- China

- /

- Electric Utilities

- /

- SHSE:600396

The Market Doesn't Like What It Sees From Huadian Liaoning Energy Development Co.,Ltd's (SHSE:600396) Revenues Yet

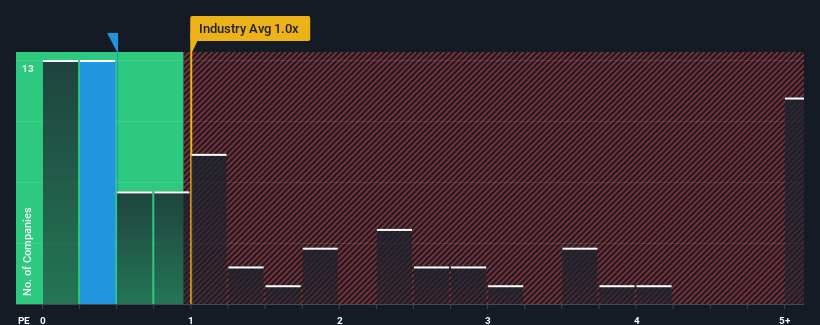

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Huadian Liaoning Energy Development Co.,Ltd (SHSE:600396) is a stock worth checking out, seeing as almost half of all the Electric Utilities companies in China have P/S ratios greater than 1.5x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Huadian Liaoning Energy DevelopmentLtd

What Does Huadian Liaoning Energy DevelopmentLtd's P/S Mean For Shareholders?

It looks like revenue growth has deserted Huadian Liaoning Energy DevelopmentLtd recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Huadian Liaoning Energy DevelopmentLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Huadian Liaoning Energy DevelopmentLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 3.5% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 2.1% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Huadian Liaoning Energy DevelopmentLtd is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Huadian Liaoning Energy DevelopmentLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Huadian Liaoning Energy DevelopmentLtd (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Huadian Liaoning Energy DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600396

Huadian Liaoning Energy DevelopmentLtd

Produces and sells electricity and heat in the Liaoning and Inner Mongolia regions of China.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives