Stock Analysis

- China

- /

- Metals and Mining

- /

- SHSE:600219

Shandong Nanshan AluminiumLtd And 2 Other Leading Dividend Stocks In China

Reviewed by Simply Wall St

Amidst a backdrop of deflationary pressures and subdued consumer confidence in China, investors are increasingly focusing on the resilience and potential yield offered by dividend stocks. In this context, understanding the fundamentals of leading dividend-paying companies like Shandong Nanshan Aluminium Ltd becomes crucial for those seeking stable returns in a fluctuating market environment.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.47% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.65% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.53% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.15% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.68% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.76% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.46% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.65% | ★★★★★★ |

Click here to see the full list of 226 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shandong Nanshan AluminiumLtd (SHSE:600219)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shandong Nanshan Aluminium Co., Ltd. is a global company engaged in the research, development, manufacturing, importing, selling, and exporting of aluminum profiles with a market capitalization of approximately CN¥44.49 billion.

Operations: Shandong Nanshan Aluminium Co., Ltd. generates its revenue primarily from the research, development, manufacturing, and international trade of aluminum profiles.

Dividend Yield: 3.2%

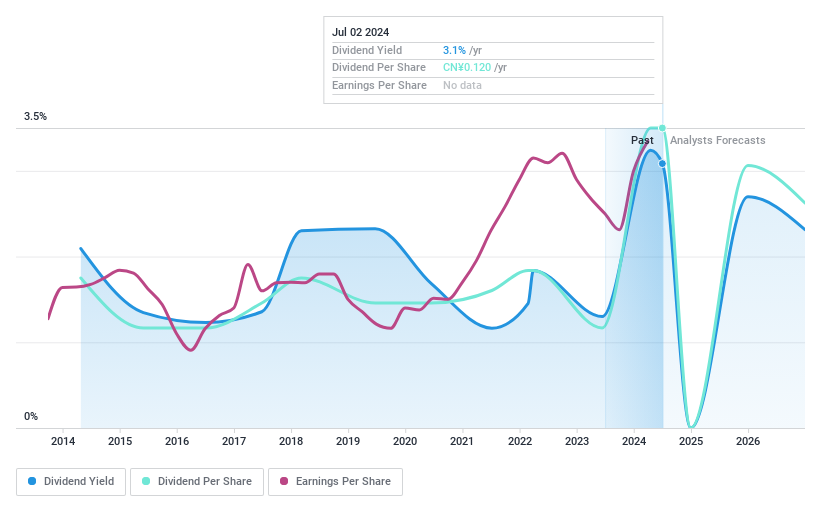

Shandong Nanshan Aluminium Ltd. reported a notable increase in Q1 2024 earnings, with net income rising to CNY 851 million from CNY 518.94 million year-over-year, reflecting robust financial health. Despite a volatile dividend history, the company maintains a competitive dividend yield of 3.16%, ranking in the top quartile of Chinese dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios at 35.9% and cash payout at 52.2%, respectively. Recent share buybacks underscore confidence in its valuation, enhancing shareholder value amidst market fluctuations.

- Click here and access our complete dividend analysis report to understand the dynamics of Shandong Nanshan AluminiumLtd.

- The analysis detailed in our Shandong Nanshan AluminiumLtd valuation report hints at an deflated share price compared to its estimated value.

HUAYU Automotive Systems (SHSE:600741)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HUAYU Automotive Systems Company Limited, with a market capitalization of CN¥50.48 billion, engages in the research, development, manufacturing, and global sales of automotive parts.

Operations: HUAYU Automotive Systems Company Limited generates its revenue primarily through the research, development, manufacturing, and sale of automotive parts on a global scale.

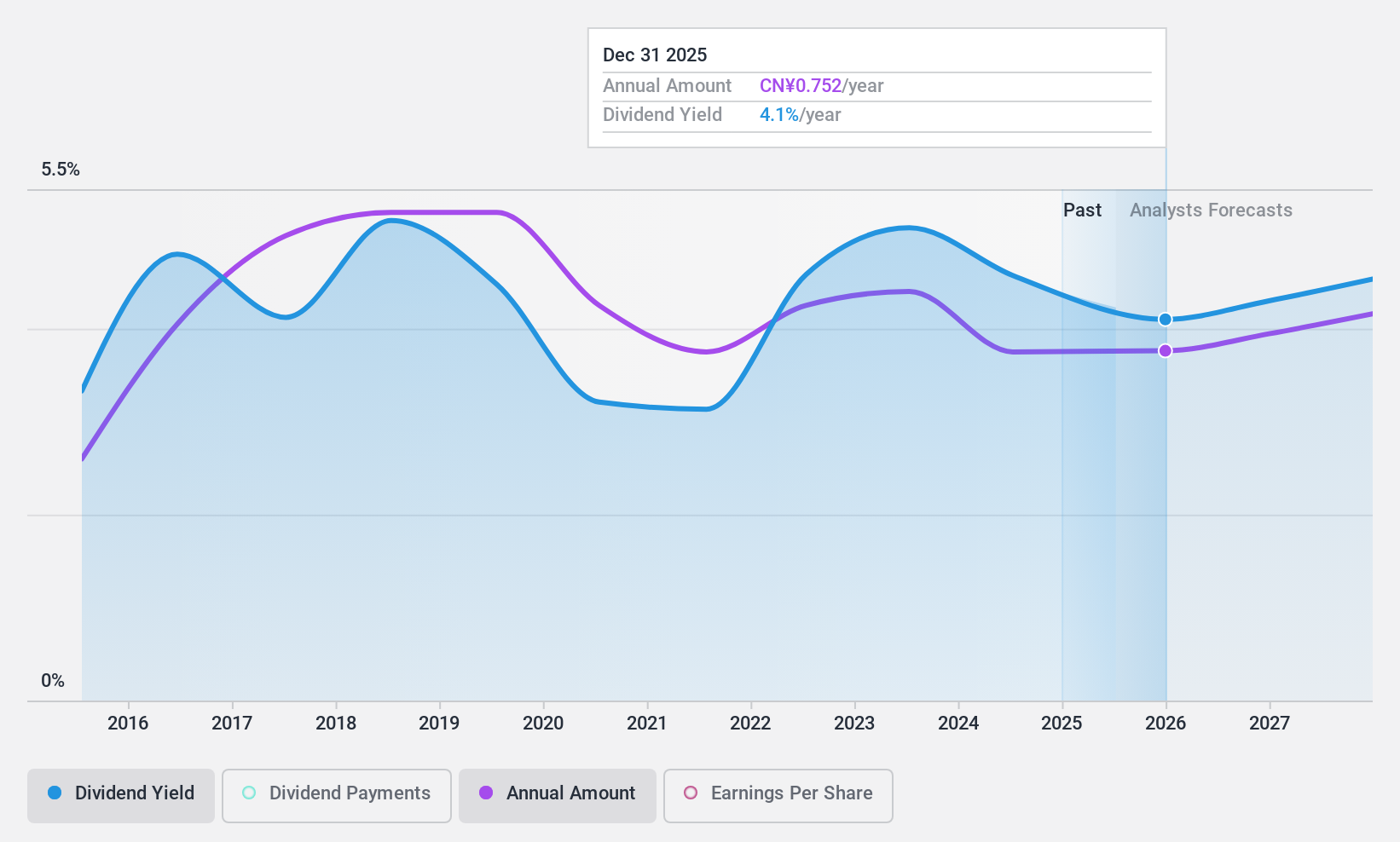

Dividend Yield: 4.7%

HUAYU Automotive Systems reported a slight increase in Q1 2024 sales to CNY 37.02 billion, though net income dipped to CNY 1.26 billion from CNY 1.43 billion year-over-year. The company's dividends have shown volatility over the past decade, with a current payout ratio of 33.6% indicating dividends are covered by earnings and cash flows (cash payout ratio: 33.1%). Recent strategic alliance with Uhnder aims to boost its ADAS capabilities, potentially impacting future performance positively despite an expected average earnings decline of 1% annually over the next three years.

- Get an in-depth perspective on HUAYU Automotive Systems' performance by reading our dividend report here.

- The valuation report we've compiled suggests that HUAYU Automotive Systems' current price could be quite moderate.

Guangdong Provincial Expressway Development (SZSE:000429)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Provincial Expressway Development Co., Ltd. operates expressways and bridges in the People's Republic of China, with a market capitalization of approximately CN¥20.64 billion.

Operations: Guangdong Provincial Expressway Development Co., Ltd. generates its revenue primarily from the development and operation of expressways and bridges across the People's Republic of China.

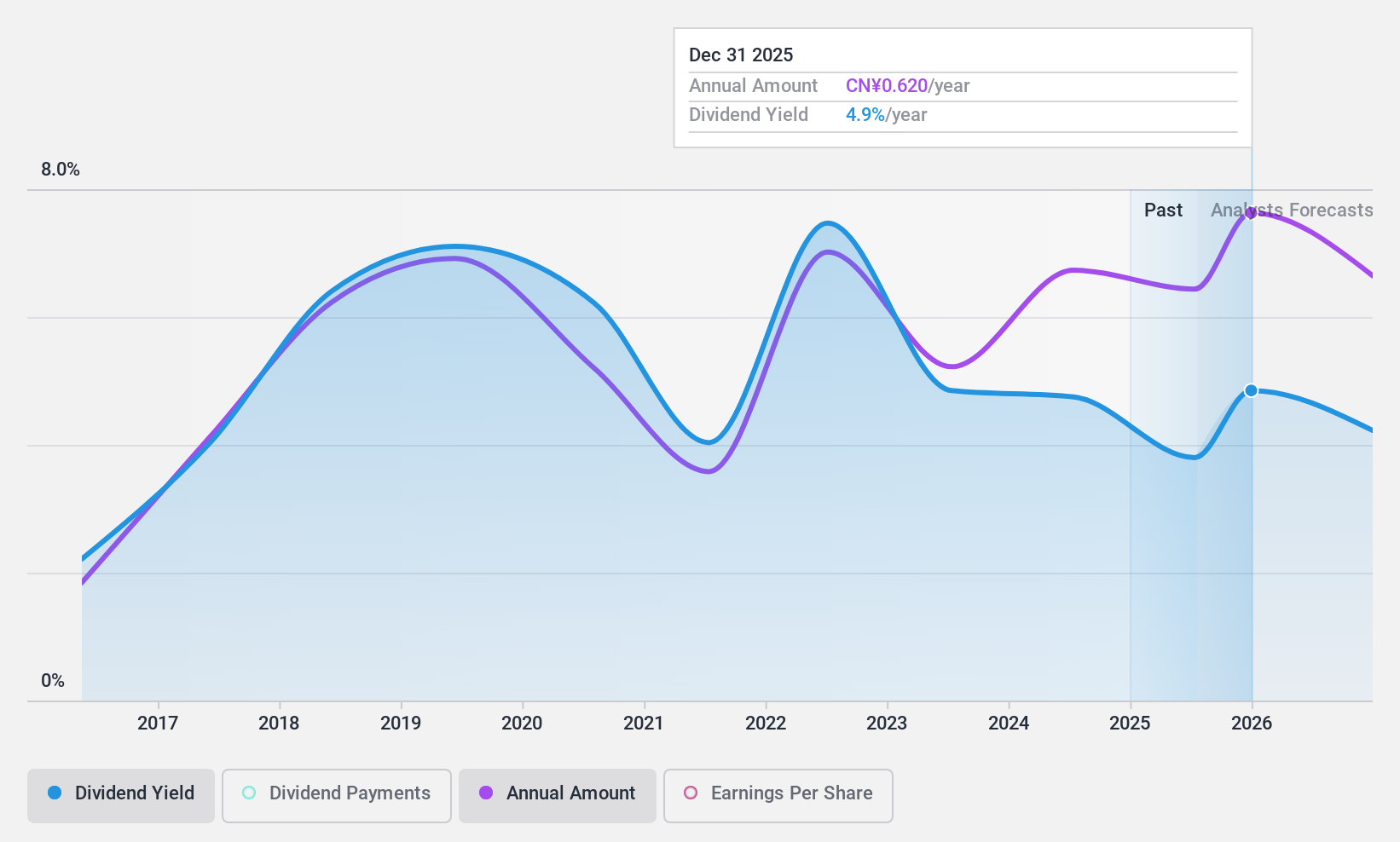

Dividend Yield: 5.2%

Guangdong Provincial Expressway Development Co., Ltd. recently reported a slight decrease in Q1 2024 sales to CNY 1.12 billion, with net income rising to CNY 420.71 million. Despite a reasonable payout ratio of 70.1%, the company's dividend history is marked by inconsistency and volatility over the past decade, reflecting an unstable dividend track record. However, dividends have grown over this period and are currently well-covered by both earnings and cash flows (cash payout ratio: 57.5%).

- Dive into the specifics of Guangdong Provincial Expressway Development here with our thorough dividend report.

- Upon reviewing our latest valuation report, Guangdong Provincial Expressway Development's share price might be too pessimistic.

Next Steps

- Click here to access our complete index of 226 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shandong Nanshan AluminiumLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600219

Shandong Nanshan AluminiumLtd

Researches and develops, manufactures, imports, sells, and exports aluminum profiles worldwide.

Flawless balance sheet established dividend payer.