It's A Story Of Risk Vs Reward With Jiayou International Logistics Co.,Ltd (SHSE:603871)

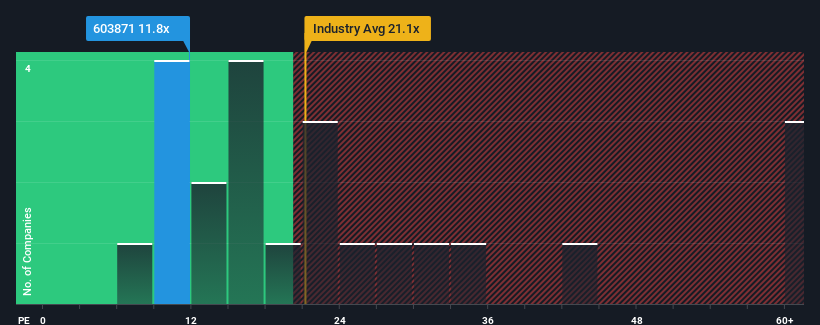

Jiayou International Logistics Co.,Ltd's (SHSE:603871) price-to-earnings (or "P/E") ratio of 11.8x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 40x and even P/E's above 79x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Jiayou International LogisticsLtd has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Jiayou International LogisticsLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Jiayou International LogisticsLtd's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 43% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 239% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 39% as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is not materially different.

In light of this, it's peculiar that Jiayou International LogisticsLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Jiayou International LogisticsLtd's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Jiayou International LogisticsLtd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 2 warning signs for Jiayou International LogisticsLtd (1 is significant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Jiayou International LogisticsLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603871

Jiayou International LogisticsLtd

Engages in the provision of domestic and international multimodal transportation, logistics infrastructure investment, and operation and supply chain trade.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives