Orchid Pharma And 2 Other Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced increased pressure compared to their large-cap counterparts. Despite these headwinds, opportunities remain for discerning investors who can identify companies with strong fundamentals and growth potential in this volatile environment. In such times, finding undiscovered gems like Orchid Pharma requires a keen eye for businesses that exhibit resilience and adaptability amidst broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company involved in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India with a market cap of ₹70.56 billion.

Operations: Orchid Pharma generates revenue primarily from its pharmaceuticals segment, amounting to ₹8.81 billion. The company's financial performance is characterized by a focus on this core revenue stream.

Orchid Pharma, a nimble player in the pharmaceutical industry, has shown impressive earnings growth of 44.6% over the past year, outpacing its industry peers. This growth is mirrored by its net income for Q1 2024, which surged to INR 293.51 million from INR 94.05 million a year prior. Trading at nearly 32% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. The company’s debt levels appear manageable with a net debt to equity ratio of 11.3%, indicating financial stability amidst recent inclusion in the S&P Global BMI Index and regulatory challenges related to GST audits for FY2019-2020.

- Navigate through the intricacies of Orchid Pharma with our comprehensive health report here.

Evaluate Orchid Pharma's historical performance by accessing our past performance report.

Zhongtong Bus HoldingLTD (SZSE:000957)

Simply Wall St Value Rating: ★★★★★★

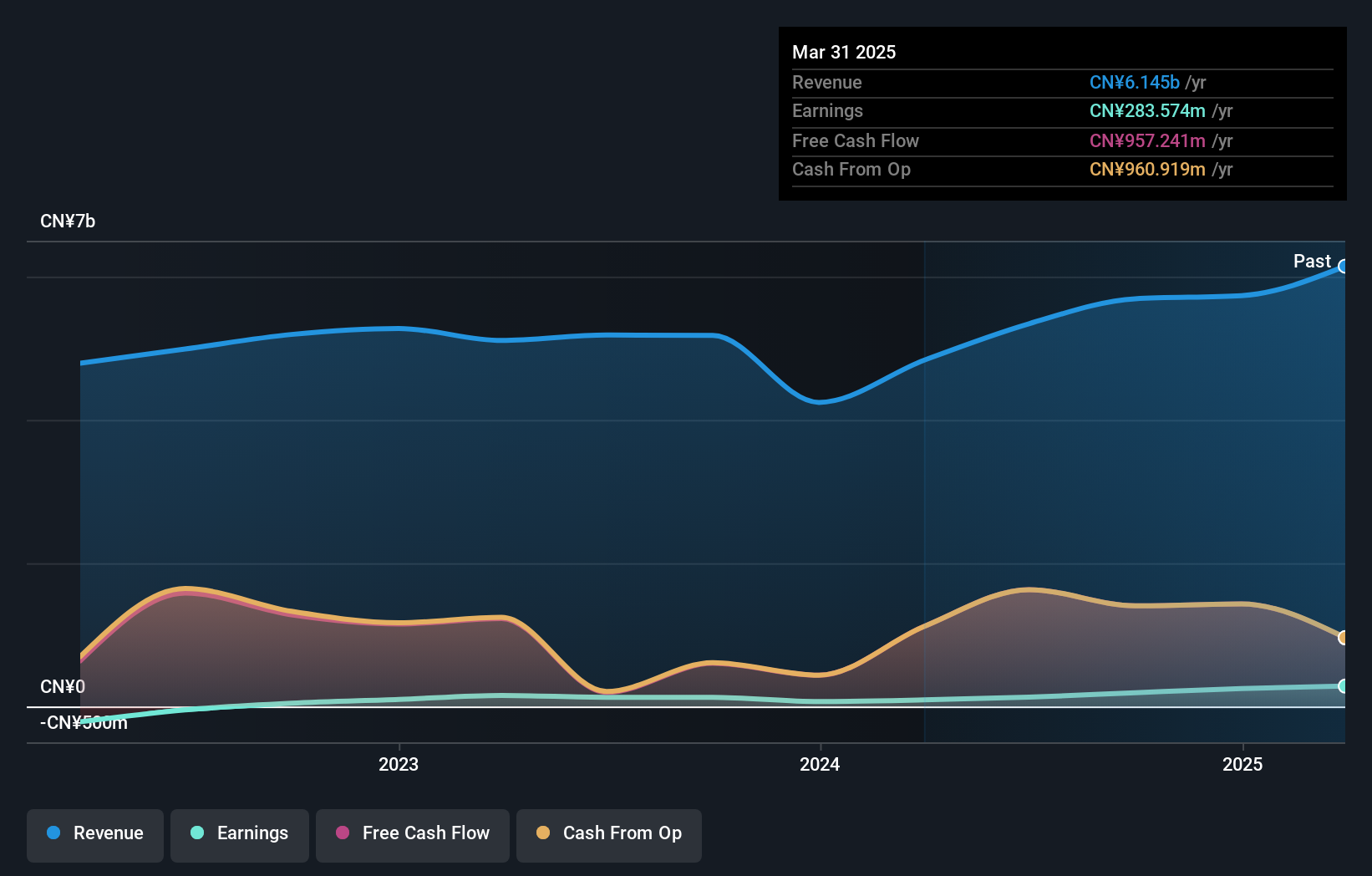

Overview: Zhongtong Bus Holding Co., LTD specializes in the manufacture and sale of buses in China, with a market capitalization of CN¥6.64 billion.

Operations: Zhongtong Bus Holding Co., LTD generates revenue primarily from the sale of buses. The company's financial performance shows a focus on managing production costs, which impacts its profitability. Notably, the net profit margin has shown variability in recent periods, indicating fluctuations in cost efficiency or pricing strategies.

Zhongtong Bus Holding, a nimble player in the machinery sector, has demonstrated impressive growth with earnings surging 48.9% over the past year, outpacing industry averages. The company reported sales of CNY 4.23 billion for the nine months ending September 2024, up from CNY 2.79 billion a year earlier, while net income climbed to CNY 195 million from CNY 74 million. Trading at an attractive valuation—77% below its estimated fair value—Zhongtong benefits from high-quality earnings despite a notable one-off gain of CN¥54 million and operates debt-free with positive free cash flow.

- Click to explore a detailed breakdown of our findings in Zhongtong Bus HoldingLTD's health report.

Assess Zhongtong Bus HoldingLTD's past performance with our detailed historical performance reports.

Guangdong Shunkong DevelopmentLtd (SZSE:003039)

Simply Wall St Value Rating: ★★★★★★

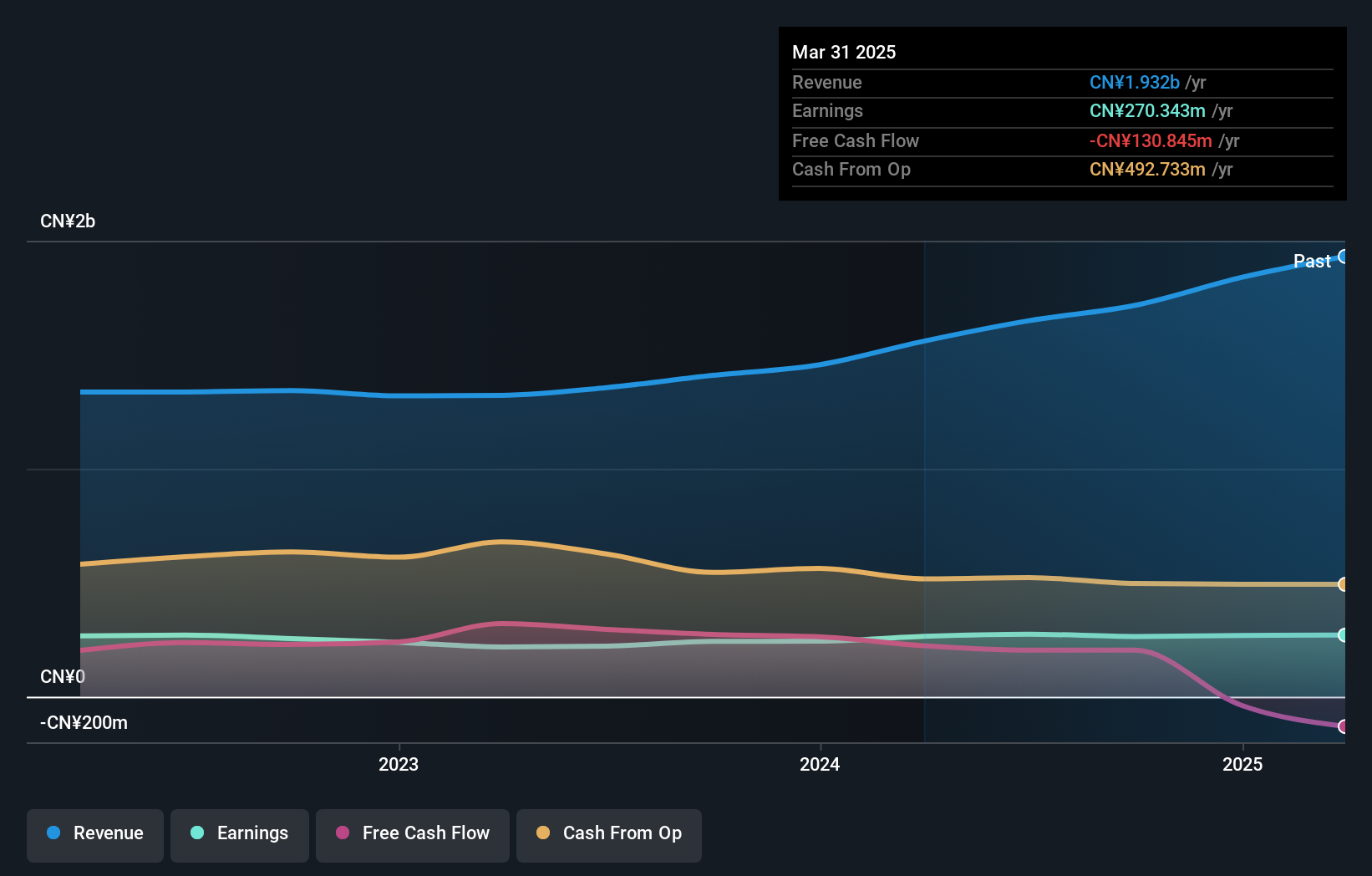

Overview: Guangdong Shunkong Development Co., Ltd. is involved in the production and sale of tap water in China, with a market cap of CN¥7.90 billion.

Operations: The company generates its revenue primarily from the sale of tap water in China. Its financial performance is characterized by a focus on optimizing production costs to enhance profitability, with attention to gross profit margin trends.

Guangdong Shunkong Development, a smaller player in its sector, showcases solid financial health with a satisfactory net debt to equity ratio of 29.7%. The company's earnings growth of 8.8% over the past year surpasses the Water Utilities industry's average of 2.6%, highlighting its competitive edge. With interest payments covered comfortably by EBIT at 11.7 times, financial stability appears robust. Recent earnings reports reveal sales climbing to CNY 1,334 million for the first nine months of 2024 from CNY 1,073 million last year, while net income rose to CNY 204 million from CNY 184 million previously.

Taking Advantage

- Delve into our full catalog of 4734 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongtong Bus HoldingLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000957

Zhongtong Bus HoldingLTD

Engages in the manufacture and sale of buses in China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives