ripe for further upside, or has the market already priced in future growth?

Most Popular Narrative: 14.7% Undervalued

Hensoldt’s most-followed narrative places its fair value well above the recent closing price, highlighting major upside potential as the stock trades under analyst expectations. This sets the stage for a debate on whether Hensoldt’s aggressive expansion plans truly justify its current valuation.

The company reports robust order intake growth driven by increased defense spending, particularly in air defense, across Europe. However, future revenue expectations are based on elevated budget levels, which may not fully materialize, leading to potential overvaluation risk tied to revenue projections.

Curious what’s fueling this narrative’s bullish fair value? The answer isn’t just more defense contracts. Dive in and discover the surprising mix of growth projections, margin shifts, and ambitious expansion bets that analysts believe could reshape Hensoldt’s future and its price tag.

Result: Fair Value of €98.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, volatile defense budgets or weaker-than-expected contract wins could quickly challenge the bullish growth narrative and put current investor optimism to the test.

Find out about the key risks to this Hensoldt narrative.

Another View: What Do the Numbers Really Say?

While analysts see upside, our DCF model offers a different perspective. It estimates Hensoldt’s fair value at €132.67 per share, well above today’s price. This suggests the stock could be significantly undervalued if cash flow projections hold up. However, what happens if future cash flows do not meet expectations?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hensoldt Narrative

If you want your own spin on the numbers and outlook, you can assemble a personalized Hensoldt narrative in just a few minutes. Do it your way

A great starting point for your Hensoldt research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let smart opportunities slip by. The right stock could transform your portfolio, so put yourself ahead of the crowd with a few targeted moves.

- Spot companies shaking up tomorrow’s markets and get in early with these 24 AI penny stocks built on innovation and artificial intelligence.

- Secure steady income by checking out these 16 dividend stocks with yields > 3% offering strong yields that reward your patience and boost long-term gains.

- Ride the next big technological leap by jumping on these 26 quantum computing stocks, where breakthroughs are more than headlines and can serve as investment catalysts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives