What Volkswagen (XTRA:VOW3)'s First Quarterly Loss in Five Years Means for Shareholders

Reviewed by Sasha Jovanovic

- Volkswagen recently reported a quarterly net loss of €313 million for the third quarter of 2025, its first quarterly loss in five years, largely due to the impact of U.S. tariffs and challenges with its electric vehicle strategy at subsidiary Porsche.

- This setback prompted leadership changes, with CEO Oliver Blume set to step down from Porsche and retain only his role at the parent company amid investor concerns about the group’s direction.

- We'll examine how the operating loss driven by U.S. tariffs and Porsche's EV strategy reversal impacts Volkswagen's investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Volkswagen Investment Narrative Recap

Volkswagen’s story centers on its ability to execute a global transition to electric vehicles while managing geopolitical risks such as U.S. tariffs. The recent quarterly net loss, in part due to new tariffs and a setback in Porsche’s EV strategy, directly pressures short-term profit recovery, intensifying the focus on trade friction as the most important immediate risk, while also impacting the credibility of management’s restructuring narrative.

Of recent developments, the leadership change at Porsche, prompted by these losses, stands out. Volkswagen’s decision to have CEO Oliver Blume step down from Porsche reflects management’s intent to address brand-specific concerns and demonstrates how executive structure is shifting in response to critical short-term catalysts and risks related to U.S. market exposure and electric vehicle profitability.

Yet, in contrast to expectations of a rebound, persistent U.S. tariffs represent a structural threat that investors should be aware of if...

Read the full narrative on Volkswagen (it's free!)

Volkswagen's narrative projects €352.0 billion revenue and €15.8 billion earnings by 2028. This requires 2.8% yearly revenue growth and an €7.4 billion increase in earnings from €8.4 billion today.

Uncover how Volkswagen's forecasts yield a €113.55 fair value, a 23% upside to its current price.

Exploring Other Perspectives

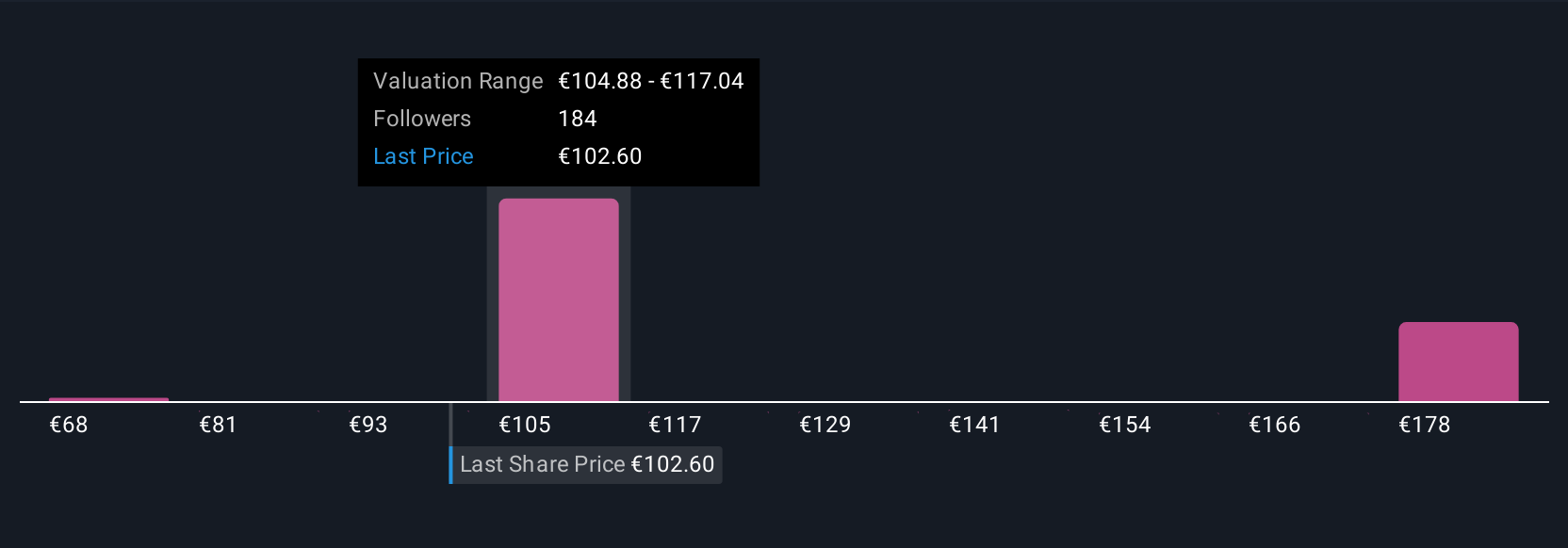

Ten fair value estimates from the Simply Wall St Community place Volkswagen between €68.40 and €144.45, with significant spread at both extremes. With U.S. tariffs weighing heavily on earnings, these varied opinions show why understanding all sides is vital before forming your own view.

Explore 10 other fair value estimates on Volkswagen - why the stock might be worth 26% less than the current price!

Build Your Own Volkswagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Volkswagen research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Volkswagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Volkswagen's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives