- Czech Republic

- /

- Renewable Energy

- /

- SEP:EFORU

Investors Still Aren't Entirely Convinced By E4U a.s.'s (SEP:EFORU) Earnings Despite 43% Price Jump

E4U a.s. (SEP:EFORU) shareholders have had their patience rewarded with a 43% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

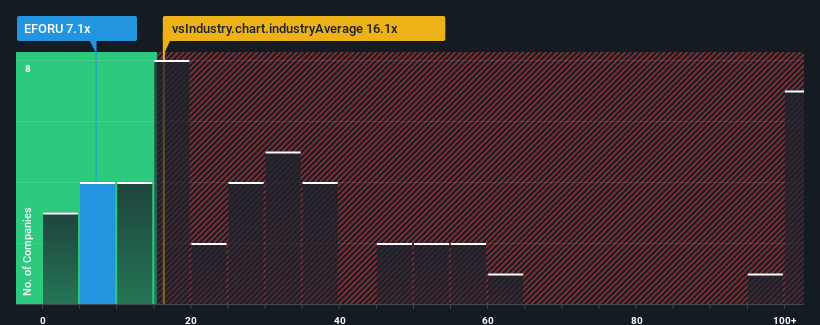

Even after such a large jump in price, E4U's price-to-earnings (or "P/E") ratio of 7.2x might still make it look like a strong buy right now compared to the market in Czech Republic, where around half of the companies have P/E ratios above 16x and even P/E's above 33x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

We've discovered 3 warning signs about E4U. View them for free.E4U certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for E4U

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like E4U's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 45%. Pleasingly, EPS has also lifted 130% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 4.9% shows it's a great look while it lasts.

With this information, we find it very odd that E4U is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Key Takeaway

E4U's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that E4U currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for E4U (1 is a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on E4U, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if E4U might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:EFORU

E4U

Invests in and operates plants that generate energy from renewable sources in the Czech Republic.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026