- China

- /

- Transportation

- /

- SZSE:002627

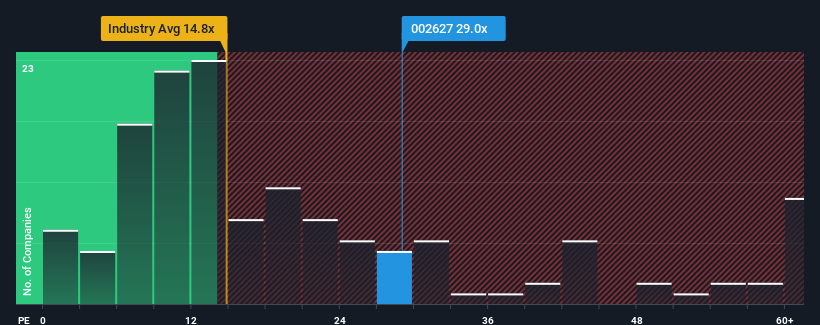

Some Shareholders Feeling Restless Over Hubei Three Gorges Tourism Group Co., Ltd.'s (SZSE:002627) P/E Ratio

It's not a stretch to say that Hubei Three Gorges Tourism Group Co., Ltd.'s (SZSE:002627) price-to-earnings (or "P/E") ratio of 29x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Hubei Three Gorges Tourism Group has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Hubei Three Gorges Tourism Group

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Hubei Three Gorges Tourism Group's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 80% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 23% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 36% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Hubei Three Gorges Tourism Group's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Hubei Three Gorges Tourism Group revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Hubei Three Gorges Tourism Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hubei Three Gorges Tourism Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002627

Hubei Three Gorges Tourism Group

Provides road passenger transport services in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives