Semiconductor Supply Chain Disruptions Could Be a Game Changer for Mercedes-Benz Group (XTRA:MBG)

Reviewed by Sasha Jovanovic

- Earlier this month, Mercedes-Benz Group announced it had secured a short-term semiconductor supply following disruptions involving Dutch chipmaker Nexperia, warning that the broader automotive industry faces ongoing risks to the availability of essential electronic components.

- This development highlights the continued vulnerability of automakers to supply chain instabilities, particularly in sourcing chips for critical vehicle systems.

- We'll now explore how these renewed semiconductor supply chain risks could influence Mercedes-Benz's underlying investment narrative and earnings outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Mercedes-Benz Group Investment Narrative Recap

For shareholders, the core belief centers on Mercedes-Benz Group's ability to protect premium brand positioning, deploy new electric and digital products, and maintain healthy margins despite industry volatility. The recent semiconductor update spotlights supply chain fragility but does not materially alter the biggest near-term catalyst, the large-scale launch of new EV models, or the primary risk linked to margin pressure from weaker China sales and global tariff uncertainty.

One of the most relevant recent announcements is the upcoming transition of Jorg Burzer to Chief Technology Officer, leading the Development Procurement division. This move directly intersects with the chip supply challenge, as consistent executive focus on procurement and development may help Mercedes-Benz mitigate ongoing supply chain headwinds, an operational factor that supports its readiness to drive EV launches and digital transformation.

Yet, in sharp contrast to the optimism around product launches, investors should be especially mindful of how global tariff and trade dynamics could ...

Read the full narrative on Mercedes-Benz Group (it's free!)

Mercedes-Benz Group's outlook anticipates €146.0 billion in revenue and €8.5 billion in earnings by 2028. This scenario is based on a 1.6% annual revenue growth rate and a €1.7 billion increase in earnings from the current €6.8 billion.

Uncover how Mercedes-Benz Group's forecasts yield a €60.08 fair value, a 12% upside to its current price.

Exploring Other Perspectives

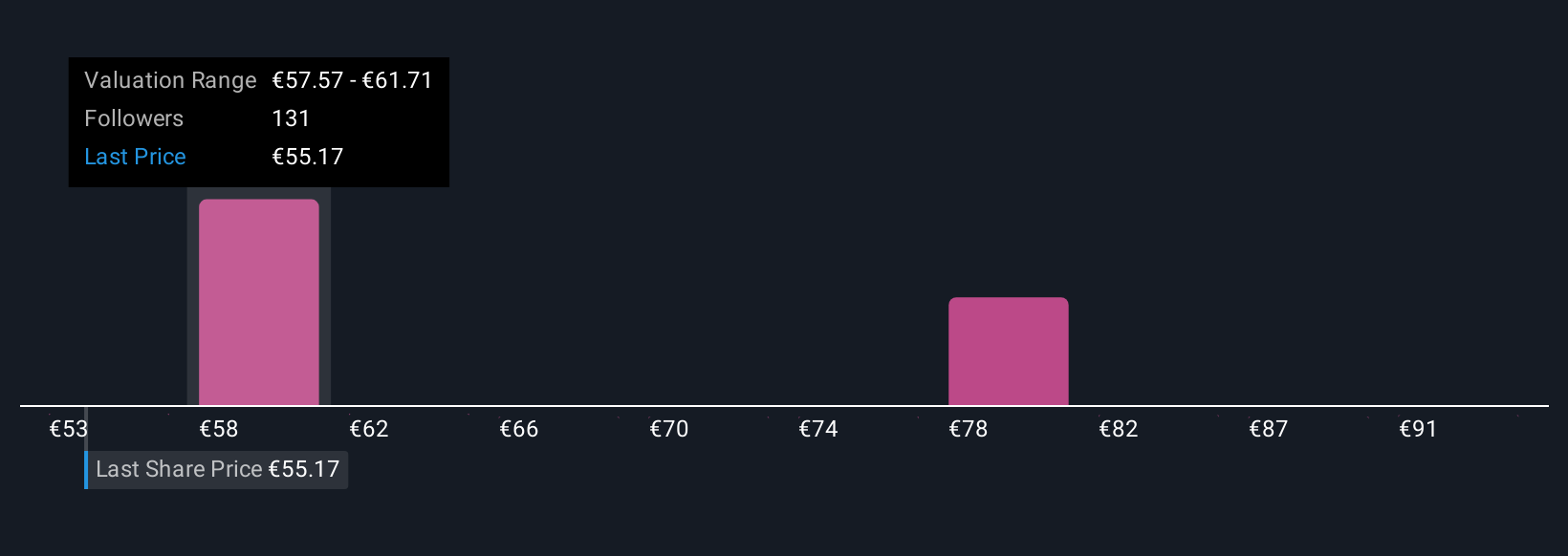

Eight individual members of the Simply Wall St Community set Mercedes-Benz Group's fair value between €56 and €82.76. With consensus risk centered on China-driven margin pressure, sharply differing outlooks invite further thought on future earnings resilience.

Explore 8 other fair value estimates on Mercedes-Benz Group - why the stock might be worth as much as 54% more than the current price!

Build Your Own Mercedes-Benz Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercedes-Benz Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mercedes-Benz Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercedes-Benz Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBG

Mercedes-Benz Group

Operates as an automotive company in Germany and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives