Merkur PrivatBank (XTRA:MBK) Profit Margin Tops Prior Year, Challenges Narratives on Valuation Premium

Reviewed by Simply Wall St

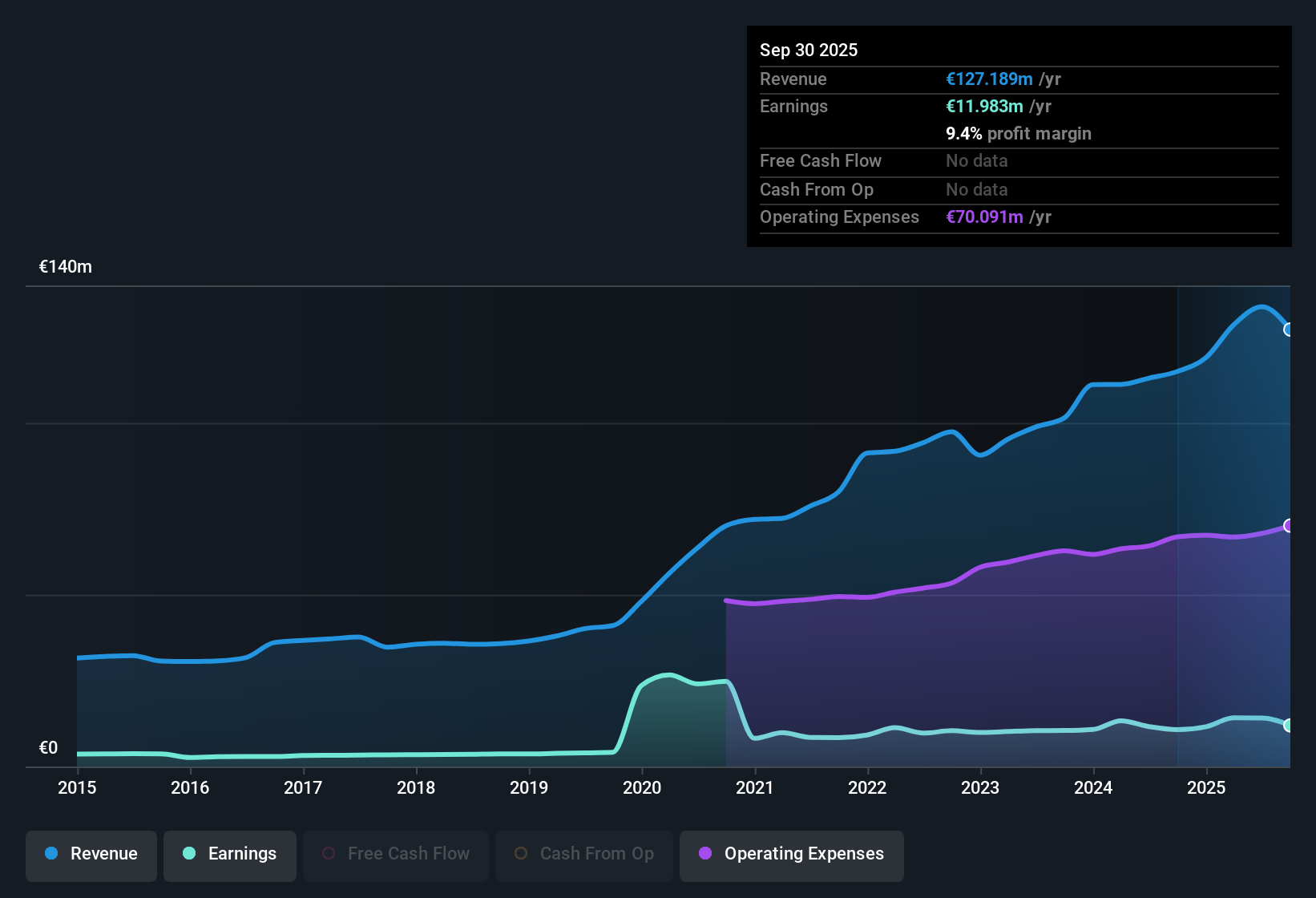

Merkur PrivatBank KgaA (XTRA:MBK) reported a net profit margin of 9.4%, edging up from 9.3% last year, with annual earnings growth of 11.8% far outpacing its five-year annualized rate of 0.9%. While earnings are projected to grow by 9.8% per year going forward, which is below the German market’s expected 16.5%, and revenue is forecast to rise at 3.1% per year compared to the 6% market average, the figures point to improving profitability with some acceleration on recent trends. Investors are likely to focus on MBK’s consistent profit growth, relative peer value, and attractive dividends, even as its top-line and bottom-line growth trail broader benchmarks.

See our full analysis for Merkur PrivatBank KgaA.Next up, let’s see how these results measure up against the market’s narrative and where MBK’s latest performance challenges or confirms current expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Edges Up Over Five-Year Trend

- Net profit margin reached 9.4% this year, edging up from 9.3% last year and standing noticeably higher than the 0.9% annualized earnings growth rate over the past five years. This highlights a modest but meaningful improvement in profitability over the longer term.

- What is surprising is that while recent results point to improved profits, the expected annual earnings growth going forward is 9.8% per year and still lags the broader German market forecast of 16.5%.

- This contrast shows MBK’s fundamentals are solidifying, but its pace is noticeably slower than the sector’s momentum.

- The slightly rising profit margin supports the case for MBK’s durable operations, even if outperforming the market remains a stretch.

Peer Valuation Gap Remains Wide

- MBK trades at a price-to-earnings ratio of 12.5x, much lower than the peer group average of 31.2x, but above the European Banks industry average of 9.7x. This puts its valuation in an unusual spot between sector bargains and industry premiums.

- MBK’s shares currently trade at €19.30, which is also well above its DCF fair value of €8.70 and highlights a distinct valuation premium that runs counter to narrative claims of “good value.”

- This market pricing may indicate confidence in MBK’s resilience or dividend appeal, but it raises the bar for future performance to justify the higher multiple.

- While value-oriented investors may be drawn in by the peer discount, the premium to intrinsic value invites careful scrutiny if sector trends shift.

Dividend and Profit Growth Drive Appeal

- Reporting consistent profit or revenue growth alongside an attractive dividend, MBK’s reward profile stands out even as its top-line and bottom-line growth rates fall short of broader benchmarks.

- Consensus narrative notes that the bank’s steady approach to income and value attracts investors focused on stability and payouts. Yet, the moderation in future growth expectations suggests rewards are balanced by the reality of modest acceleration.

- Many investors will weigh steady profit growth and dividends against the more dynamic but riskier profiles of faster-growing peers.

- MBK’s reliable fundamentals offer a clear proposition for those prioritizing long-term income and value amidst competitive sector dynamics.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Merkur PrivatBank KgaA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite consistent profits and attractive dividends, Merkur PrivatBank’s slower earnings and revenue growth leave it lagging far behind faster growing German peers.

If you’re looking to capture more upside, discover high growth potential stocks screener (59 results) with robust growth forecasts that can put sluggish performance in the rear-view mirror.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBK

Merkur PrivatBank KgaA

Provides various private banking products and services in Germany.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)