- Germany

- /

- Auto Components

- /

- XTRA:SHA0

3 German Stocks Estimated To Be Up To 28.3% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, the German stock market has faced challenges as the DAX Index fell by 1.81%, reflecting broader investor caution amid escalating Middle East tensions and economic uncertainties in Europe. As investors navigate these turbulent waters, identifying stocks that are trading below their intrinsic value can present opportunities for potential long-term gains. In this context, understanding a company's fundamentals and assessing its intrinsic value become crucial steps in evaluating investment prospects within Germany's diverse market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.75 | €31.00 | 46% |

| init innovation in traffic systems (XTRA:IXX) | €34.90 | €52.04 | 32.9% |

| Formycon (XTRA:FYB) | €50.60 | €81.95 | 38.3% |

| CeoTronics (DB:CEK) | €5.50 | €10.12 | 45.7% |

| Gerresheimer (XTRA:GXI) | €80.65 | €112.48 | 28.3% |

| Schweizer Electronic (XTRA:SCE) | €3.78 | €7.19 | 47.5% |

| OTRS (DB:TR9) | €10.00 | €17.09 | 41.5% |

| MTU Aero Engines (XTRA:MTX) | €284.90 | €566.41 | 49.7% |

| Your Family Entertainment (DB:RTV) | €2.30 | €4.34 | 47% |

| Basler (XTRA:BSL) | €8.88 | €12.68 | 30% |

Below we spotlight a couple of our favorites from our exclusive screener.

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €2.78 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions both in Germany and internationally.

Operations: Revenue Segments (in millions of €): The company generates revenue through its three main segments: Plastics & Devices (€1,013.10 million), Primary Packaging Glass (€558.90 million), and Advanced Technologies (€75.40 million).

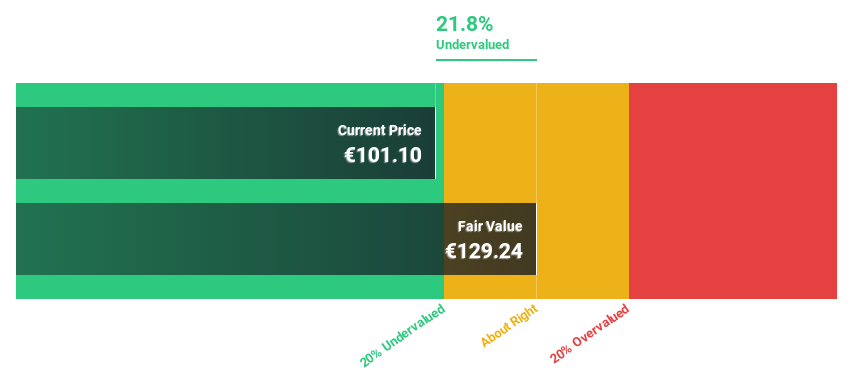

Estimated Discount To Fair Value: 28.3%

Gerresheimer is trading at €80.65, significantly below its estimated fair value of €112.48, suggesting undervaluation based on cash flows. Despite a high debt level, earnings are forecast to grow significantly at 21.25% annually over the next three years, outpacing the German market's growth rate. However, recent guidance revisions indicate slower organic revenue growth for 2024 and 2025, potentially impacting future cash flow projections despite current undervaluation indicators.

- Upon reviewing our latest growth report, Gerresheimer's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Gerresheimer's balance sheet by reading our health report here.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market capitalization of approximately €239.71 billion.

Operations: The company generates revenue of €32.54 billion from its Applications, Technology & Services segment worldwide.

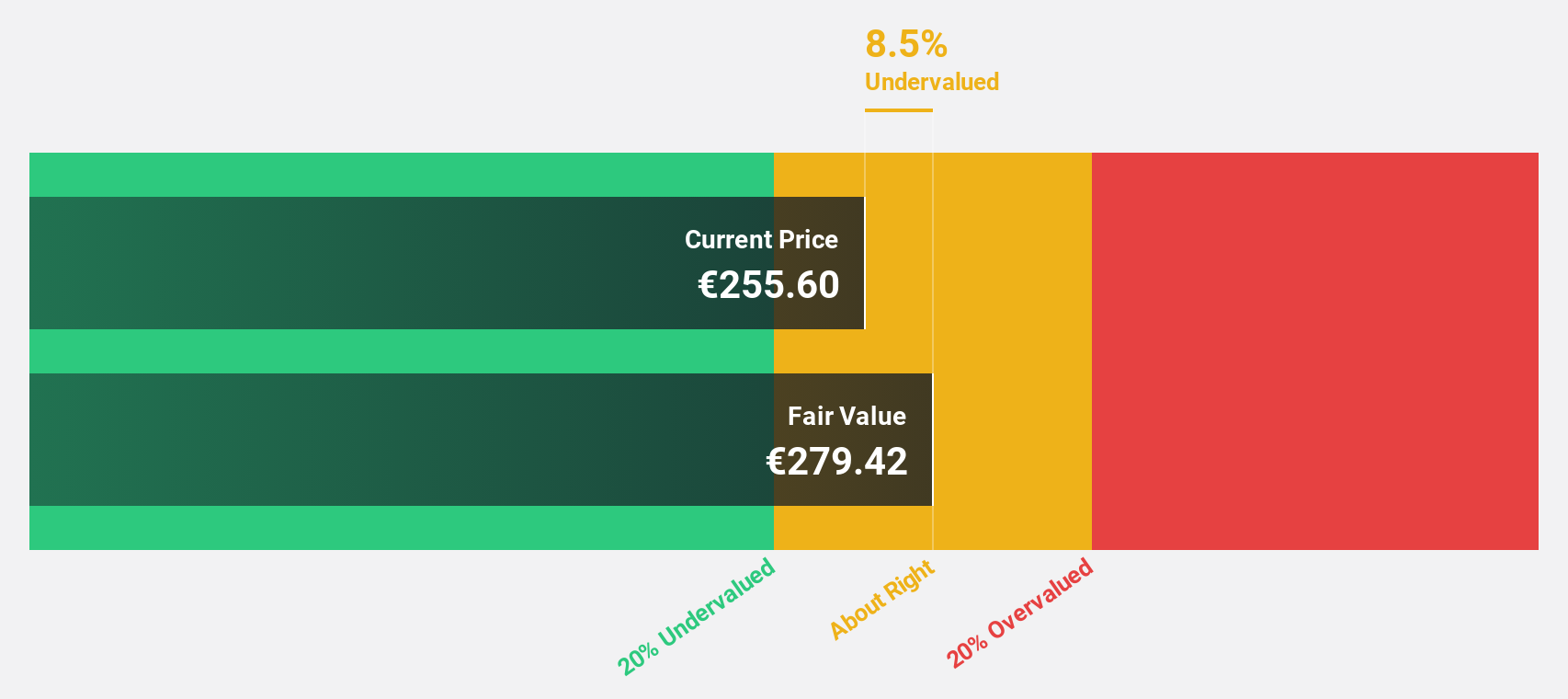

Estimated Discount To Fair Value: 25.1%

SAP is trading at €206.05, which is 25.1% below its estimated fair value of €275.18, indicating it may be undervalued based on cash flows. The company's earnings are expected to grow significantly at 37.9% annually, surpassing the German market's growth rate of 20.1%. Recent AI innovations like Joule and SAP Knowledge Graph could enhance business efficiency and data utilization, potentially supporting future revenue growth despite a forecasted low return on equity of 16.4%.

- Insights from our recent growth report point to a promising forecast for SAP's business outlook.

- Click here to discover the nuances of SAP with our detailed financial health report.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific with a market cap of approximately €4.65 billion.

Operations: The company's revenue segments consist of Automotive Technologies at €9.80 billion, Vehicle Lifetime Solutions at €2.43 billion, and Bearings & Industrial Solutions at €4.10 billion.

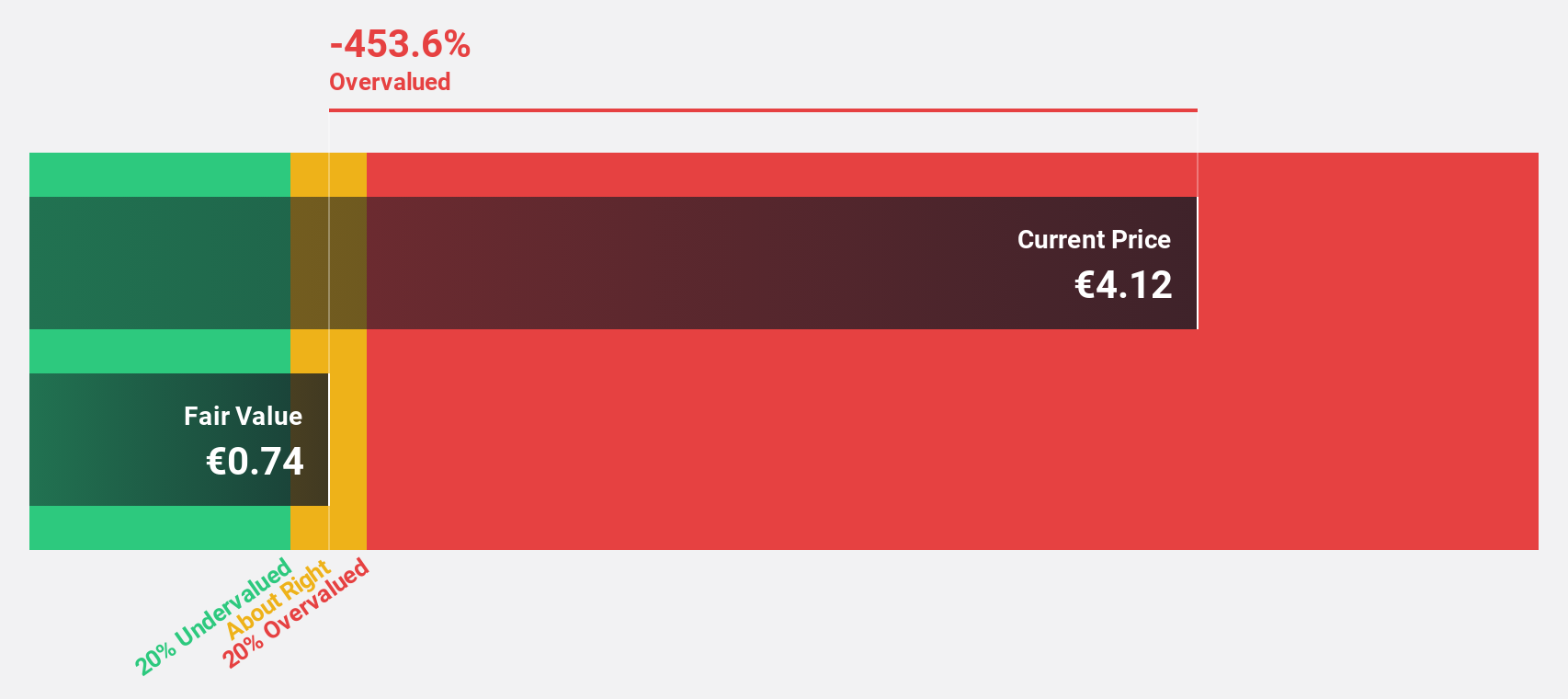

Estimated Discount To Fair Value: 14.4%

Schaeffler is trading at €4.93, 14.4% below its estimated fair value of €5.75, suggesting potential undervaluation based on cash flows. Despite a decline in net profit margins from 3.5% to 1.9%, earnings are forecast to grow significantly at 38.1% annually, outpacing the German market's growth rate of 20.1%. However, interest payments are not well covered by earnings and shareholders have experienced substantial dilution recently, which may impact financial stability moving forward.

- Our expertly prepared growth report on Schaeffler implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Schaeffler here with our thorough financial health report.

Make It Happen

- Unlock our comprehensive list of 20 Undervalued German Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SHA0

Schaeffler

Develops, manufactures, and sells components and systems for industrial applications in Europe, the Americas, China, and the Asia Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives