- Czech Republic

- /

- Tobacco

- /

- SEP:TABAK

Is Philip Morris CR a.s.'s (SEP:TABAK) Stock Price Struggling As A Result Of Its Mixed Financials?

With its stock down 5.1% over the past month, it is easy to disregard Philip Morris CR (SEP:TABAK). We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Fundamentals usually dictate market outcomes so it makes sense to study the company's financials. Particularly, we will be paying attention to Philip Morris CR's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Philip Morris CR

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Philip Morris CR is:

51% = Kč3.5b ÷ Kč6.8b (Based on the trailing twelve months to June 2023).

The 'return' is the yearly profit. So, this means that for every CZK1 of its shareholder's investments, the company generates a profit of CZK0.51.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Philip Morris CR's Earnings Growth And 51% ROE

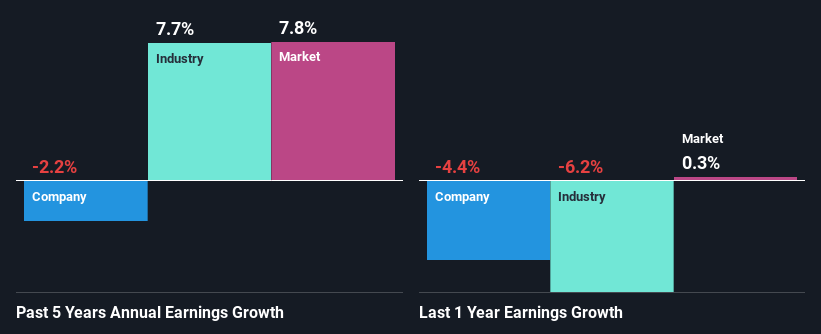

To begin with, Philip Morris CR has a pretty high ROE which is interesting. Secondly, even when compared to the industry average of 13% the company's ROE is quite impressive. Needless to say, we are quite surprised to see that Philip Morris CR's net income shrunk at a rate of 2.2% over the past five years. So, there might be some other aspects that could explain this. These include low earnings retention or poor allocation of capital.

So, as a next step, we compared Philip Morris CR's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 7.7% over the last few years.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Philip Morris CR fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Philip Morris CR Using Its Retained Earnings Effectively?

Philip Morris CR's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 99% (or a retention ratio of 0.5%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. To know the 2 risks we have identified for Philip Morris CR visit our risks dashboard for free.

Moreover, Philip Morris CR has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

In total, we're a bit ambivalent about Philip Morris CR's performance. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Philip Morris CR and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:TABAK

Philip Morris CR

Through its subsidiary, Philip Morris Slovakia s.r.o., manufactures and markets tobacco products under the Marlboro, L&M, Chesterfield, Petra Klasik, Sparta, and RGD brands in the Czech Republic and the Slovak Republic.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion