Porsche (XTRA:P911) Margin Slump Challenges Bullish Turnaround Narrative in Latest Earnings

Reviewed by Simply Wall St

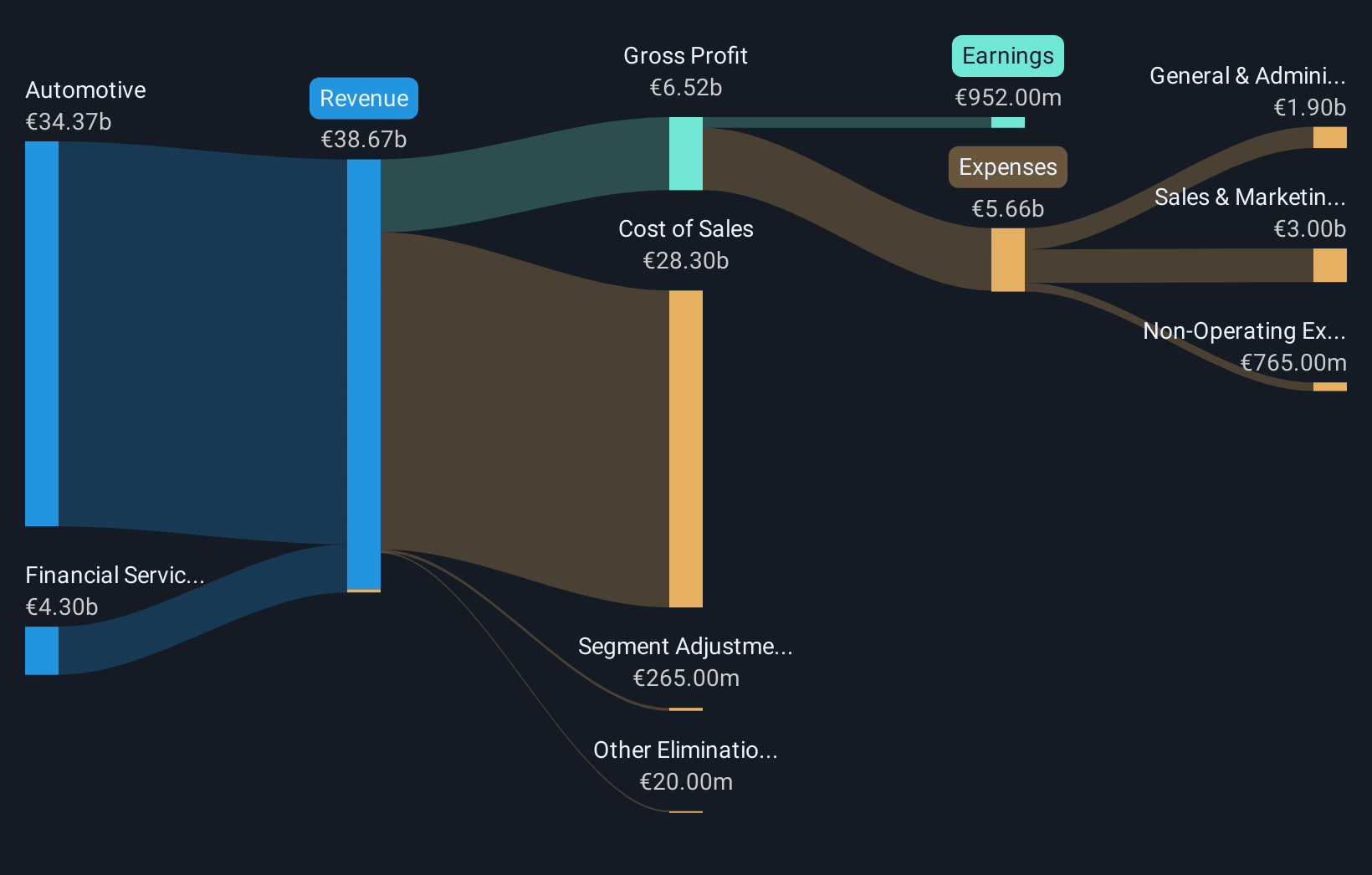

Dr. Ing. h.c. F. Porsche (XTRA:P911) saw net profit margins fall to 2.5% from 10.2% last year. This capped off another tough stretch in which earnings dropped by 9.2% per year on average over five years and remained negative year-on-year. Despite these pressures, the shares are trading at €47.16, below their estimated fair value of €63.43. Investors are tuning in for the promise of a 36.13% annualized earnings rebound over the next three years, which outpaces the broader German market.

See our full analysis for Dr. Ing. h.c. F. Porsche.The next section puts these earnings in context by seeing how the fresh numbers stack up against the leading narratives circulating in the Simply Wall St community. Let’s dig into where the numbers support the story and where surprises may emerge.

See what the community is saying about Dr. Ing. h.c. F. Porsche

Profit Margin Forecasts Recover From Recent Lows

- Analysts expect profit margins to rise from today’s 5.6% to 8.4% within three years, a notable recovery after margins slid to just 2.5% in the latest results compared to 10.2% a year ago.

- According to the analysts’ consensus view, margin recovery is anchored in two main claims:

- Consensus notes strict cost controls and a 15% workforce reduction target by 2029 are intended to structurally lower operating expenses and directly support this margin rebound.

- Higher-margin revenue from digital features and exclusivity programs, especially in affluent regions like China, is expected to offset pressure from softer volumes and restructuring costs.

- The consensus view’s projected path sets a much stronger margin outlook than current results suggest, with analysts emphasizing the operational turnaround as a key to long-term earnings quality.

Valuation Still Offers Upside Despite Peer Premium

- P911 trades at €47.16, below its DCF fair value of €63.43. Its price-to-earnings ratio of 45.1x far exceeds global peers at 18.8x and direct auto peers at 8.4x.

- Analysts’ consensus narrative acknowledges this valuation gap presents a mixed picture:

- While the share’s steep premium to auto peers on current profits signals caution, analysts highlight that earnings growth forecasts of 36.13% annually could justify a higher valuation if margin recovery plays out.

- The relatively small spread between the current share price and the analyst price target of €44.27 (about 6% upside) suggests the market is waiting to see operational improvements before rerating the stock in line with its fair value estimate.

China Slowdown and High Tariffs Remain Key Risks

- The consensus narrative flags China, Porsche’s second-largest market, where volumes have fallen over 50% from peak, as a major risk for future growth and margin expansion.

- On the risk side, analysts warn that weakening in China, slower luxury EV adoption, and tariffs of up to 15% are straining margins and introducing greater uncertainty:

- Consensus highlights that high restructuring charges from strategic realignment, plus persistent trade friction, are already weighing on near-term profits and could delay the expected earnings rebound if trends intensify.

- Fierce competition and shifting preferences in the luxury EV segment add pressure, with analysts arguing that only a successful rollout of new digital offerings and exclusivity programs can offset these headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dr. Ing. h.c. F. Porsche on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your perspective and craft your own narrative in under three minutes using our platform: Do it your way

A great starting point for your Dr. Ing. h.c. F. Porsche research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Porsche’s volatile profit margins, high peer valuation, and reliance on a swift turnaround leave investors exposed to unpredictable earnings swings and market skepticism.

If you want steadier performance, use stable growth stocks screener (2102 results) to find companies with reliable earnings and revenue growth that weather downturns more consistently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:P911

Dr. Ing. h.c. F. Porsche

Engages in automotive and financial services business in Germany, Europe, North America, China, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives