- China

- /

- Telecom Services and Carriers

- /

- SHSE:603220

China Bester Group Telecom Co., Ltd. (SHSE:603220) Stocks Shoot Up 33% But Its P/E Still Looks Reasonable

China Bester Group Telecom Co., Ltd. (SHSE:603220) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 149% following the latest surge, making investors sit up and take notice.

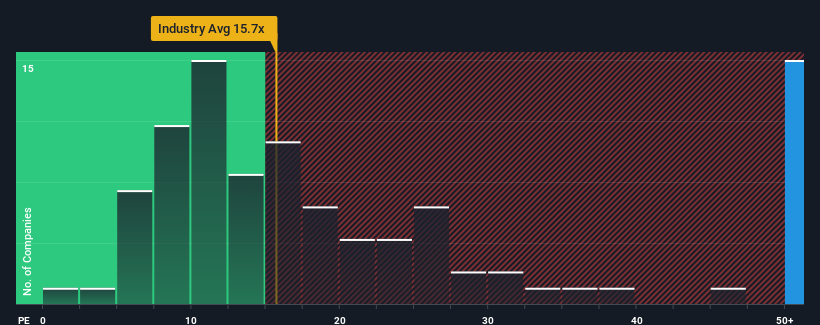

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 28x, you may consider China Bester Group Telecom as a stock to avoid entirely with its 78.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

China Bester Group Telecom has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for China Bester Group Telecom

Is There Enough Growth For China Bester Group Telecom?

China Bester Group Telecom's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.8%. Even so, admirably EPS has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 70% over the next year. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's understandable that China Bester Group Telecom's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From China Bester Group Telecom's P/E?

China Bester Group Telecom's P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of China Bester Group Telecom's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - China Bester Group Telecom has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603220

China Bester Group Telecom

Engages in the planning, design, construction, maintenance, and optimization of communications networks for telecom operators in China.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives