Commerzbank (XTRA:CBK): Examining Valuation After Strong Share Price Gains in 2024

Reviewed by Simply Wall St

Commerzbank (XTRA:CBK) continues to attract investor attention as its stock shows steady performance this month, even after modest movement in the past week. The share price has hovered around €31.82, reflecting ongoing market interest.

See our latest analysis for Commerzbank.

Commerzbank’s impressive share price return of 104.5% year-to-date signals strong momentum in 2024. This reflects renewed optimism and perhaps a shift in how investors perceive the bank’s growth prospects and risk profile. Over the longer term, its total shareholder return has been even more eye-catching, with gains of 106.6% in the past year and 594% over five years. This underscores a notable turnaround and sustained value creation along the way.

If this resurgence in banks piques your interest, it might be an ideal moment to broaden your watchlist and discover fast growing stocks with high insider ownership

But with shares now so elevated, the big question is whether Commerzbank remains undervalued relative to its earnings and growth, or if the market has already priced in much of that upside for now.

Most Popular Narrative: 1.3% Undervalued

The most widely followed narrative places Commerzbank's fair value at €32.25, just above its last close of €31.82. This near-parity suggests analysts see little room for further upside at current levels, setting up a debate over whether the rebound has fully run its course.

*Ongoing restructuring, cost discipline, and digital transformation, including further branch reductions and automation, remain on track to improve the cost/income ratio towards the 50% target by 2028. These measures are expected to drive structurally improved net margins and profitability. The introduction of new account fee structures for private customers (already adopted by over 1 million clients out of 2.4 million) and continued high growth in net commission income (targeting 7% or more per year) reflect Commerzbank's successful shift to more resilient, fee-based earnings streams. This shift helps offset interest rate pressures and underpins sustainable revenue growth.*

How realistic are the bold margin improvements and fee income ambitions behind this sharp valuation shift? The analytical model leans heavily on projected operational efficiencies and business model reinvention. Wondering which numbers drive the narrative's outlook for Commerzbank? Dive in to see the pivotal factors powering this valuation call.

Result: Fair Value of €32.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as digital disruption from fintechs and tighter regulatory demands could pressure Commerzbank’s profit margins and slow its revenue momentum.

Find out about the key risks to this Commerzbank narrative.

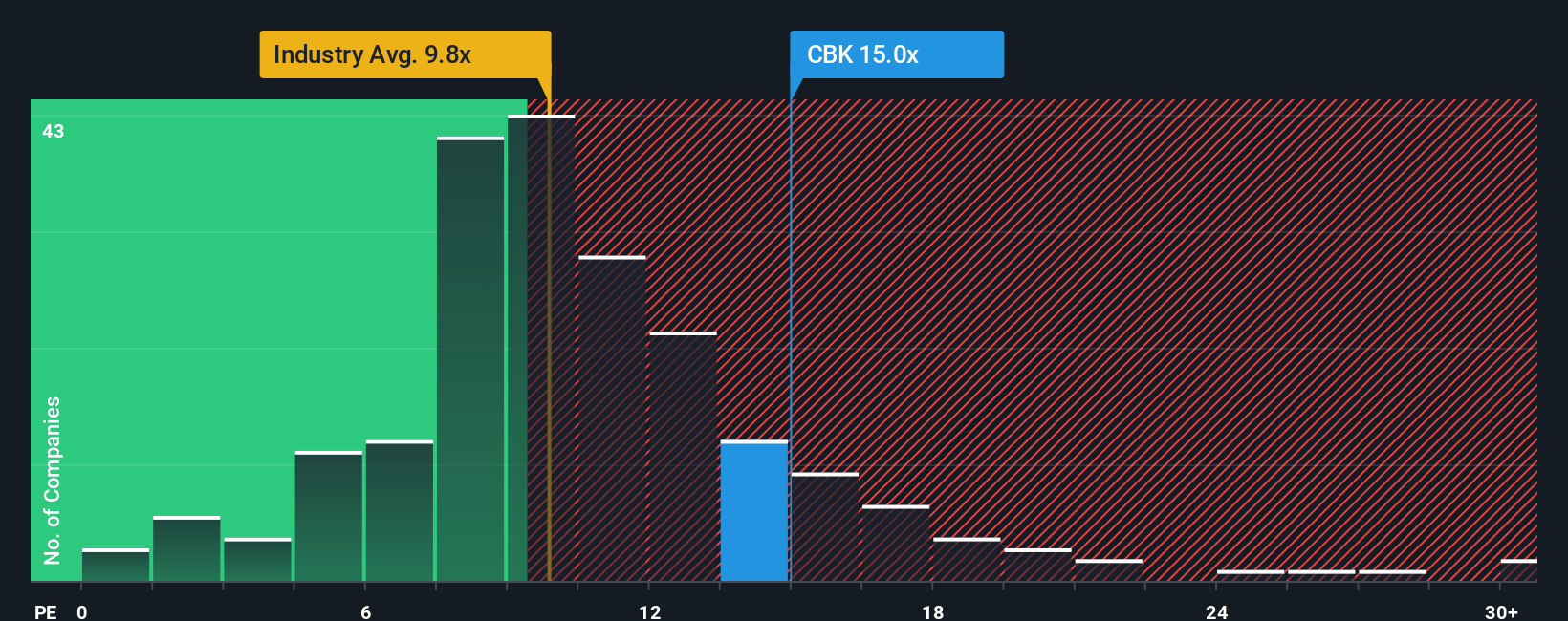

Another View: Multiples Say Shares Look Expensive

Looking through the lens of price-to-earnings, Commerzbank's shares are trading at 14.7x, a clear premium to both its European banking peers (10.1x) and its peer average (11.3x). This is also above the fair ratio of 14x, which suggests some valuation risk if the market’s enthusiasm cools. If the gap closes, Commerzbank’s current momentum could face resistance.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commerzbank Narrative

If you’d rather draw your own conclusions or prefer hands-on research, you can build your own Commerzbank story in just a few minutes. Do it your way

A great starting point for your Commerzbank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your reach with these handpicked themes and stay ahead of the game before others even notice the potential.

- Boost your income this year by targeting companies with reliable payouts. Start with these 16 dividend stocks with yields > 3%, which features impressive yields above 3%.

- Capitalize on the potential of generative AI by checking out these 24 AI penny stocks, where companies are driving innovation across industries.

- Discover underappreciated gems trading below their fair value with these 870 undervalued stocks based on cash flows, based on robust cash flow analysis and market mispricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CBK

Commerzbank

Provides banking and capital market products and services to private and small business customers, corporate, financial service providers, and institutional clients in Germany, rest of Europe, the Americas, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives