- Cyprus

- /

- Real Estate

- /

- CSE:PND

Are Pandora Investments's (CSE:PND) Statutory Earnings A Good Guide To Its Underlying Profitability?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Pandora Investments' (CSE:PND) statutory profits are a good guide to its underlying earnings.

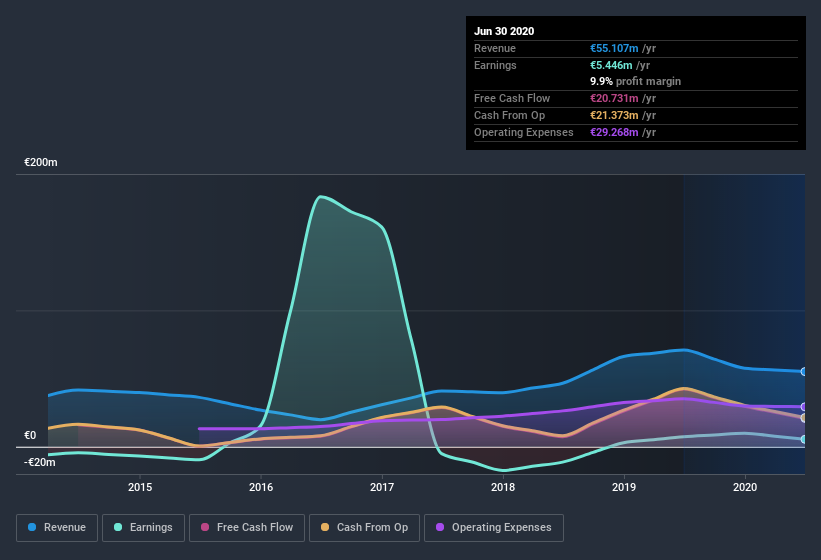

It's good to see that over the last twelve months Pandora Investments made a profit of €5.45m on revenue of €55.1m. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

See our latest analysis for Pandora Investments

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will discuss how unusual items have impacted Pandora Investments' most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Pandora Investments.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Pandora Investments' profit was reduced by €1.4m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Pandora Investments doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Pandora Investments' Profit Performance

Because unusual items detracted from Pandora Investments' earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Pandora Investments' statutory profit actually understates its earnings potential! Unfortunately, though, its earnings per share actually fell back over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 3 warning signs for Pandora Investments (of which 2 are significant!) you should know about.

This note has only looked at a single factor that sheds light on the nature of Pandora Investments' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Pandora Investments, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CSE:PND

Pandora Investments

Together with subsidiaries, engages in the real estate development and tourism business in Cyprus and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success