Is BMW Trading Below Its True Value After Recent Cash Flow Projections?

Reviewed by Bailey Pemberton

If you’re sitting on the fence, wondering what to do about Bayerische Motoren Werke stock, you’re not alone. Investors have watched BMW’s price edge up 1.0% in the past week, even as the broader auto sector faces big questions, and after a modest dip of -3.9% over the last month. Zoom out a little further and you’ll notice this isn’t a short-term story, either. Year-to-date, the stock is up 2.9%; over the past twelve months, holders have seen a return of 10.9%. And the five-year picture? That’s a hefty 84.4% gain, which is not too shabby in a competitive market.

What’s driving all this? Part of the recent narrative includes rising interest in electrified vehicle strategies and the ongoing buzz around premium car demand in Europe and Asia. Supply chains have stabilized, helping to calm some nerves. Meanwhile, global headlines about regulatory policy shifts and sustainability targets continue to swirl, adding new dimensions to the way investors assess risk and upside here. It all stacks up to an environment where people are actively weighing not just where BMW has been, but where it could go next.

Curious about whether BMW is undervalued, fairly priced, or maybe even a bargain? According to our current valuation checks, BMW gets a value score of 4 out of 6, indicating the company is undervalued in most but not all of the benchmarks analysts watch closely. Up next, we’ll break down exactly what those valuation approaches are, how BMW stacks up on each, and, as promised, introduce an even better way to gauge true value at the end of this article.

Approach 1: Bayerische Motoren Werke Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to their present value. This approach aims to reveal what the company’s operations are truly worth, based on how much cash they are expected to generate over time.

For Bayerische Motoren Werke, the most recent reported Free Cash Flow (FCF) stands at negative €1.19 billion, a figure reflecting recent investments or fluctuating working capital. Analysts project strong recovery and growth, with FCF expected to reach €5.42 billion by 2029. Over the next decade, Simply Wall St extrapolates these trends further and shows annual FCF hovering around €5.2 billion by 2035. Most of these estimates rely on a blend of analyst expectations for the next five years and algorithmic projections for the years beyond.

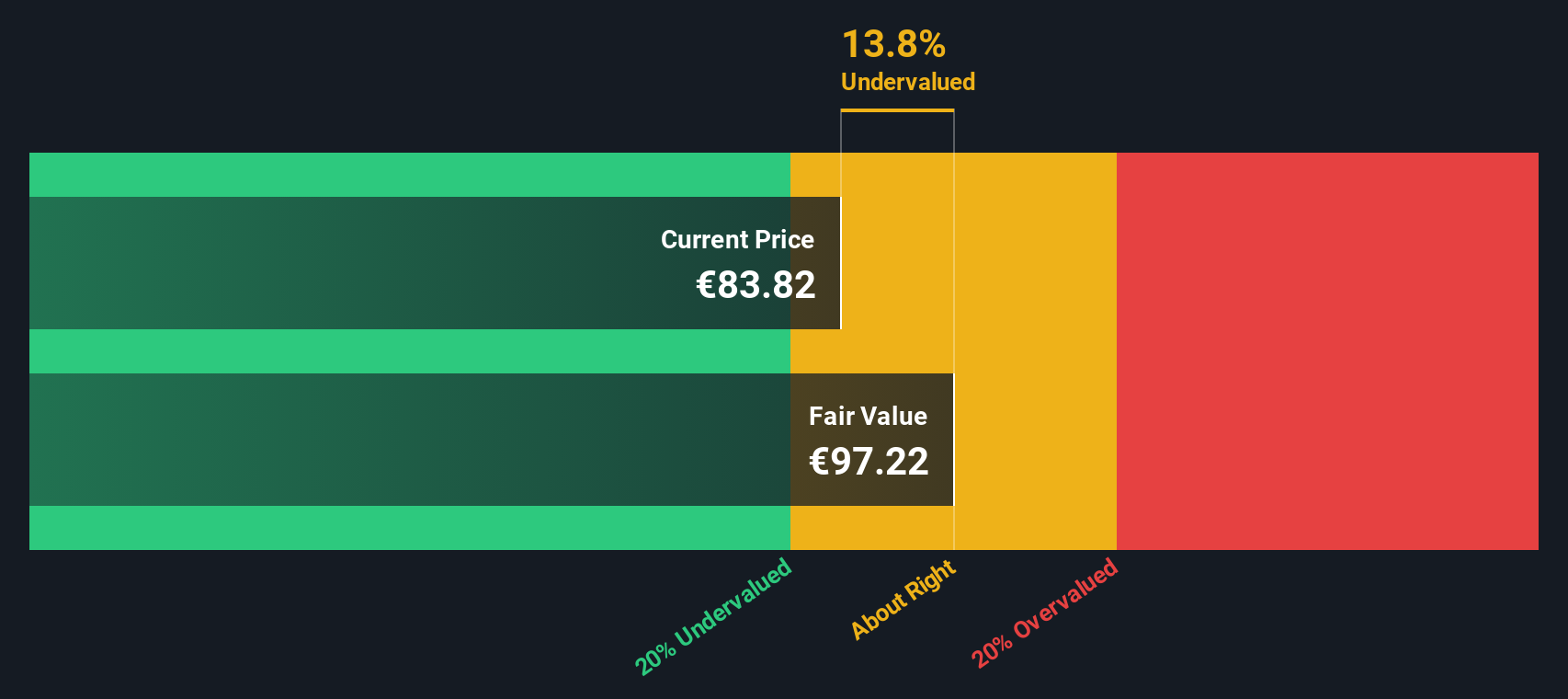

Based on these projections, the DCF model calculates an intrinsic value of €95.99 per share. With the stock currently trading at a price approximately 16.3% below this estimate, the model indicates that BMW is significantly undervalued relative to its true long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bayerische Motoren Werke is undervalued by 16.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bayerische Motoren Werke Price vs Earnings

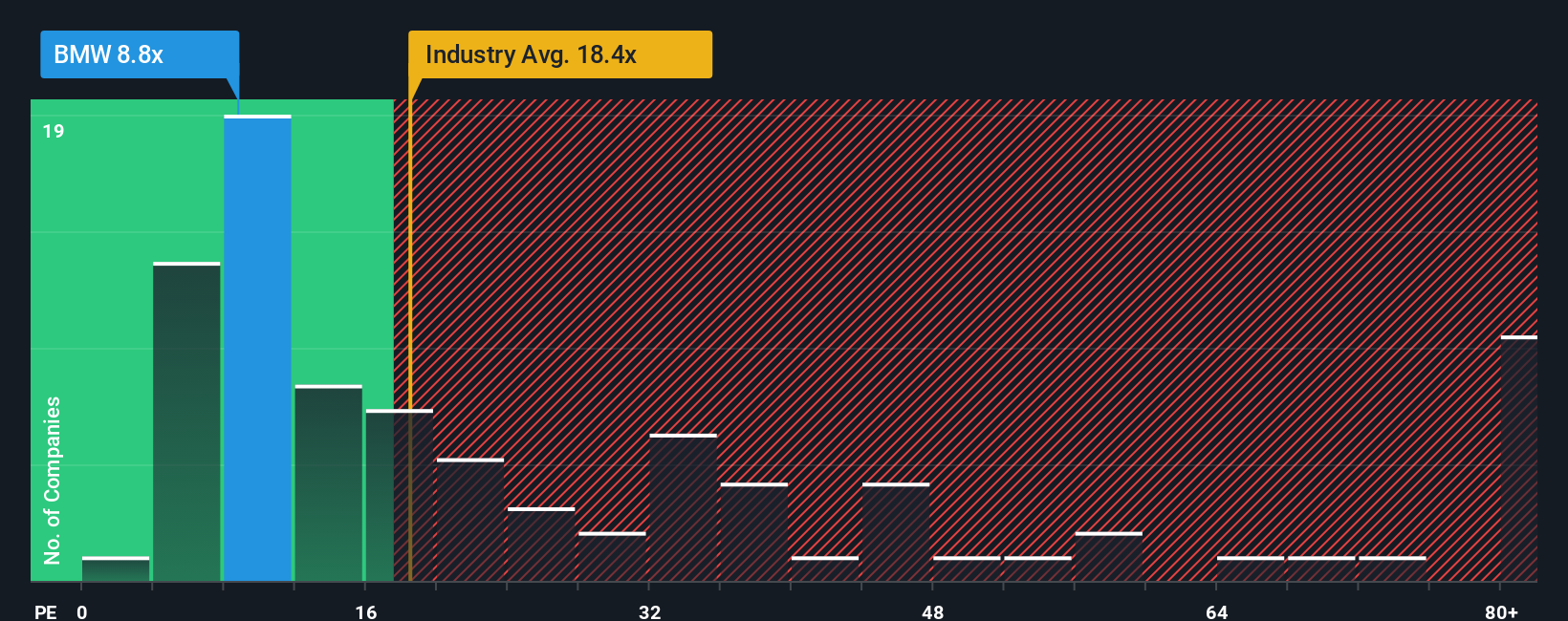

The Price-to-Earnings (PE) ratio is a classic and practical tool for valuing profitable companies like Bayerische Motoren Werke. By comparing the stock price to its earnings, investors get a quick sense of whether the market expects continued growth or sees added risk. Generally, higher growth expectations or lower perceived risks justify a higher "normal" or "fair" PE ratio. In contrast, slower growth or increased risks lead to lower multiples being seen as reasonable.

BMW is currently trading at a PE ratio of 8.6x. For context, this sits below the auto industry average of 18.8x and also undercuts the average for its peer companies, which is 10.9x. This initial look suggests that the market may be undervaluing BMW relative to its sector.

However, Simply Wall St introduces the concept of a "Fair Ratio," which in BMW’s case is calculated at 11.3x. This proprietary metric goes beyond just comparing to peers or industry averages. It incorporates key factors unique to BMW, such as its earnings growth outlook, profit margins, risk profile, and its market capitalization. With these considerations, the Fair Ratio offers a more tailored and meaningful comparison for investors deciding if the current price presents a genuine opportunity.

With BMW’s actual PE ratio (8.6x) sitting well below its Fair Ratio (11.3x), the stock appears undervalued according to this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bayerische Motoren Werke Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalised investment story. It links your own view of a company’s future, like forecasts for revenue, profit, margins and valuation, to the current numbers.

Instead of relying only on fixed ratios and formulas, Narratives help you connect what’s happening at Bayerische Motoren Werke to a dynamic, shareable fair value that is rooted in your assumptions and outlook. This approach empowers investors to go beyond the headline numbers by reflecting their perspective and expectations, creating a true “story behind the numbers.”

Narratives are accessible for free to all investors on Simply Wall St’s Community page, used by millions globally. They allow you to easily compare your Fair Value estimate with the current share price to help you decide when to buy, hold or sell. Narratives also update dynamically whenever key news or data changes.

For example, some investors see BMW’s bold EV expansion and premium segment strength supporting a fair value up at €135. Others are more cautious, highlighting risks in China and assign a fair value closer to €68. Narratives empower you to choose and track the outlook that is best aligned with your unique view and investing goals.

Do you think there's more to the story for Bayerische Motoren Werke? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayerische Motoren Werke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BMW

Bayerische Motoren Werke

Develops, manufactures, and sells automobiles and motorcycles, spare parts, and accessories worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives