As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, small-cap stocks face a unique set of challenges and opportunities. With the S&P 500 Index experiencing slight declines amid these tensions, investors are increasingly looking toward undiscovered gems that can thrive despite broader market volatility. In this environment, identifying promising small-cap stocks often involves seeking companies with resilient business models and growth potential that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

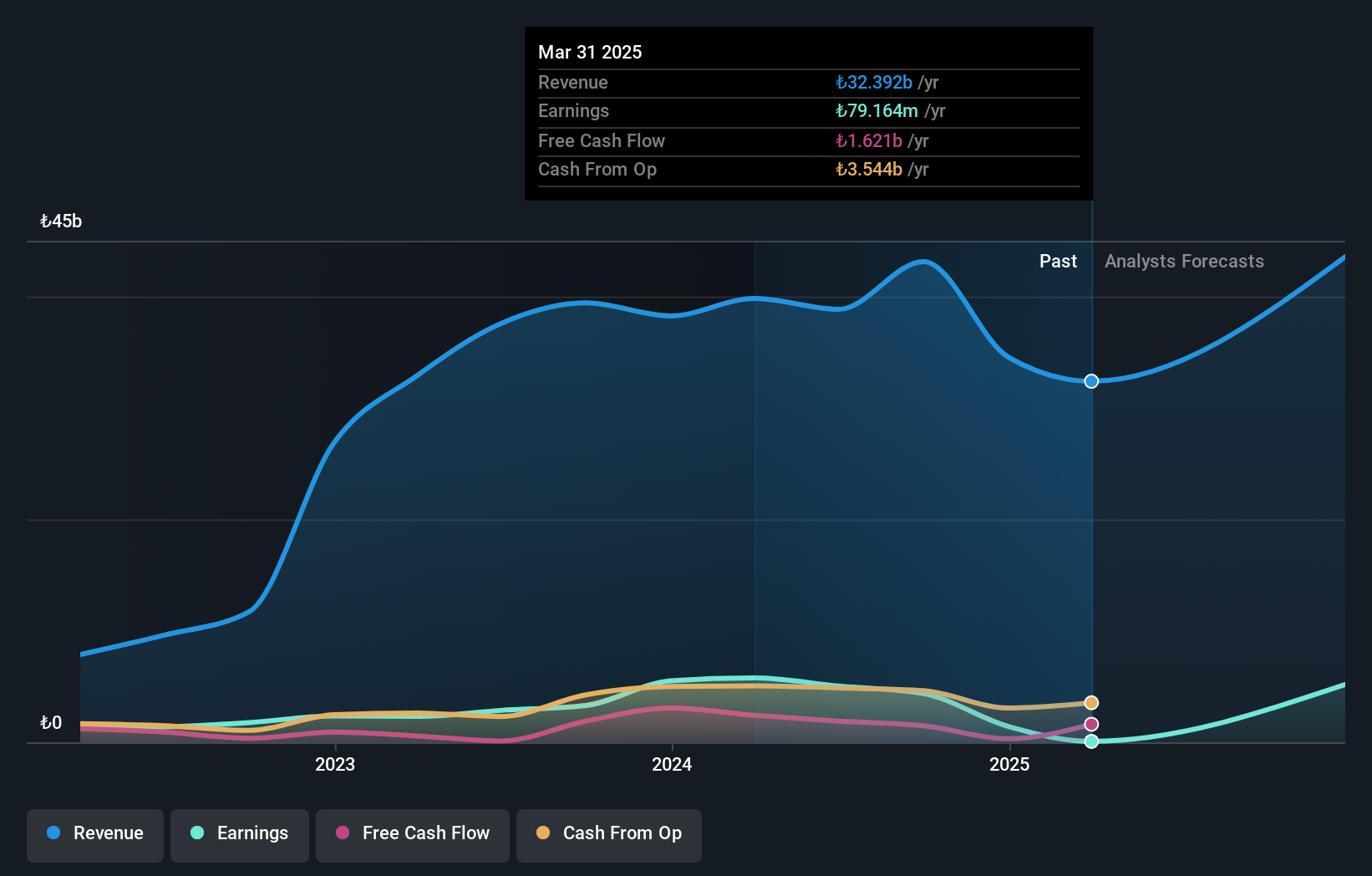

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret (IBSE:BRISA)

Simply Wall St Value Rating: ★★★★★★

Overview: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. is a leading tire manufacturing company with a market cap of TRY26.38 billion, specializing in the production and distribution of vehicle tires.

Operations: Brisa's primary revenue stream comes from the sale of vehicle tires, generating TRY24.87 billion.

Brisa Bridgestone Sabanci, a smaller player in the auto components sector, has shown impressive earnings growth of 53.7% annually over the past five years. Despite not outpacing the industry's recent growth rate of 32.8%, its debt to equity ratio significantly improved from 351.5% to 81.5%. With a price-to-earnings ratio of 8.3x, it trades below Turkey's market average of 15.1x, suggesting potential undervaluation. The company's net debt to equity stands at a satisfactory level of 28.8%, and it consistently generates positive free cash flow, indicating robust financial health and operational efficiency moving forward.

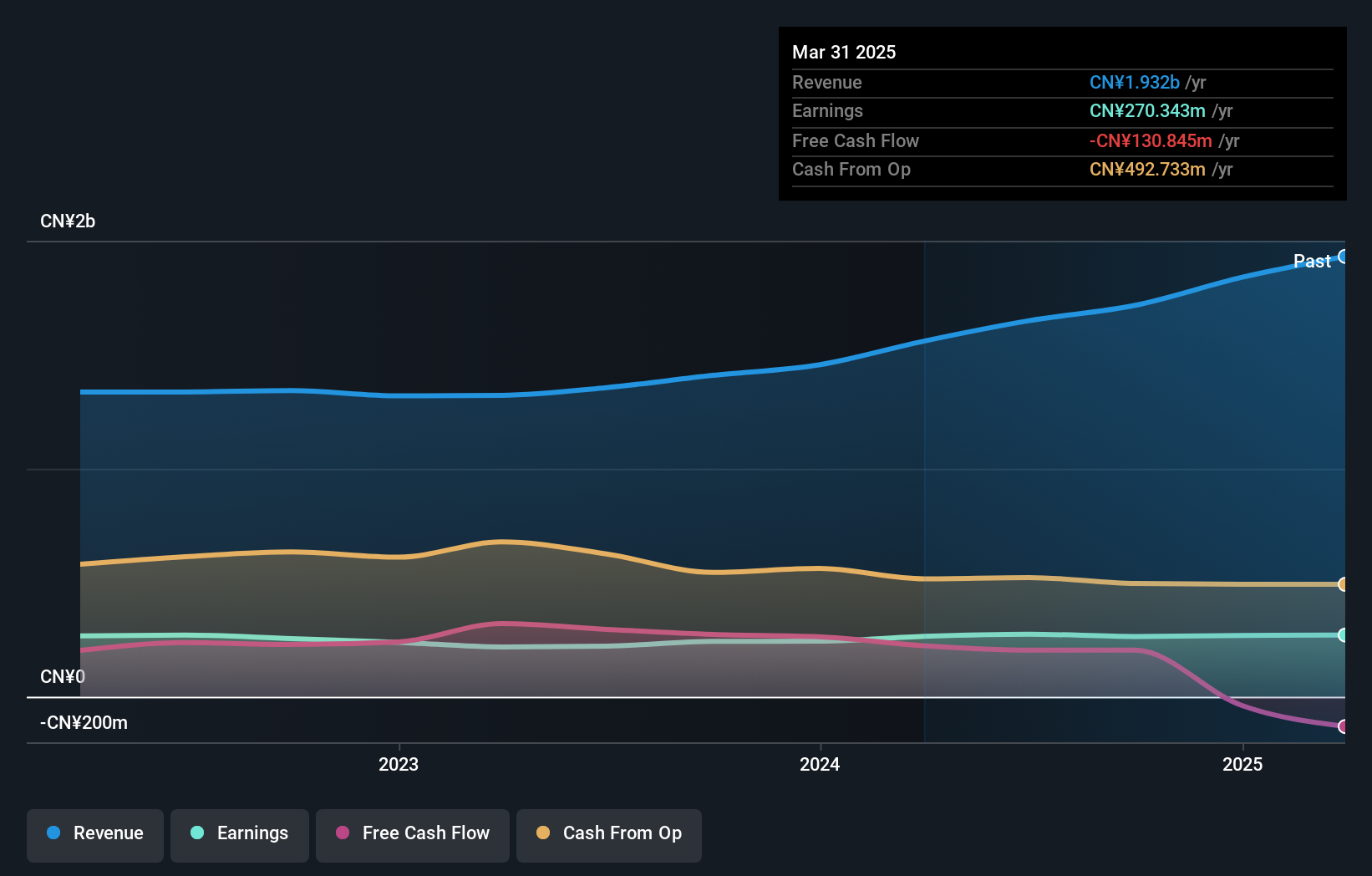

Guangdong Shunkong DevelopmentLtd (SZSE:003039)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Shunkong Development Co., Ltd. focuses on the production and sale of tap water in China, with a market capitalization of CN¥7.93 billion.

Operations: Shunkong Development generates revenue primarily from the production and sale of tap water. The company's financial performance is highlighted by a net profit margin trend that provides insights into its profitability.

Guangdong Shunkong Development, operating in the water utilities sector, has showcased solid financial health with a net debt to equity ratio of 29.7%, considered satisfactory. Over the past year, its earnings growth of 8.8% outpaced the industry average of 0.8%, supported by high-quality earnings and an EBIT covering interest payments 11.7 times over. The company’s price-to-earnings ratio stands at 30x, offering better value compared to the broader CN market's 36.7x benchmark. Recently, a special shareholders meeting was scheduled to discuss acquiring full equities in another firm and reallocating surplus funds from terminated projects.

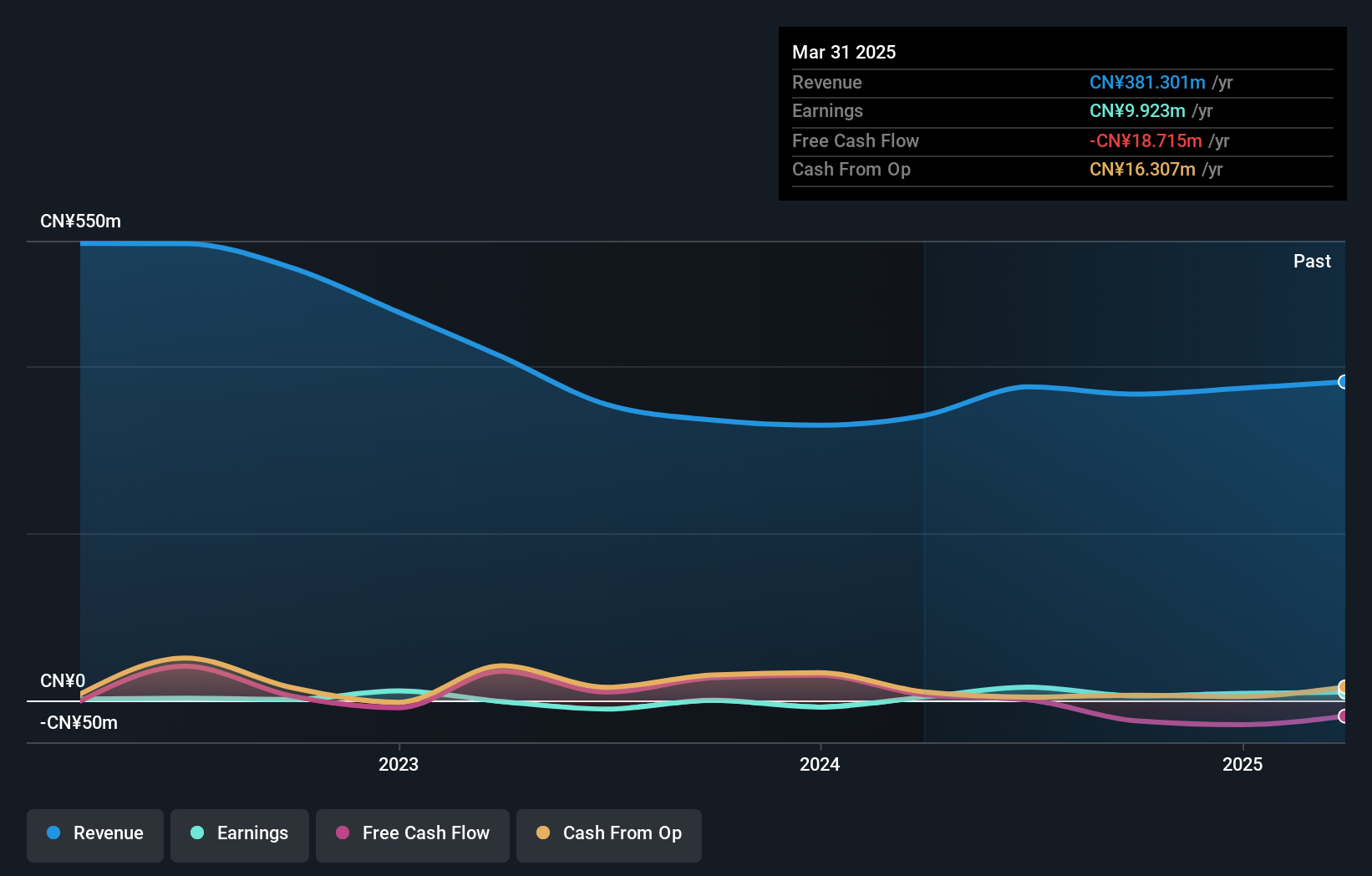

Shandong Tongda Island New MaterialsLtd (SZSE:300321)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Tongda Island New Materials Co., Ltd. operates in the textile manufacturing industry and has a market capitalization of CN¥2.24 billion.

Operations: Tongda Island generates revenue primarily from textile manufacturing, amounting to CN¥366.51 million. The company has a market capitalization of CN¥2.24 billion.

Shandong Tongda Island New Materials Ltd. stands out with a remarkable earnings growth of 2021.8% over the past year, significantly outperforming the Chemicals industry average of -5.4%. Despite this impressive performance, its earnings have seen a yearly decline of 52.8% over the last five years, likely impacted by non-recurring gains such as a CN¥4.8M one-off item in recent results. The company operates debt-free, alleviating concerns about interest coverage and financial leverage pressures while maintaining profitability that suggests cash runway isn't an issue moving forward in their sector's competitive landscape.

Where To Now?

- Gain an insight into the universe of 4704 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300321

Shandong Tongda Island New MaterialsLtd

Shandong Tongda Island New Materials Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion