Investors Appear Satisfied With Jiangsu Azure Corporation's (SZSE:002245) Prospects

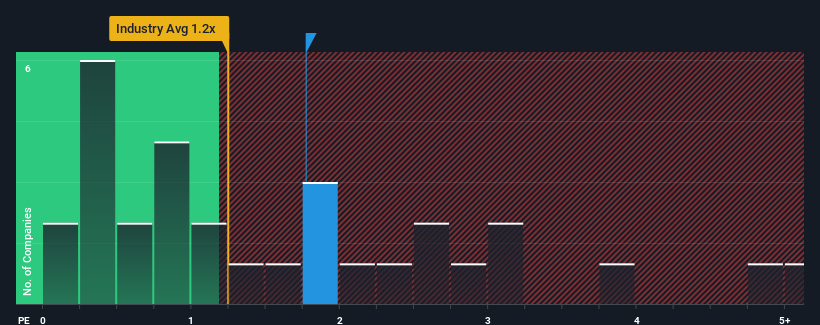

Jiangsu Azure Corporation's (SZSE:002245) price-to-sales (or "P/S") ratio of 1.8x may not look like an appealing investment opportunity when you consider close to half the companies in the Logistics industry in China have P/S ratios below 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Jiangsu Azure

What Does Jiangsu Azure's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Jiangsu Azure has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Azure will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Jiangsu Azure's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 35% over the next year. That's shaping up to be materially higher than the 16% growth forecast for the broader industry.

With this information, we can see why Jiangsu Azure is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jiangsu Azure maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Logistics industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Jiangsu Azure that you should be aware of.

If these risks are making you reconsider your opinion on Jiangsu Azure, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002245

Jiangsu Azure

Engages in lithium batteries, LED chips, and metal logistics and distribution businesses in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives