- China

- /

- Renewable Energy

- /

- SZSE:002479

We Think Zhejiang Fuchunjiang Environmental ThermoelectricLTD (SZSE:002479) Is Taking Some Risk With Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Zhejiang Fuchunjiang Environmental Thermoelectric Co.,LTD. (SZSE:002479) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Zhejiang Fuchunjiang Environmental ThermoelectricLTD

What Is Zhejiang Fuchunjiang Environmental ThermoelectricLTD's Debt?

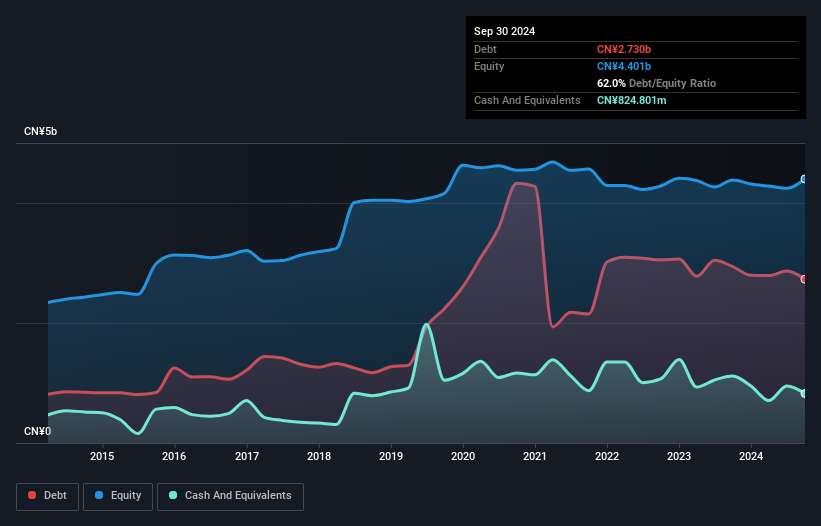

As you can see below, Zhejiang Fuchunjiang Environmental ThermoelectricLTD had CN¥2.73b of debt at September 2024, down from CN¥2.94b a year prior. On the flip side, it has CN¥824.8m in cash leading to net debt of about CN¥1.90b.

A Look At Zhejiang Fuchunjiang Environmental ThermoelectricLTD's Liabilities

We can see from the most recent balance sheet that Zhejiang Fuchunjiang Environmental ThermoelectricLTD had liabilities of CN¥3.41b falling due within a year, and liabilities of CN¥1.07b due beyond that. On the other hand, it had cash of CN¥824.8m and CN¥481.0m worth of receivables due within a year. So its liabilities total CN¥3.18b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of CN¥3.84b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Zhejiang Fuchunjiang Environmental ThermoelectricLTD's debt is 2.6 times its EBITDA, and its EBIT cover its interest expense 5.0 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Importantly Zhejiang Fuchunjiang Environmental ThermoelectricLTD's EBIT was essentially flat over the last twelve months. We would prefer to see some earnings growth, because that always helps diminish debt. There's no doubt that we learn most about debt from the balance sheet. But it is Zhejiang Fuchunjiang Environmental ThermoelectricLTD's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Zhejiang Fuchunjiang Environmental ThermoelectricLTD recorded free cash flow worth 75% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Neither Zhejiang Fuchunjiang Environmental ThermoelectricLTD's ability to handle its total liabilities nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But the good news is it seems to be able to convert EBIT to free cash flow with ease. We think that Zhejiang Fuchunjiang Environmental ThermoelectricLTD's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Zhejiang Fuchunjiang Environmental ThermoelectricLTD (of which 1 doesn't sit too well with us!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Fuchunjiang Environmental ThermoelectricLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002479

Zhejiang Fuchunjiang Environmental ThermoelectricLTD

Zhejiang Fuchunjiang Environmental Thermoelectric Co.,LTD.

Average dividend payer with slight risk.

Market Insights

Community Narratives