Porsche SE (XTRA:PAH3): Exploring Current Valuation as Investor Sentiment Shows Signs of Shifting

Reviewed by Simply Wall St

Most Popular Narrative: 9.3% Undervalued

According to a widely-followed narrative, Porsche Automobil Holding currently trades below its estimated fair value, hinting at meaningful upside. This analysis highlights the stock's notable discount and the potential value waiting to be unlocked by investors.

PAH3 appears undervalued at current levels. However, traditional DCF valuation is challenging due to its holding company structure. The discount to NAV and analyst targets suggest potential upside, though risks around VW's performance and debt levels remain key concerns.

Ever wondered what’s driving this significant valuation gap? The full narrative unmasks a core set of financial assumptions and reveals how exposure to major automotive icons shapes the upside case for Porsche Automobil Holding. Peek under the hood to discover the surprising metrics and bold forecasts that power this compelling fair value argument.

Result: Fair Value of €40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high net debt and potential impairment losses on investments could quickly undermine the attractiveness of the undervaluation case.

Find out about the key risks to this Porsche Automobil Holding narrative.Another View: The SWS DCF Model

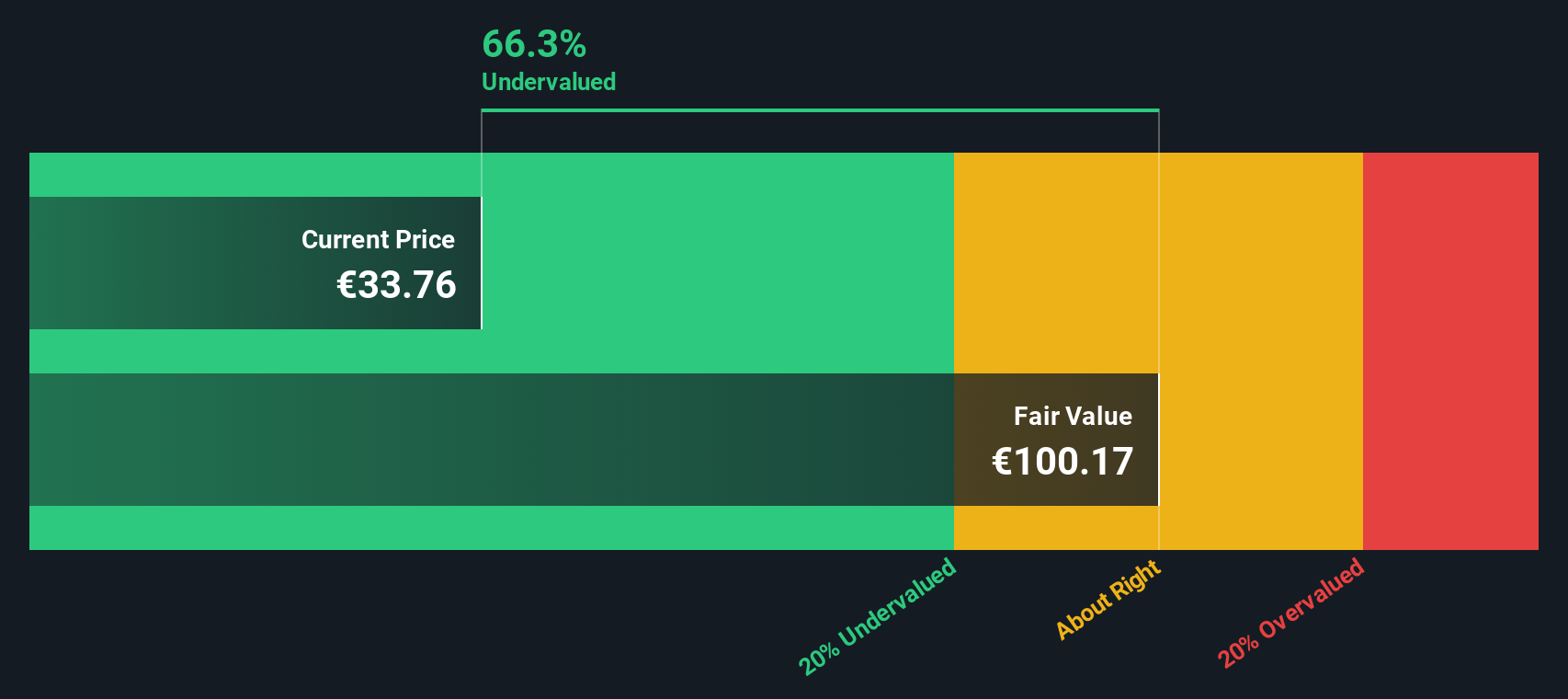

While many value Porsche Automobil Holding by looking at its relative discount, our DCF model points toward a very different picture. This model also projects the shares as undervalued. However, does it capture the full story, or is something being missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Porsche Automobil Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Porsche Automobil Holding Narrative

If you find yourself with a different perspective or want to dig deeper, you can build your own case in just a few minutes. Do it your way.

A great starting point for your Porsche Automobil Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock more ways to build a smarter portfolio. Don’t let unique opportunities in fast-growing sectors, disruptive innovation, and income-generating stocks pass you by.

- Seize the potential for outsized returns by targeting up-and-coming companies leading breakthroughs in technology and markets with our penny stocks with strong financials.

- Find tomorrow’s trendsetters in artificial intelligence by checking out stocks that are shaping the future era of automation with our AI penny stocks.

- Power up your income strategy and spot companies offering robust payouts above 3% with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About XTRA:PAH3

Porsche Automobil Holding

Through its subsidiaries, operates as an automobile manufacturer worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives