- China

- /

- Renewable Energy

- /

- SZSE:300614

Revenues Not Telling The Story For Henan BCCY Environmental Energy Co., Ltd (SZSE:300614) After Shares Rise 27%

Henan BCCY Environmental Energy Co., Ltd (SZSE:300614) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 50% in the last twelve months.

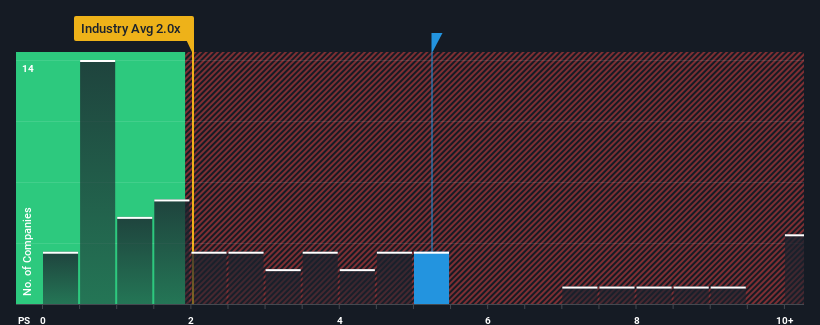

Since its price has surged higher, given around half the companies in China's Renewable Energy industry have price-to-sales ratios (or "P/S") below 2x, you may consider Henan BCCY Environmental Energy as a stock to avoid entirely with its 5.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Henan BCCY Environmental Energy

How Has Henan BCCY Environmental Energy Performed Recently?

For example, consider that Henan BCCY Environmental Energy's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Henan BCCY Environmental Energy's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Henan BCCY Environmental Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. The last three years don't look nice either as the company has shrunk revenue by 20% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's an unpleasant look.

With this in mind, we find it worrying that Henan BCCY Environmental Energy's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has lead to Henan BCCY Environmental Energy's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Henan BCCY Environmental Energy revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Having said that, be aware Henan BCCY Environmental Energy is showing 4 warning signs in our investment analysis, and 1 of those can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Henan BCCY Environmental Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300614

Henan BCCY Environmental Energy

Henan BCCY Environmental Energy Co., Ltd, Ltd focuses on the development and utilization of environmental energy.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives