- China

- /

- Water Utilities

- /

- SZSE:001376

Optimistic Investors Push Jiangxi Bestoo Energy Co.,Ltd. (SZSE:001376) Shares Up 25% But Growth Is Lacking

Jiangxi Bestoo Energy Co.,Ltd. (SZSE:001376) shares have continued their recent momentum with a 25% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

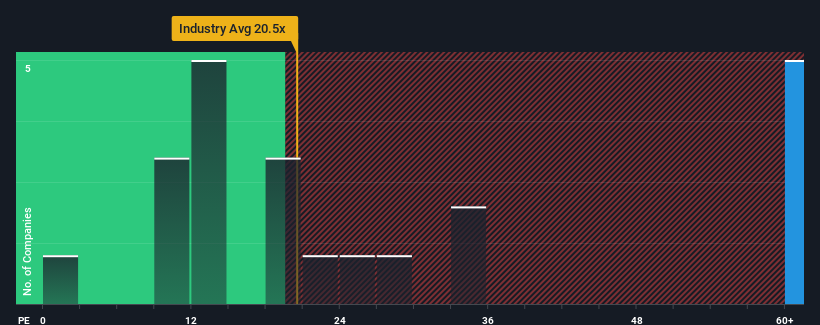

Following the firm bounce in price, Jiangxi Bestoo EnergyLtd's price-to-earnings (or "P/E") ratio of 74.6x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 32x and even P/E's below 20x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen firmly for Jiangxi Bestoo EnergyLtd recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Jiangxi Bestoo EnergyLtd

How Is Jiangxi Bestoo EnergyLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Jiangxi Bestoo EnergyLtd's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. Pleasingly, EPS has also lifted 36% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Jiangxi Bestoo EnergyLtd is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Jiangxi Bestoo EnergyLtd's P/E

The strong share price surge has got Jiangxi Bestoo EnergyLtd's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Jiangxi Bestoo EnergyLtd revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Jiangxi Bestoo EnergyLtd has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Jiangxi Bestoo EnergyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001376

Jiangxi Bestoo EnergyLtd

Provides centralized heating services for industrial parks and downstream industrial customers in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives