Stock Analysis

China Express AirlinesLTD (SZSE:002928 shareholders incur further losses as stock declines 5.1% this week, taking three-year losses to 53%

While not a mind-blowing move, it is good to see that the China Express Airlines Co.,LTD (SZSE:002928) share price has gained 18% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 53% in that time. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

After losing 5.1% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for China Express AirlinesLTD

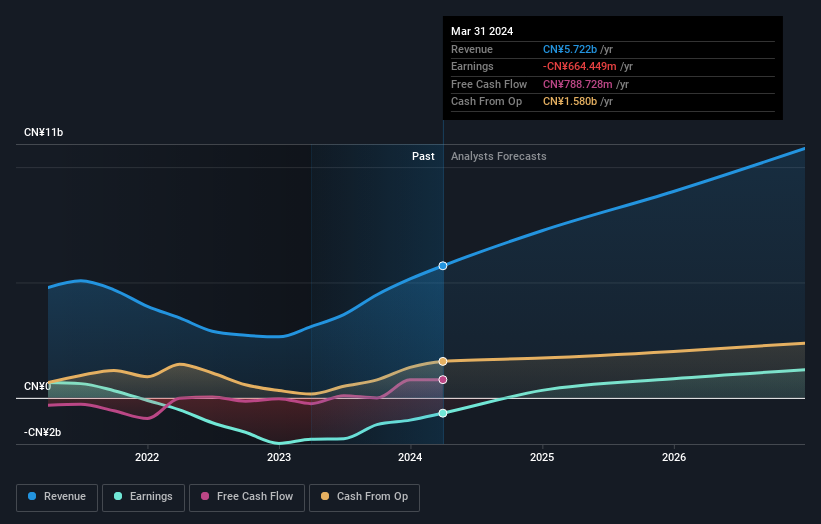

Given that China Express AirlinesLTD didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, China Express AirlinesLTD grew revenue at 1.7% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 15% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at China Express AirlinesLTD's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 15% in the twelve months, China Express AirlinesLTD shareholders did even worse, losing 23%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether China Express AirlinesLTD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether China Express AirlinesLTD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002928

China Express AirlinesLTD

Engages in the air passenger and cargo transportation business in China.

Exceptional growth potential with imperfect balance sheet.