- China

- /

- Electric Utilities

- /

- SHSE:600505

Sichuan Xichang Electric Power Co.,Ltd.'s (SHSE:600505) Popularity With Investors Is Clear

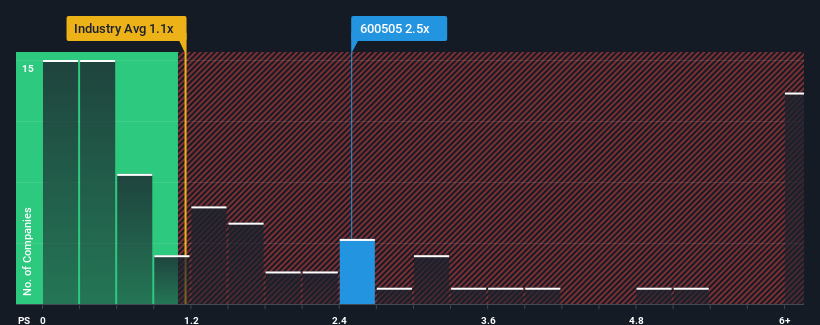

Sichuan Xichang Electric Power Co.,Ltd.'s (SHSE:600505) price-to-sales (or "P/S") ratio of 2.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Electric Utilities industry in China have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Sichuan Xichang Electric PowerLtd

What Does Sichuan Xichang Electric PowerLtd's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Sichuan Xichang Electric PowerLtd's revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sichuan Xichang Electric PowerLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Sichuan Xichang Electric PowerLtd?

Sichuan Xichang Electric PowerLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 36% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

When compared to the industry's one-year growth forecast of 8.0%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Sichuan Xichang Electric PowerLtd's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Sichuan Xichang Electric PowerLtd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Sichuan Xichang Electric PowerLtd you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600505

Sichuan Xichang Electric PowerLtd

Engages in generation, supply, distribution, and sale of hydropower power in Liangshan prefecture, Sichuan province, China.

Low risk and overvalued.

Market Insights

Community Narratives