As Asian markets navigate a landscape marked by resilient economic indicators in Japan and technology-driven optimism in China, investors are increasingly looking toward dividend stocks as a means of generating steady income amidst fluctuating market conditions. In this context, identifying strong dividend-paying stocks can offer stability and potential returns, making them an appealing choice for those seeking reliable income streams within the dynamic Asian market.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.44% | ★★★★★★ |

| NCD (TSE:4783) | 4.60% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.81% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.50% | ★★★★★★ |

Click here to see the full list of 1043 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

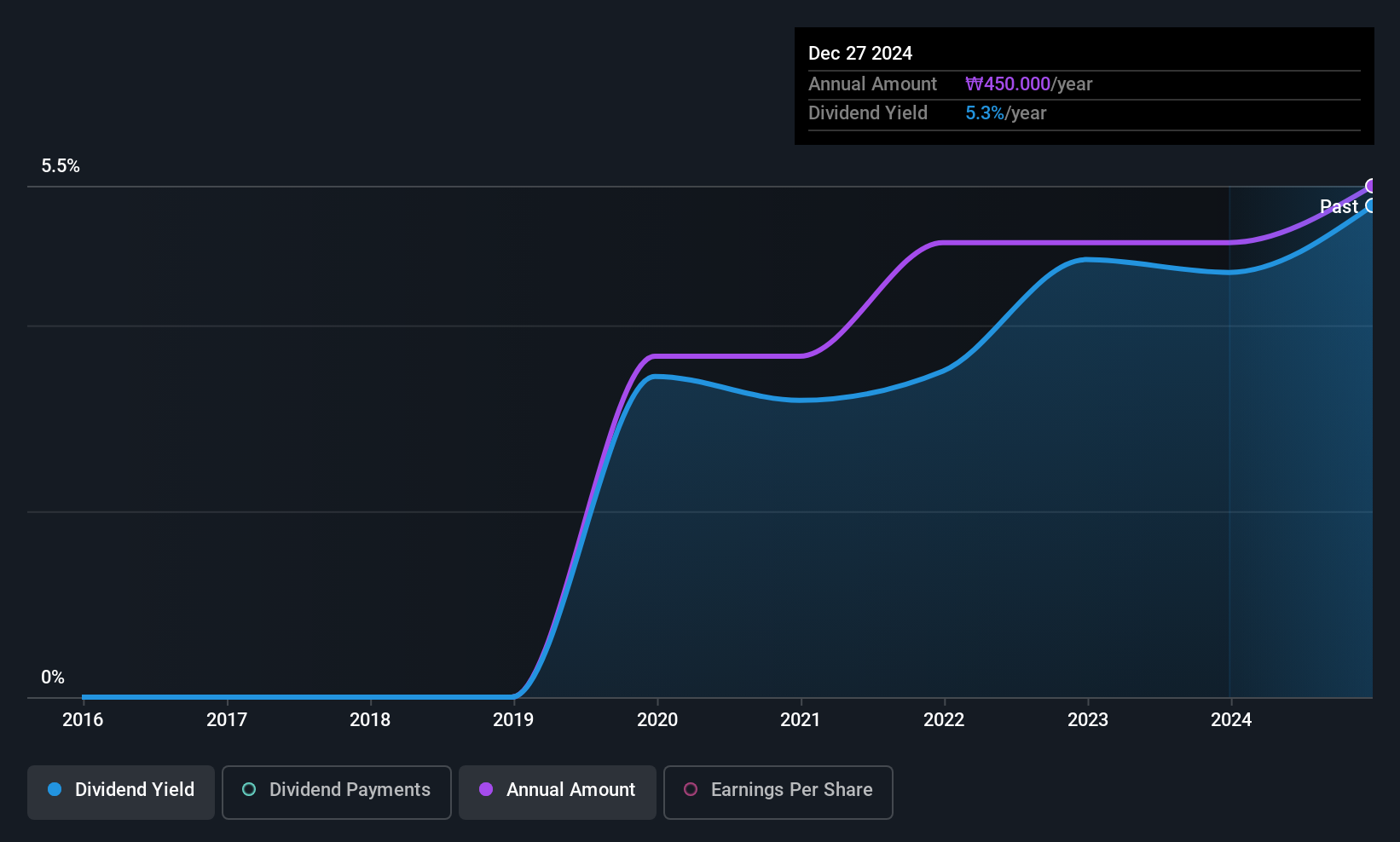

Motonic (KOSE:A009680)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components worldwide, with a market cap of approximately ₩246.12 billion.

Operations: Motonic Corporation generates revenue from its worldwide sales of automotive components.

Dividend Yield: 5.3%

Motonic's dividend profile is backed by a sustainable payout, with dividends covered by earnings (42.7% payout ratio) and cash flows (47.2% cash payout ratio). The company has consistently paid dividends for six years, offering a yield of 5.27%, which ranks in the top 25% of the KR market. Although relatively new to dividend payments, its commitment is underscored by the recent announcement of an annual dividend of ₩600 per share, payable in April 2026.

- Click to explore a detailed breakdown of our findings in Motonic's dividend report.

- Upon reviewing our latest valuation report, Motonic's share price might be too pessimistic.

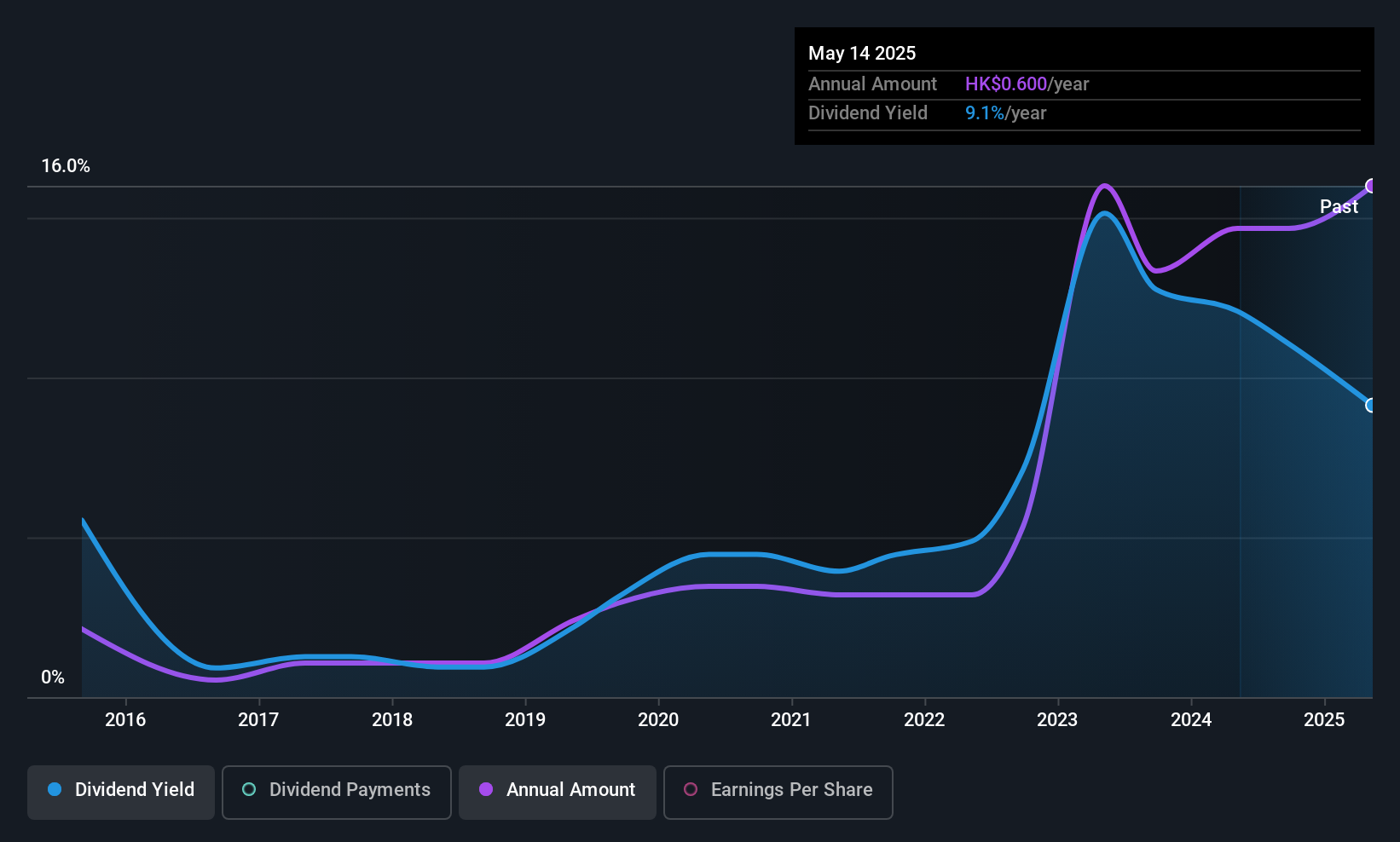

Dream International (SEHK:1126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dream International Limited is an investment holding company that designs, develops, manufactures, and sells plush stuffed toys, plastic figures, dolls, die casting products, and fabrics with a market cap of HK$6.29 billion.

Operations: Dream International Limited generates revenue from various segments, including HK$2.90 billion from plush stuffed toys, HK$2.38 billion from plastic figures, and HK$386.72 million from tarpaulin.

Dividend Yield: 7.0%

Dream International's dividend yield is among the top 25% in the Hong Kong market, supported by a sustainable payout ratio of 57.4% from earnings and 69.8% from cash flows. Despite recent growth, dividends have been volatile over the past decade, indicating some instability. The company trades significantly below its fair value estimate, suggesting potential value for investors seeking dividend income. Recent board changes may impact governance but are not expected to affect dividend policy directly.

- Unlock comprehensive insights into our analysis of Dream International stock in this dividend report.

- Our expertly prepared valuation report Dream International implies its share price may be lower than expected.

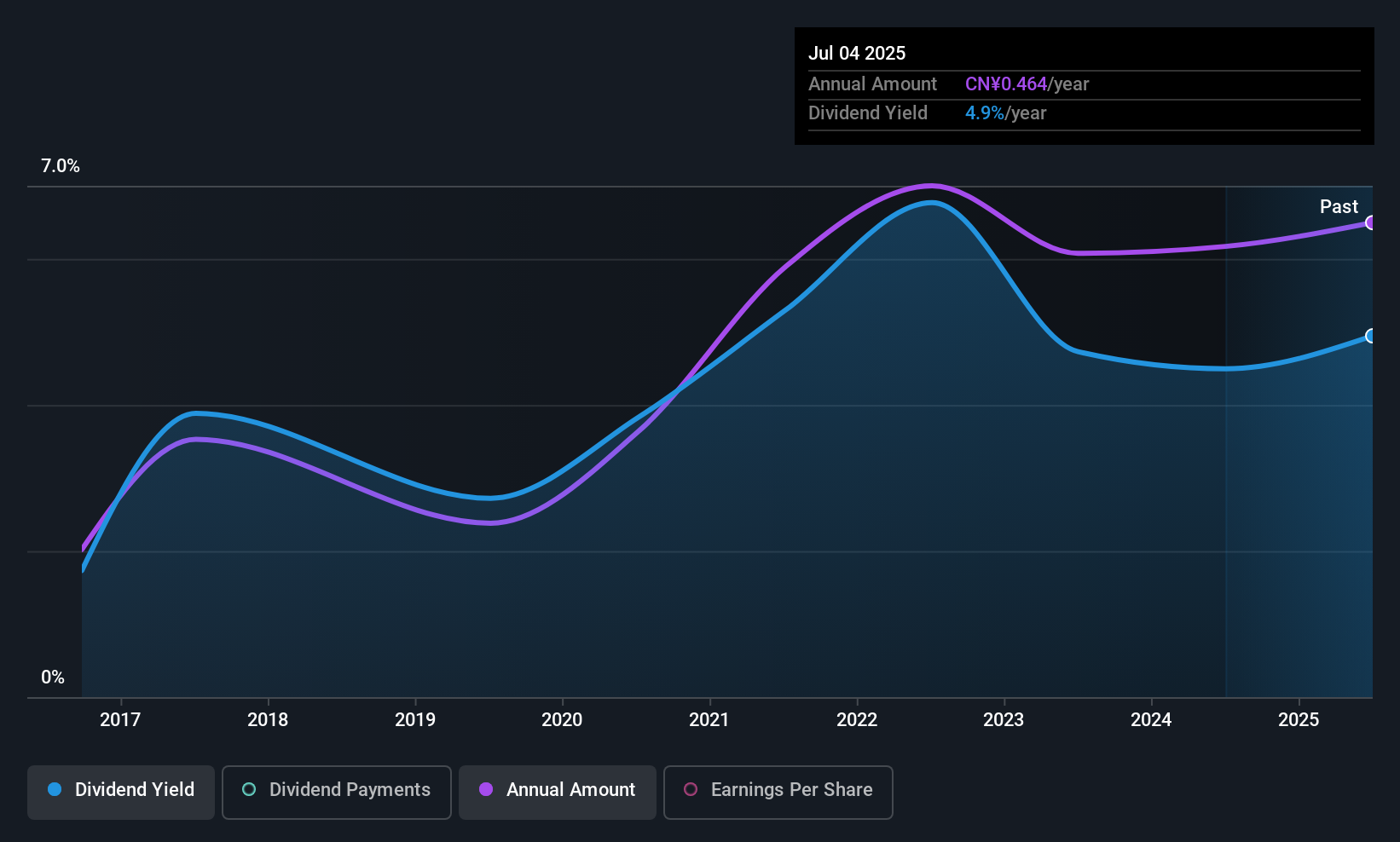

Jiangxi Hongcheng EnvironmentLtd (SHSE:600461)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangxi Hongcheng Environment Co., Ltd., along with its subsidiaries, is engaged in the production and supply of tap water in China, with a market capitalization of CN¥12.79 billion.

Operations: Jiangxi Hongcheng Environment Co., Ltd. generates revenue primarily through its operations in the production and distribution of tap water across China.

Dividend Yield: 4.7%

Jiangxi Hongcheng Environment's dividend yield is in the top 25% of the Chinese market, yet its sustainability is questionable due to a high cash payout ratio of 97.2%. Despite trading below estimated fair value and having a reasonable earnings payout ratio of 49.3%, dividends have been volatile over the past decade. Although earnings grew at 9.5% annually over five years, recent revenue decline and high debt levels pose challenges for consistent dividend payments.

- Navigate through the intricacies of Jiangxi Hongcheng EnvironmentLtd with our comprehensive dividend report here.

- The analysis detailed in our Jiangxi Hongcheng EnvironmentLtd valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Explore the 1043 names from our Top Asian Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1126

Dream International

An investment holding company, designs, develops, manufactures, and sells plush stuffed toys, plastic figures, dolls, die casting products, and fabrics.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026