- China

- /

- Wireless Telecom

- /

- SHSE:600050

China United Network Communications Limited's (SHSE:600050) Share Price Boosted 34% But Its Business Prospects Need A Lift Too

China United Network Communications Limited (SHSE:600050) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

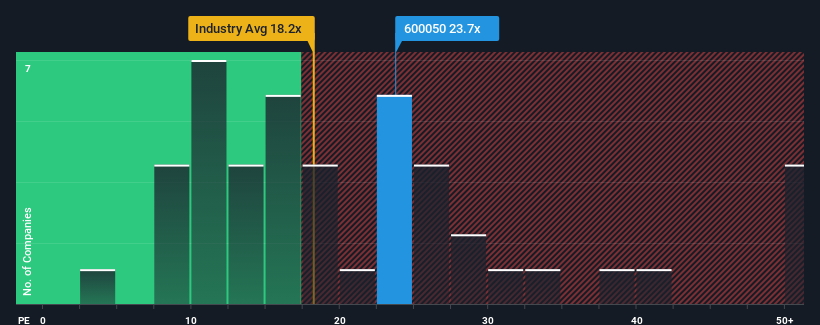

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider China United Network Communications as an attractive investment with its 23.7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for China United Network Communications as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for China United Network Communications

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like China United Network Communications' to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. The latest three year period has also seen an excellent 31% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 7.2% over the next year. With the market predicted to deliver 37% growth , the company is positioned for a weaker earnings result.

With this information, we can see why China United Network Communications is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From China United Network Communications' P/E?

The latest share price surge wasn't enough to lift China United Network Communications' P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of China United Network Communications' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for China United Network Communications that you need to take into consideration.

If these risks are making you reconsider your opinion on China United Network Communications, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600050

China United Network Communications

Provides telecommunication services in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success