European Penny Stocks: 3 Picks With Market Caps Over €20M To Watch

Reviewed by Simply Wall St

As the European markets navigate a landscape of mixed economic signals and fluctuating indices, investors are increasingly curious about opportunities in smaller, lesser-known companies. Penny stocks, despite their somewhat outdated moniker, continue to capture attention for their potential to combine affordability with growth prospects. In this article, we will explore several European penny stocks that exhibit strong financial fundamentals and could offer intriguing possibilities for those interested in the potential of emerging market players.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| DigiTouch (BIT:DGT) | €1.985 | €27.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €231.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.68 | DKK118.33M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.81 | €39M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.977 | €78.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Faes Farma (BME:FAE) | €4.525 | €1.41B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0798 | €8.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.924 | €30.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 275 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market cap of €1.08 billion.

Operations: The company's revenue is generated entirely from its folding boxboard, fresh fibre linerboard, and market pulp businesses, amounting to €1.89 billion.

Market Cap: €1.08B

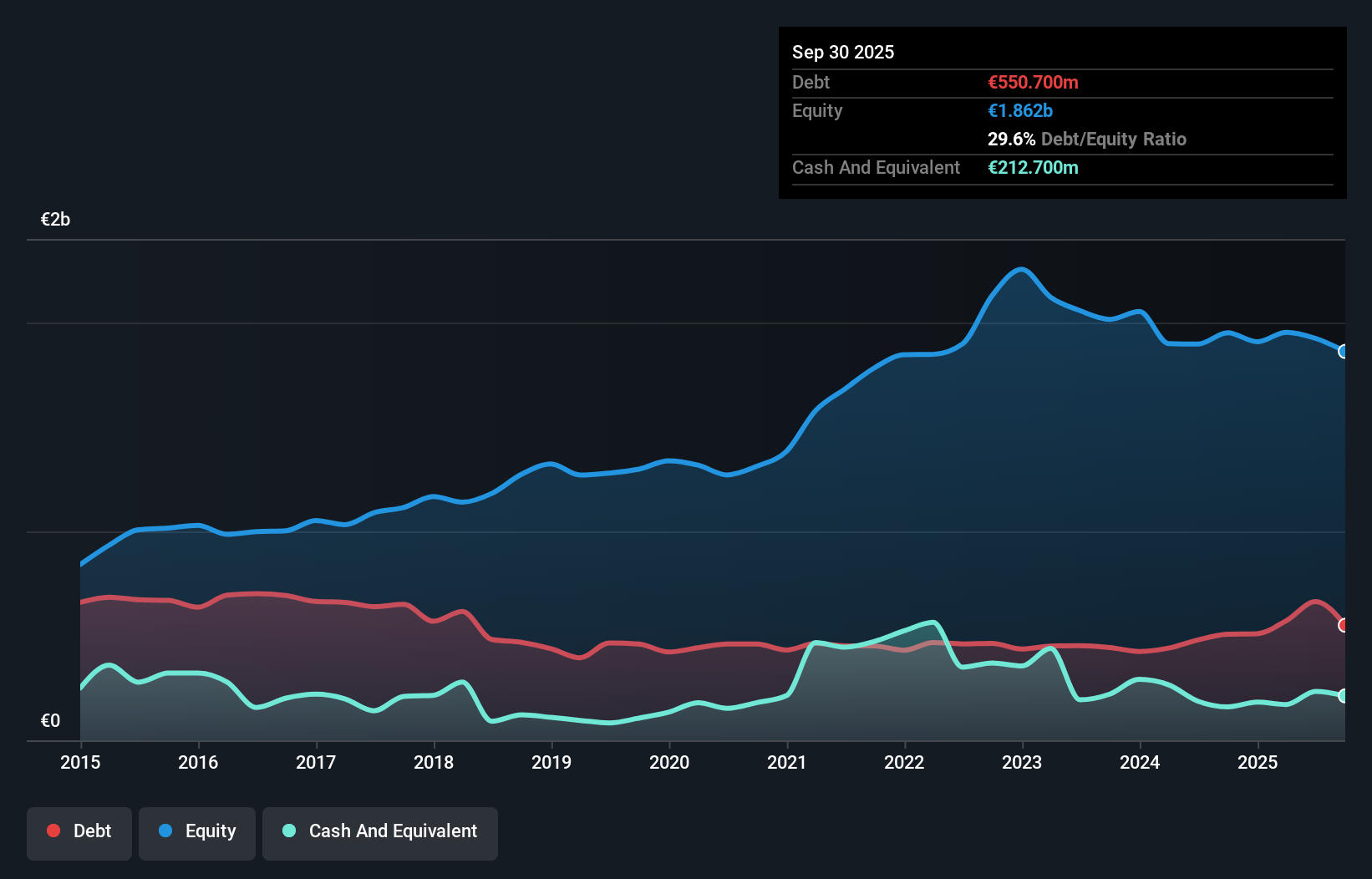

Metsä Board Oyj, with a market cap of €1.08 billion, operates in the folding boxboard and market pulp sectors. Despite being unprofitable with increasing losses over the past five years, its short-term assets exceed liabilities, indicating financial resilience. Recent earnings showed declining sales and a net loss for the third quarter of 2025. However, strategic moves like a €250 million revolving credit facility linked to sustainability targets and a €60 million modernization project at its Simpele mill highlight efforts towards operational efficiency and environmental goals. The management team is relatively new but supported by an experienced board of directors.

- Get an in-depth perspective on Metsä Board Oyj's performance by reading our balance sheet health report here.

- Understand Metsä Board Oyj's earnings outlook by examining our growth report.

NEXT Biometrics Group (OB:NEXT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NEXT Biometrics Group ASA, along with its subsidiaries, offers fingerprint sensor technology across Asia, Europe, Africa, and North America with a market cap of NOK419.51 million.

Operations: The company generates NOK45.17 million in revenue from its fingerprint sensor technology segment.

Market Cap: NOK419.51M

NEXT Biometrics Group ASA, with a market cap of NOK419.51 million, faces challenges as it remains unprofitable despite generating NOK45.17 million in revenue from its fingerprint sensor technology segment. The company recently completed a NOK20 million follow-on equity offering to bolster its cash runway, which was previously estimated at 3-4 months based on free cash flow. NEXT's short-term assets significantly exceed both short and long-term liabilities, providing some financial stability. A recent large-scale order for their FAP 30 ‘Granite’ sensor indicates potential growth opportunities in government ID programs across Africa and Latin America.

- Click here to discover the nuances of NEXT Biometrics Group with our detailed analytical financial health report.

- Assess NEXT Biometrics Group's previous results with our detailed historical performance reports.

hGears (XTRA:HGEA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: hGears AG develops, manufactures, distributes, and supplies precision components and subsystems globally with a market cap of €20.59 million.

Operations: The company generates revenue from various regions, with €7.31 million from the USA, €6.14 million from China, and €14.92 million from the Rest of The World.

Market Cap: €20.59M

hGears AG, with a market cap of €20.59 million, is navigating the penny stock landscape despite its current unprofitability and high volatility. The company reported half-year sales of €49.58 million, slightly down from the previous year, yet reduced its net loss to €6.48 million from €8.09 million a year ago. Its debt situation has improved significantly over five years, with a net debt to equity ratio now at 14.6%. While hGears has reaffirmed revenue guidance between €80-90 million for 2025, it remains challenged by profitability forecasts and volatile share price movements.

- Take a closer look at hGears' potential here in our financial health report.

- Evaluate hGears' prospects by accessing our earnings growth report.

Where To Now?

- Reveal the 275 hidden gems among our European Penny Stocks screener with a single click here.

- Ready For A Different Approach? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:METSB

Metsä Board Oyj

Engages in the folding boxboard, fresh fibre linerboard, and market pulp businesses in Finland and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives