Porsche (XTRA:P911) Profit Plunge and CEO Change: Is the Brand's Strategic Direction Shifting?

Reviewed by Sasha Jovanovic

- In October 2025, Dr. Ing. h.c. F. Porsche AG announced a sharp drop in nine-month net income to €125 million, down from €2.77 billion a year earlier, alongside the appointment of Dr. Michael Leiters as CEO effective January 2026.

- The financial downturn was linked to costs from delaying electric vehicle launches, extending combustion engine models, and weaker demand in key international markets, marking a significant shift in Porsche's business trajectory.

- We'll examine how Porsche's recent profit challenges and CEO transition affect its previously optimistic investment outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Dr. Ing. h.c. F. Porsche Investment Narrative Recap

For anyone considering shares of Dr. Ing. h.c. F. Porsche AG, the big-picture case has centered on the company's ability to drive luxury vehicle demand and expand its electric and hybrid lineup, aiming for higher long-term growth and margins. However, the sharp decline in net income and recent product delays signal a material challenge to the most important near-term catalyst: the successful rollout of new EVs. The biggest risk now is the cost of slow EV adoption amid global demand weakness, which has clearly impacted short-term profitability.

Among the recent announcements, the October 2025 disclosure on earnings stands out, with net income for the first nine months plummeting to €125 million from €2.77 billion a year earlier. This was tied directly to realignment costs stemming from delayed EV models and extending combustion offerings, both of which are central to Porsche’s catalysts and immediate challenges. Contrast this with Porsche’s long-term outlook, and it’s essential for investors to also keep in mind the potential for ongoing margin pressure from...

Read the full narrative on Dr. Ing. h.c. F. Porsche (it's free!)

Dr. Ing. h.c. F. Porsche's narrative projects €41.7 billion revenue and €3.5 billion earnings by 2028. This requires 2.4% yearly revenue growth and a €1.3 billion earnings increase from €2.2 billion today.

Uncover how Dr. Ing. h.c. F. Porsche's forecasts yield a €44.53 fair value, a 6% downside to its current price.

Exploring Other Perspectives

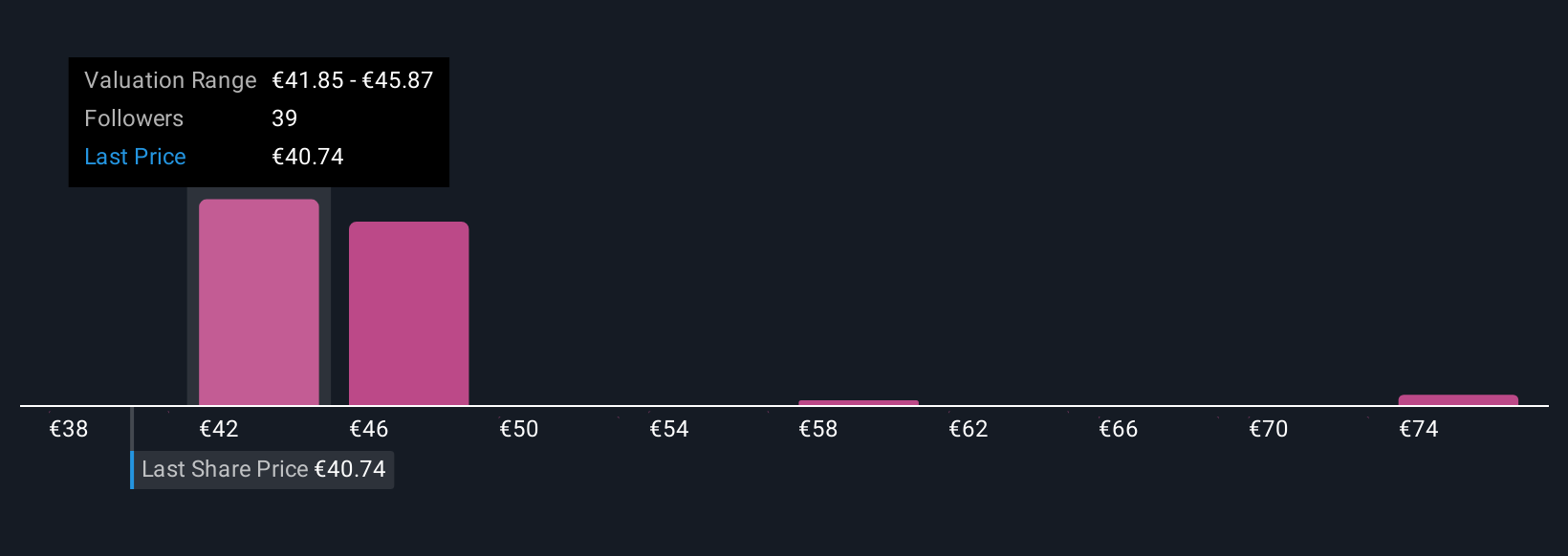

Simply Wall St Community members have published 12 fair value estimates for Porsche, ranging from €37.82 to €78.09 per share. Despite broad optimism about earnings growth, the latest earnings shock highlights just how much near-term volatility can alter these expectations, inviting you to compare a variety of sharply different viewpoints.

Explore 12 other fair value estimates on Dr. Ing. h.c. F. Porsche - why the stock might be worth as much as 66% more than the current price!

Build Your Own Dr. Ing. h.c. F. Porsche Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dr. Ing. h.c. F. Porsche research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dr. Ing. h.c. F. Porsche research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dr. Ing. h.c. F. Porsche's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:P911

Dr. Ing. h.c. F. Porsche

Engages in automotive and financial services business in Germany, Europe, North America, China, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives