- China

- /

- Personal Products

- /

- SZSE:002094

Undiscovered Gems in Global Markets to Watch This April 2025

Reviewed by Simply Wall St

In the midst of heightened global trade tensions and a significant stock market downturn triggered by unexpected U.S. tariff announcements, small-cap stocks have particularly struggled, with indices like the Russell 2000 experiencing notable declines. Despite these challenges, investors are on the lookout for undiscovered gems that can offer resilience and potential growth; qualities that become even more crucial in turbulent times like these.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Top Union Electronics | 1.20% | 7.68% | 18.91% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Advanced International Multitech | 35.61% | 5.13% | 2.17% | ★★★★★☆ |

| Co-Tech Development | 21.93% | 1.57% | 4.27% | ★★★★★☆ |

| Firich Enterprises | 36.97% | -1.55% | 33.31% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

V V Food & BeverageLtd (SHSE:600300)

Simply Wall St Value Rating: ★★★★★☆

Overview: V V Food & Beverage Co., Ltd is involved in the research, development, production, and sale of food and beverage products both in China and internationally, with a market capitalization of approximately CN¥5.43 billion.

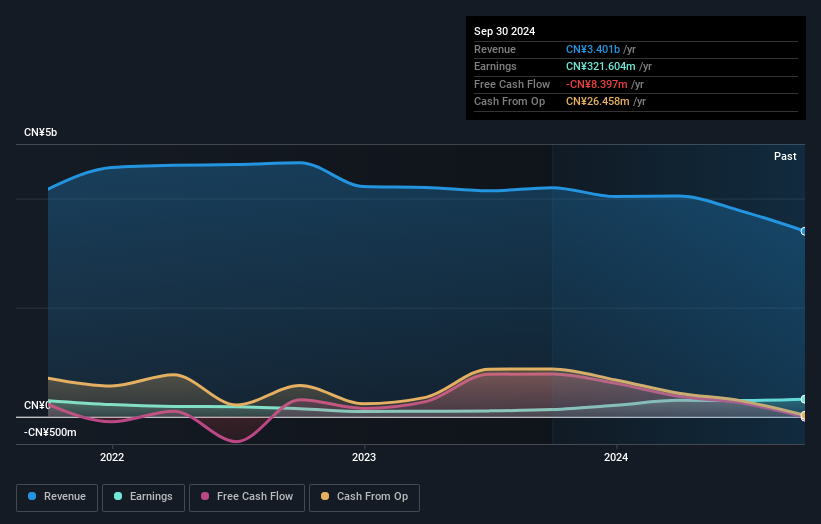

Operations: V V Food & Beverage Co., Ltd generates revenue primarily from the sale of its food and beverage products. The company's net profit margin is 8.5%, indicating its efficiency in converting sales into actual profit after expenses.

V V Food & Beverage Ltd. has shown impressive growth, with earnings surging by 146% over the past year, significantly outpacing the food industry's -5.8%. The company benefits from a strong balance sheet, having more cash than its total debt and reducing its debt-to-equity ratio from 131.4% to 10.5% in five years. Despite a large one-off gain of CN¥149M impacting recent results, their price-to-earnings ratio of 18.6x remains attractive compared to the broader CN market at 32.6x. However, free cash flow is not positive, which may be a consideration for potential investors looking at future performance stability.

- Get an in-depth perspective on V V Food & BeverageLtd's performance by reading our health report here.

Gain insights into V V Food & BeverageLtd's past trends and performance with our Past report.

CMST DevelopmentLtd (SHSE:600787)

Simply Wall St Value Rating: ★★★★★☆

Overview: CMST Development Co., Ltd. offers warehouse logistics services across China, the rest of Asia, Europe, and the United States with a market capitalization of approximately CN¥11.88 billion.

Operations: CMST Development Ltd generates revenue primarily through its warehouse logistics services. The company's market capitalization stands at approximately CN¥11.88 billion.

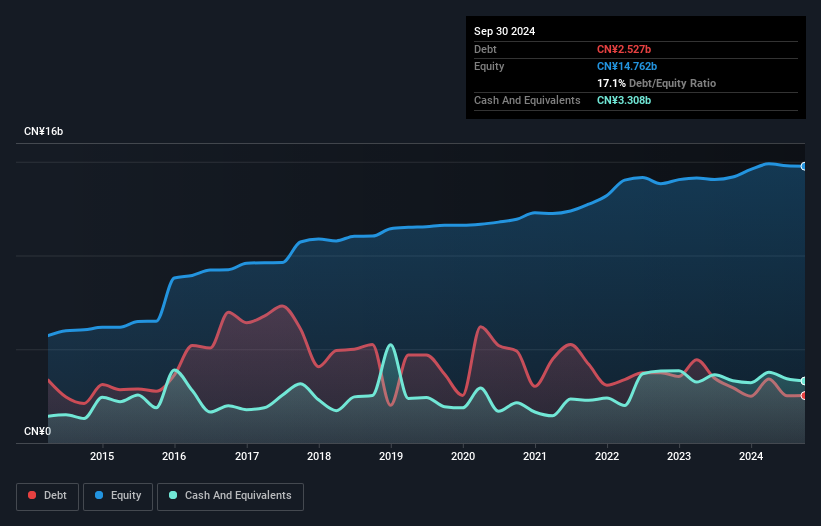

CMST Development Ltd., a promising player in the logistics sector, has been making waves with its impressive financial performance. The company boasts a price-to-earnings ratio of 15.7x, significantly below the CN market average of 32.6x, indicating potential value for investors. Over the past year, earnings surged by 59.9%, outpacing the industry growth rate of 15.4%. This growth is further supported by a reduction in its debt-to-equity ratio from 31.7% to 17.1% over five years, showcasing improved financial stability. A notable one-off gain of CN¥791 million has impacted recent results but highlights strategic financial maneuvers that could benefit future prospects.

Qingdao Kingking Applied Chemistry (SZSE:002094)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Kingking Applied Chemistry Co., Ltd. is a company involved in the production and sale of chemical products, with a market cap of CN¥3.88 billion.

Operations: The company generates revenue primarily from its chemical products, with a market cap of CN¥3.88 billion.

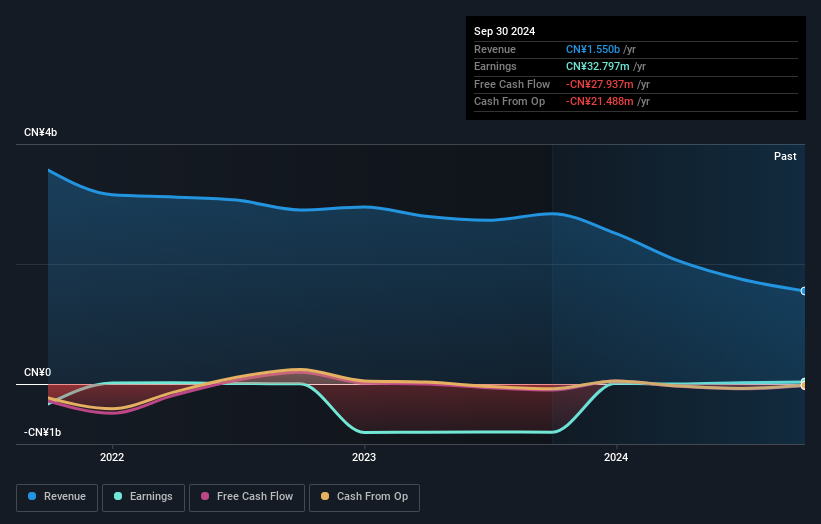

Qingdao Kingking Applied Chemistry, with a net debt to equity ratio of 32.8%, is in a satisfactory position, indicating prudent financial management. The company has recently become profitable, showcasing high-quality earnings despite the broader Personal Products industry facing a 6% contraction. However, free cash flow remains negative at -US$27.94 million as of September 2024, suggesting potential liquidity challenges. Interest coverage is not an issue as earnings exceed interest expenses comfortably. While profitability marks progress for this small player in its sector, the rising debt to equity ratio from 31.8% to 76.4% over five years warrants attention moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Qingdao Kingking Applied Chemistry.

Understand Qingdao Kingking Applied Chemistry's track record by examining our Past report.

Taking Advantage

- Discover the full array of 3179 Global Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Kingking Applied Chemistry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002094

Qingdao Kingking Applied Chemistry

Qingdao Kingking Applied Chemistry Co., Ltd.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives