- China

- /

- Telecom Services and Carriers

- /

- SZSE:300921

Discovering Undiscovered Gems in January 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of easing inflation and robust bank earnings, small-cap stocks are capturing renewed interest, with indices like the Russell 2000 seeing notable gains. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential for growth amidst shifting economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Zhongheng Huafa (SZSE:000020)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Zhongheng Huafa Co., Ltd. and its subsidiaries are engaged in the production and sale of injection molded parts, foam parts, and complete LCD monitors, with a market capitalization of CN¥2.68 billion.

Operations: Shenzhen Zhongheng Huafa generates revenue primarily from the sale of injection molded parts, foam parts, and complete LCD monitors. The company's market capitalization stands at CN¥2.68 billion.

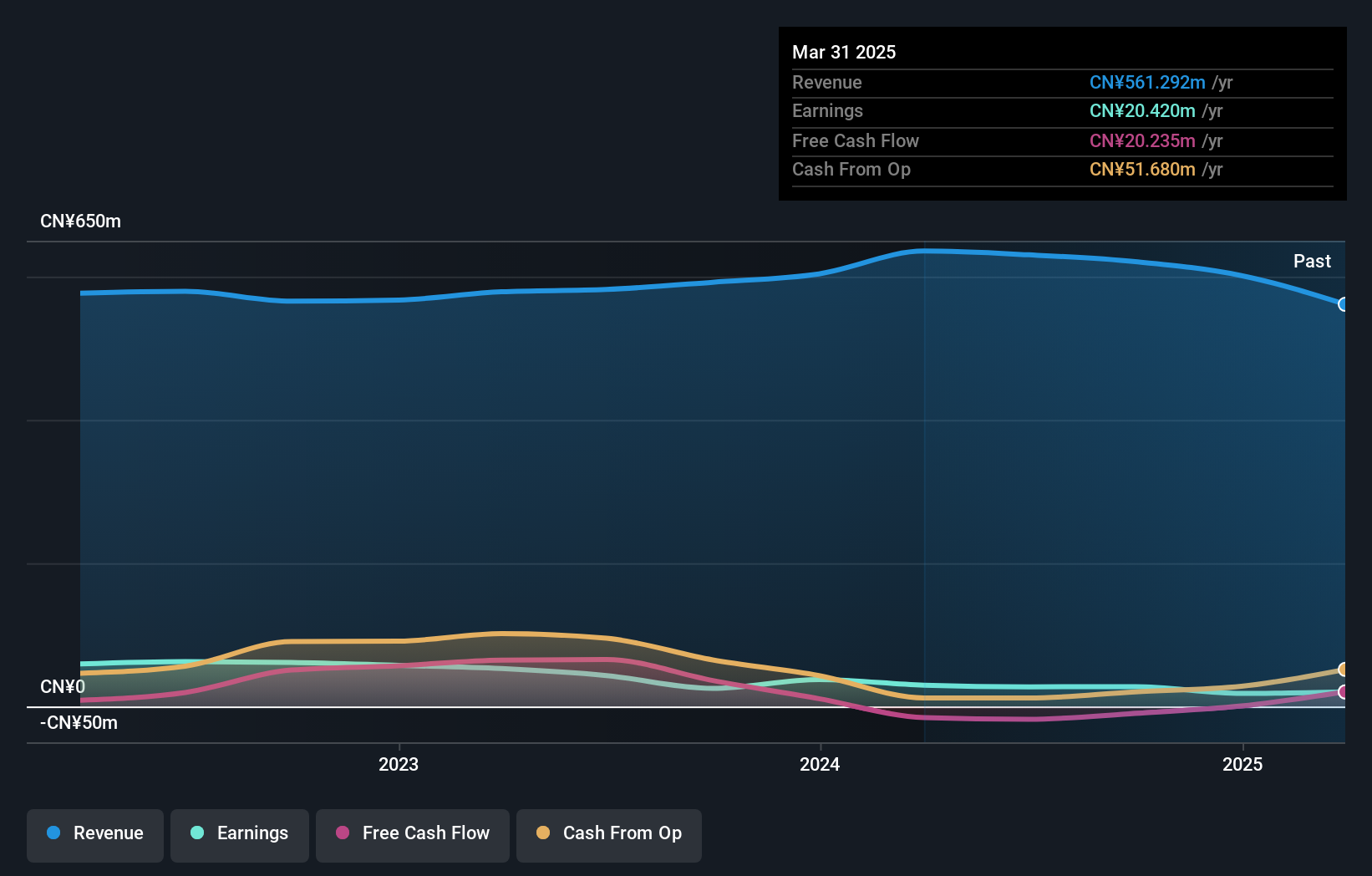

Shenzhen Zhongheng Huafa, a smaller player in the electronics industry, shows promise with its high-quality earnings and impressive growth. Over the past year, earnings grew by 7.8%, outpacing the industry's 2.3% increase. The company has successfully eliminated its debt from a previous debt-to-equity ratio of 37% five years ago, highlighting financial discipline. Recent reports reveal net income rose to CNY 14.24 million from CNY 12.44 million last year on sales of CNY 606.27 million compared to CNY 601.79 million previously, indicating steady performance despite modest revenue growth challenges in a competitive market environment.

Ningbo Runhe High-Tech Materials (SZSE:300727)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Runhe High-Tech Materials Co., Ltd. operates in the high-tech materials industry and has a market cap of CN¥4.01 billion.

Operations: Ningbo Runhe High-Tech Materials generates revenue primarily from its high-tech materials segment. The company has a market cap of CN¥4.01 billion, reflecting its position in the industry.

Ningbo Runhe High-Tech Materials, a nimble player in the chemicals sector, has shown promising growth with earnings rising 14.2% over the past year, surpassing industry averages. Despite its debt to equity ratio climbing to 27.2% over five years, it remains financially sound with more cash than total debt and interest payments well covered by EBIT at 23.7 times. Recent earnings announcements highlight sales reaching CNY 993 million for nine months ending September 2024, up from CNY 854 million in the previous year, while net income improved to CNY 69 million from CNY 61 million a year ago.

NOVA Technology (SZSE:300921)

Simply Wall St Value Rating: ★★★★★★

Overview: NOVA Technology Corporation Limited offers network communication services in China and has a market cap of CN¥3.48 billion.

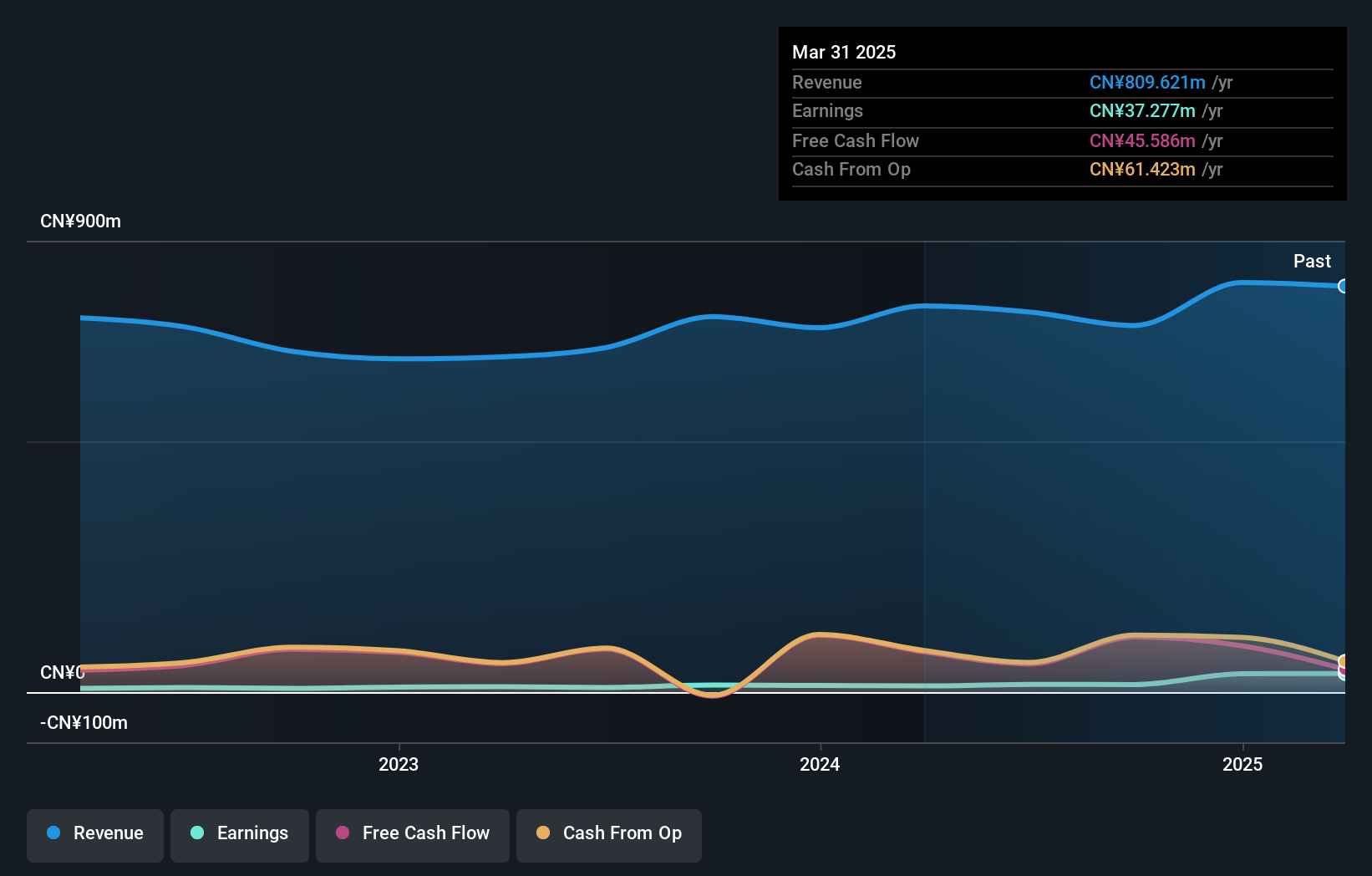

Operations: The company generates revenue primarily from network communication services in China. It experienced a net profit margin of 12.5% in the last reported period, reflecting its ability to convert a portion of its revenues into profit after accounting for all expenses.

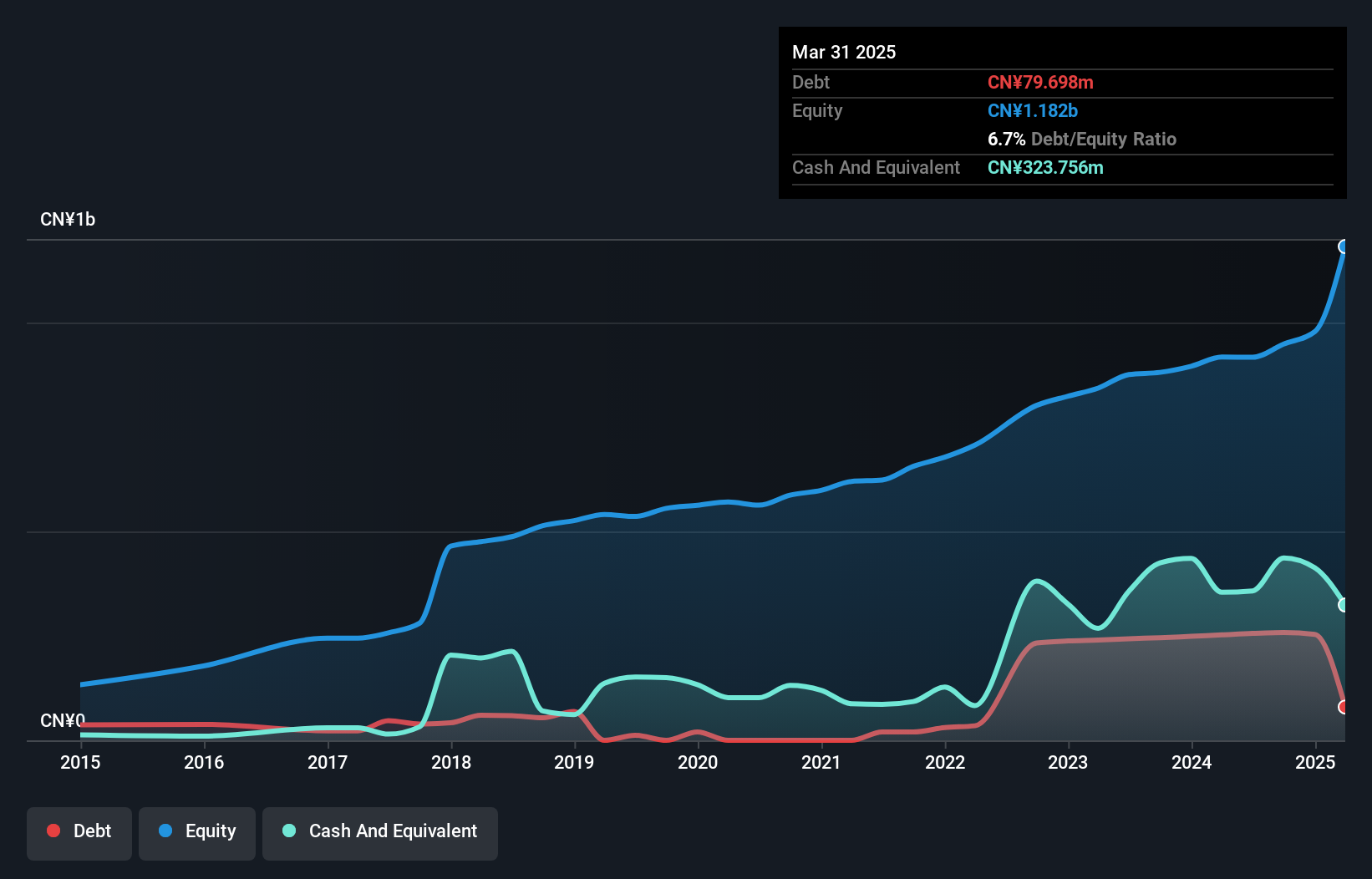

NOVA Technology, a small player in its sector, has experienced notable shifts recently. Earnings for the past year grew by 9.8%, outpacing the Telecom industry's 1.1% growth rate, yet over five years, earnings have dropped by 20.8% annually. The company's debt situation seems favorable with more cash than total debt and a reduced debt-to-equity ratio from 1.3 to 0.8 over five years, indicating improved financial health. However, despite reporting CNY 446 million in revenue for nine months ending September 2024—up from CNY 429 million—the net income fell to CNY 5.75 million from CNY 15.56 million previously, suggesting profitability challenges ahead amidst volatile market conditions and high non-cash earnings levels impacting overall performance stability.

- Get an in-depth perspective on NOVA Technology's performance by reading our health report here.

Understand NOVA Technology's track record by examining our Past report.

Where To Now?

- Delve into our full catalog of 4642 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOVA Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300921

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives