Circus (XTRA:CA1): Evaluating Valuation After Landmark REWE Launch of Autonomous Cooking Robot

Reviewed by Simply Wall St

The recent buzz around Circus (XTRA:CA1) comes after its autonomous CA-1 cooking robot made a highly anticipated premiere inside a REWE supermarket. This partnership introduces automated live meal preparation directly in-store, which is a global first.

See our latest analysis for Circus.

The excitement generated by Circus’s global-first launch at REWE comes on the heels of several rapid-fire developments, including the rollout of a six-month pilot program, new partnerships in Ukraine, and a major wave of patent filings in defense robotics. This string of catalysts appears to have shifted investor sentiment, as seen in the 40% surge in the company’s 1-month share price return. This has helped push the trailing 1-year total shareholder return to nearly 6% and suggests that momentum is building after a tough start to the year.

If the pace of Circus’s innovation has you interested in expanding your radar, this could be a great moment to discover fast growing stocks with high insider ownership.

With a share price still trading at a steep discount to analyst targets, yet a string of breakthroughs grabbing headlines, investors are left to wonder: is Circus undervalued, or has the recent momentum already been fully priced in?

Price-to-Book of 217.2x: Is it justified?

With Circus trading at a staggering price-to-book ratio of 217.2x, its current €22 share price sits far above both industry averages and traditional valuation boundaries in the machinery sector.

The price-to-book (P/B) ratio compares a company's market value to its net assets. This serves as a benchmark for how the market values its balance sheet relative to peers. For capital goods businesses like Circus, where tangible assets and profitability play a pivotal role, this ratio can reveal whether investors are betting on future growth or getting carried away.

Despite the headline-grabbing momentum, Circus appears considerably more expensive than the German Machinery industry average P/B of 1.5x and also its closest peers at 3.1x. Such an outsized multiple reflects high expectations, but also considerable risk if future growth or profitability fails to materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 217.2x (OVERVALUED)

However, Circus's weak net income and high valuation create risks, especially if rapid revenue growth slows or if market expectations shift.

Find out about the key risks to this Circus narrative.

Another View: DCF Model Suggests a Different Story

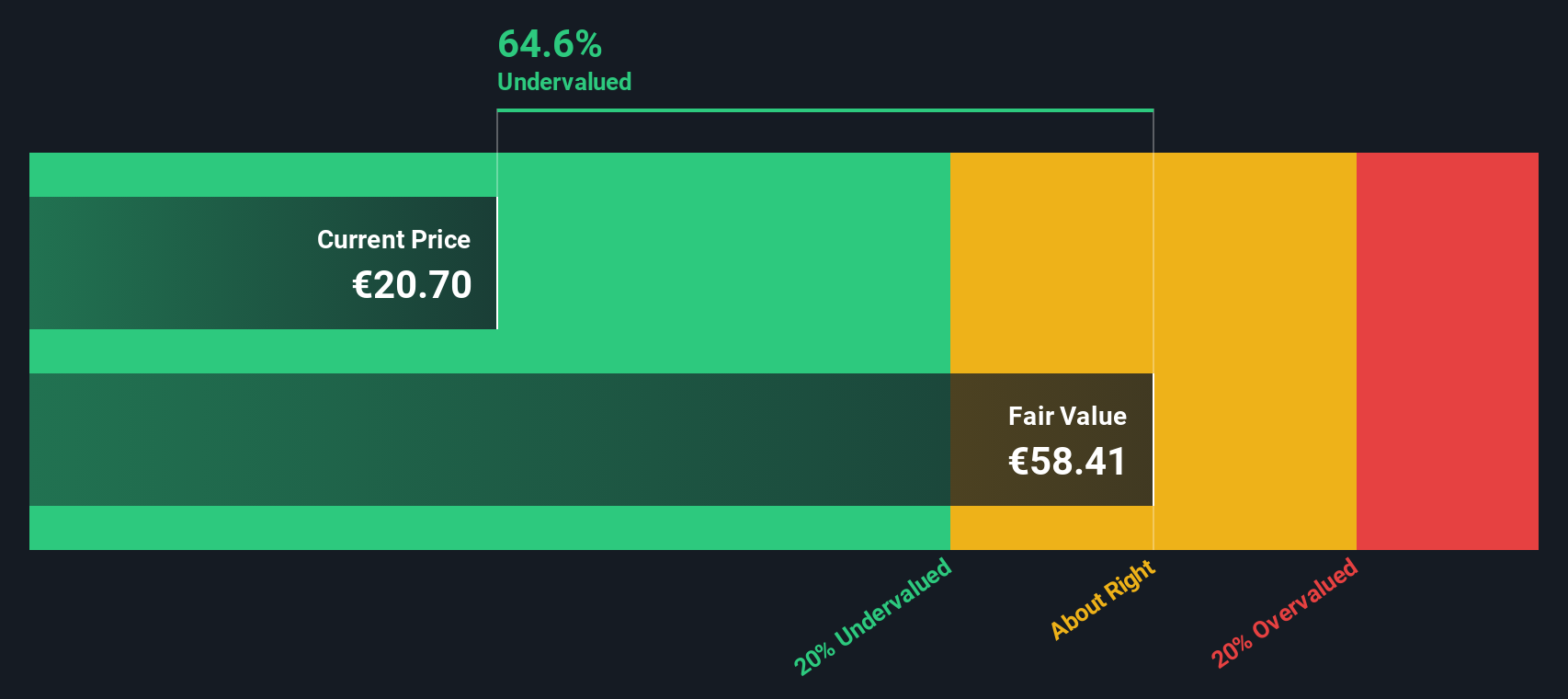

While the price-to-book ratio paints Circus as drastically overvalued, our DCF model tells a very different story. Based on cash flow forecasts, Circus shares are trading 62.6% below our fair value estimate of €58.83. This suggests a significant undervaluation. Could investors be missing the long-term upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Circus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Circus Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own analysis in just a few minutes, and Do it your way.

A great starting point for your Circus research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Seeking Your Next Investment Edge?

Capitalize on this momentum and uncover other unique opportunities using the Simply Wall Street Screener. There are standout ideas waiting just beyond the obvious choices.

- Unlock potential in companies delivering consistent income, starting with these 20 dividend stocks with yields > 3%, which showcase strong yields above 3%.

- Spot the innovators transforming medicine and health by evaluating these 33 healthcare AI stocks, powering the future of healthcare technology.

- Jump ahead of trends with these 82 cryptocurrency and blockchain stocks, featuring businesses driving new advancements in digital currencies and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CA1

Circus

A technology company, develops and delivers autonomous solutions for the food service market.

Exceptional growth potential and slightly overvalued.

Market Insights

Community Narratives