- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Exploring Three Undiscovered European Gems With Potential

Reviewed by Simply Wall St

As European markets navigate a complex landscape of interest rate policies and trade uncertainties, the pan-European STOXX Europe 600 Index remains steady, reflecting cautious investor sentiment. Amid this backdrop, identifying potential in lesser-known stocks requires a keen eye for companies that demonstrate resilience and adaptability in fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Moury Construct | 2.06% | 11.11% | 23.28% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm that focuses on early, mid, and late venture stages, emerging growth, middle market, growth capital, and buyout investments with a market cap of SEK10.22 billion.

Operations: Creades generates revenue primarily from its investments in online retailers, amounting to SEK1.36 billion. The firm's financial performance is influenced by its investment strategies and market conditions affecting these ventures.

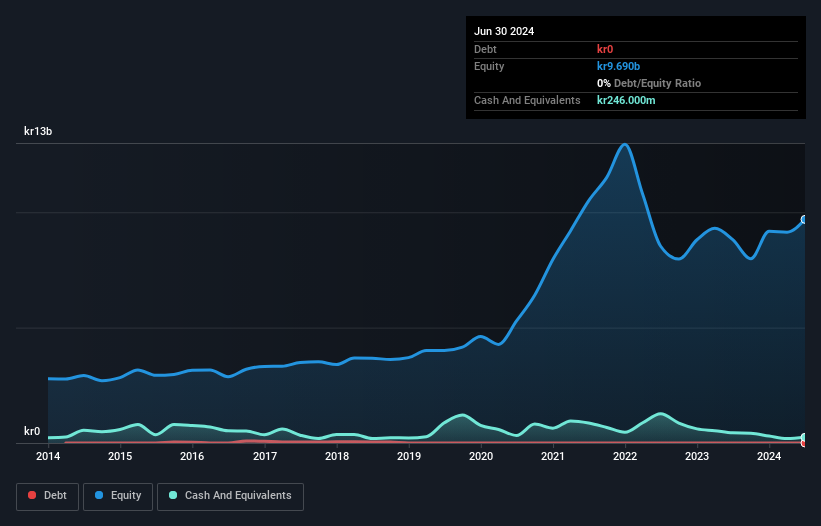

Creades, a nimble player in the financial sector, showcases a compelling picture with its price-to-earnings ratio of 8.2x, significantly lower than the Swedish market average of 22.9x. Despite earnings declining by 25% annually over five years, recent growth of 14% outpaces the industry’s negative trend. The company is debt-free and boasts high-quality past earnings alongside positive free cash flow. Recent reports show second-quarter revenue at SEK 646 million and net income at SEK 602 million, reflecting a year-over-year decrease but an overall six-month improvement to SEK 780 million from SEK 732 million last year.

Steyr Motors (XTRA:4X0)

Simply Wall St Value Rating: ★★★★★☆

Overview: Steyr Motors AG specializes in the production and distribution of diesel engines for both commercial and military vehicles on a global scale, with a market capitalization of €283.92 million.

Operations: Steyr Motors AG generates revenue primarily from two segments: Civil (€17.96 million) and Defense (€27.08 million).

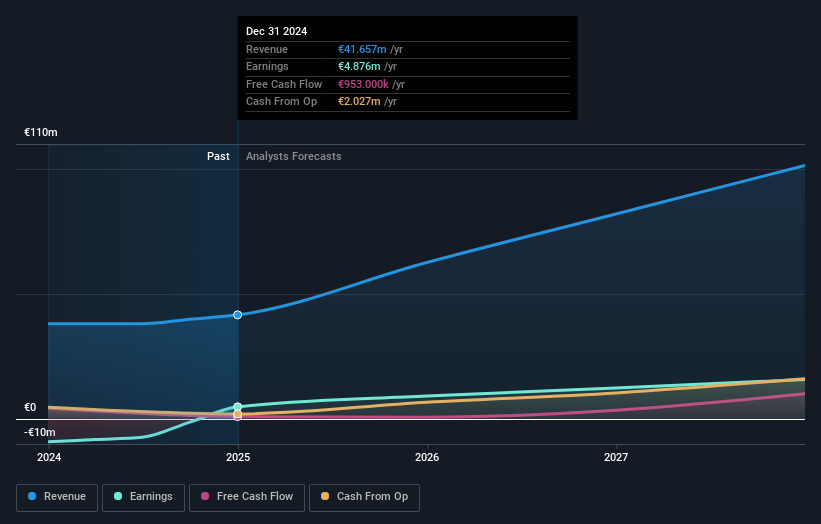

Steyr Motors, a nimble player in the engine manufacturing space, has recently been spotlighted for its strategic moves and financial performance. The company reported half-year sales of €23.13 million, up from €19.74 million the previous year, though net income slightly decreased to €2.43 million from €2.65 million. A noteworthy joint venture with Shangyan Power promises a minimum revenue of €65 million within five years without additional capital investment needed for expansion—highlighting Steyr's strategic foresight in global growth initiatives like new operations in Dubai and Poland that tap into lucrative markets across Europe and Asia.

- Dive into the specifics of Steyr Motors here with our thorough health report.

Evaluate Steyr Motors' historical performance by accessing our past performance report.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Eckert & Ziegler SE is a global manufacturer and seller of isotope technology components with a market capitalization of approximately €1.11 billion.

Operations: Eckert & Ziegler generates revenue primarily from its Medical and Isotope Products segments, with the Medical segment contributing €159.33 million and the Isotope Products segment contributing €150.29 million. The company experienced a net profit margin of 10% in its latest financial period.

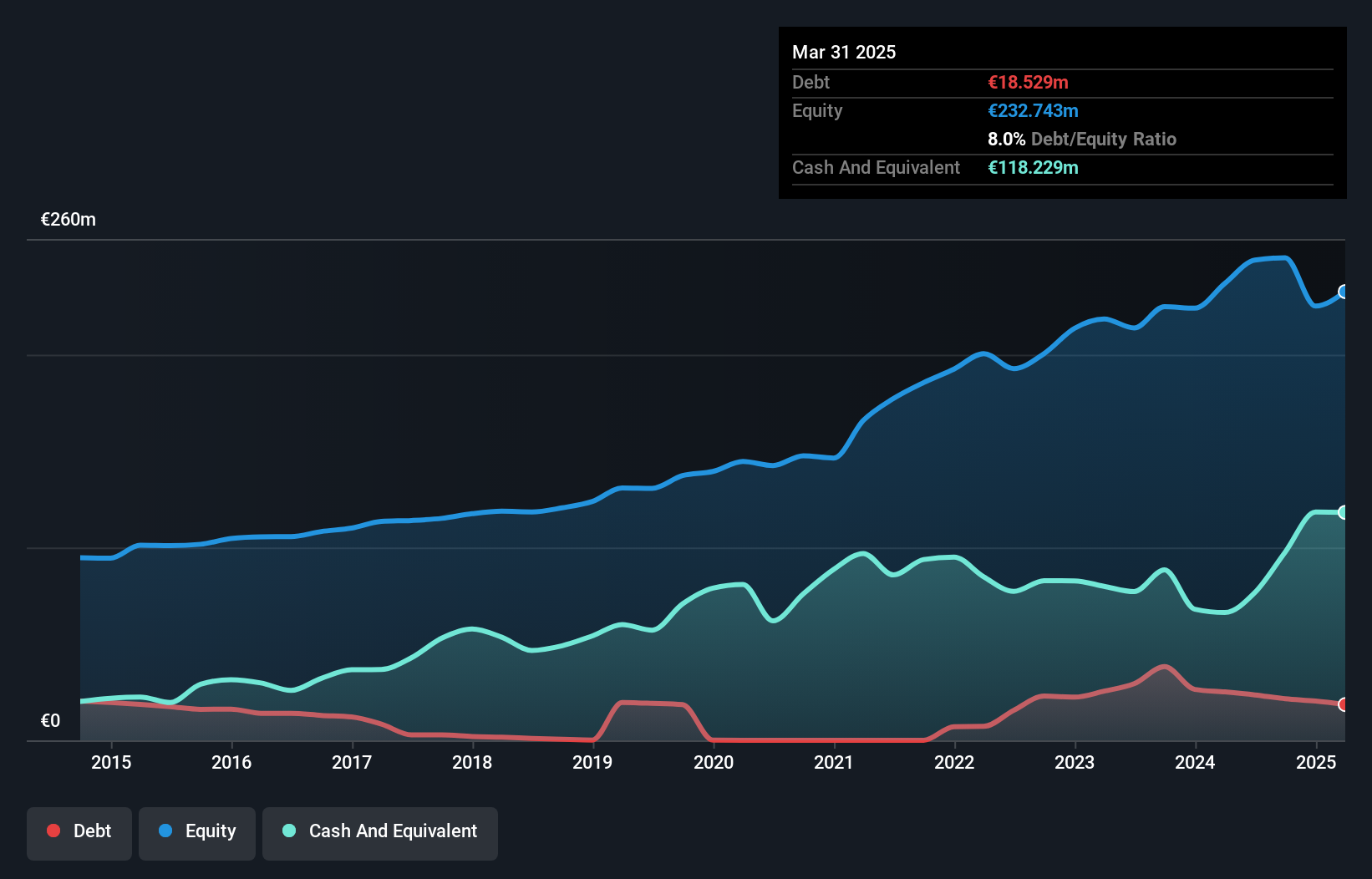

Eckert & Ziegler, a nimble player in the radiopharmaceutical space, is showing promise with a 10% earnings growth over the past year, outpacing its industry peers. Trading at 57.7% below estimated fair value and boasting high-quality earnings, it’s an intriguing prospect for those eyeing potential undervaluation. The company's strategic moves include expanding radioisotope production and securing a master service agreement with Archeus Technologies to manufacture ART-101 for prostate cancer treatment. While their debt-to-equity ratio has risen to 7.4% over five years, interest payments are well-covered by EBIT at 67.7x coverage—indicating robust financial health despite potential risks like project delays or licensing revenue volatility.

Where To Now?

- Embark on your investment journey to our 329 European Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion