- China

- /

- Metals and Mining

- /

- SHSE:601702

Discovering Shanghai Huafon Aluminium And 2 Other Promising Small Caps In China

Reviewed by Simply Wall St

As Chinese markets navigate a landscape marked by weak inflation data and concerns about economic growth, small-cap stocks present intriguing opportunities for investors. In this article, we explore Shanghai Huafon Aluminium and two other promising small-cap companies in China that could offer unique value propositions amidst these market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hubei Three Gorges Tourism Group | 11.57% | -7.07% | 1.90% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.95% | 5.39% | 47.06% | ★★★★★★ |

| Guoguang ElectricLtd.Chengdu | NA | 8.51% | 1.60% | ★★★★★★ |

| Tibet Development | 52.25% | -1.03% | 55.10% | ★★★★★★ |

| Shenzhen Easttop Supply Chain Management | 89.23% | -43.08% | 5.73% | ★★★★★☆ |

| Hubei Sanxia New Building Materials | 27.38% | -9.28% | 22.96% | ★★★★★☆ |

| Anhui Liuguo Chemical | 104.32% | 11.19% | 46.31% | ★★★★☆☆ |

| Sichuan Dowell Science and Technology | 33.70% | 13.47% | -12.57% | ★★★★☆☆ |

| Shenzhen Tongyi Industry | 72.24% | 13.41% | -16.34% | ★★★★☆☆ |

| Baoding Technology | 69.11% | 37.22% | 43.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai Huafon Aluminium (SHSE:601702)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Huafon Aluminium Corporation focuses on the research, development, production, and sales of aluminum sheets, strips, and foils with a market cap of approximately CN¥14.05 billion.

Operations: The company generates revenue primarily from its aluminum processing segment, which amounted to CN¥10.06 billion.

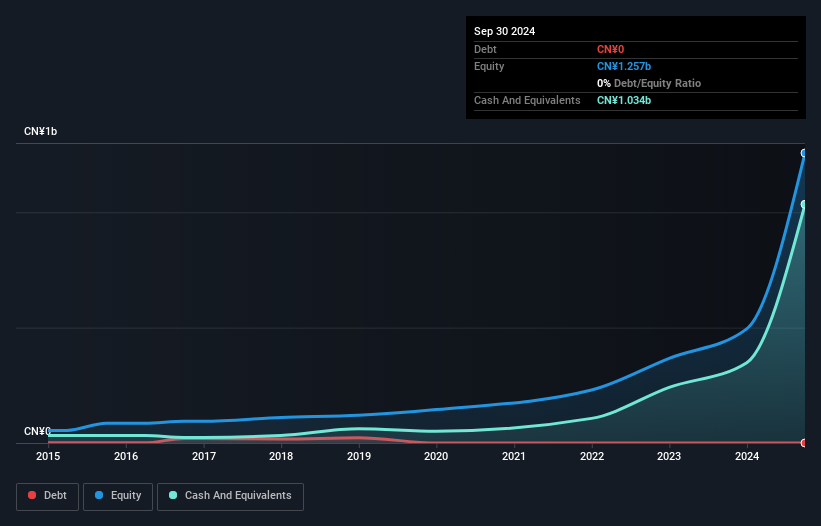

Shanghai Huafon Aluminium has shown impressive financial health, reducing its debt to equity ratio from 188.1% to 31.6% over the past five years and achieving a net debt to equity ratio of 24.2%. Recent earnings growth of 35.5% outpaced the industry average of 6.2%, with net income rising to CNY 558 million for the first half of 2024 from CNY 413 million a year ago. Trading at a P/E ratio of 13.4x, below the CN market's average, it also reported high-quality earnings and strong EBIT coverage (25.8x).

Yunnan Nantian Electronics InformationLtd (SZSE:000948)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yunnan Nantian Electronics Information Ltd (ticker: SZSE:000948) specializes in providing software and information technology services, with a market cap of CN¥6.43 billion.

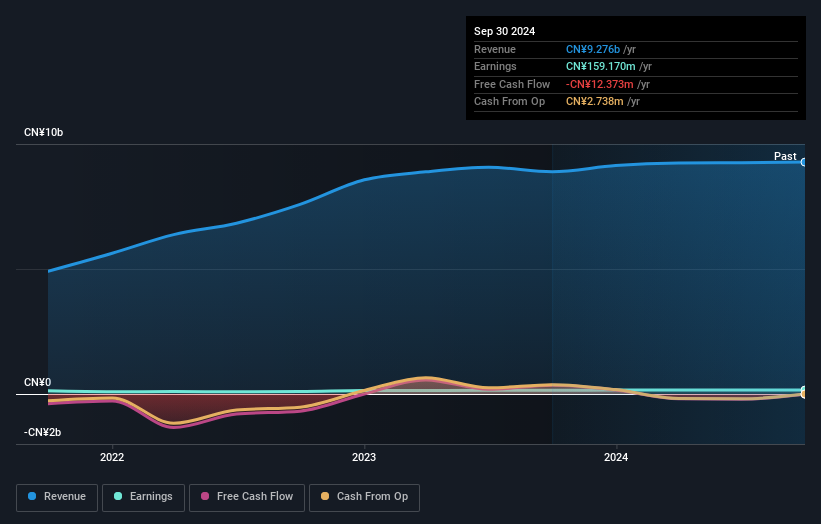

Operations: The company's primary revenue stream comes from software and information technology services, generating CN¥9.25 billion.

Yunnan Nantian Electronics Information Ltd. reported half-year sales of CN¥3.91 billion, up from CN¥3.79 billion last year, with net income rising to CN¥25.36 million from CN¥21.47 million. The company's net debt to equity ratio stands at a satisfactory 15.6%, while earnings grew by 8.3% over the past year, outpacing the IT industry's -11.6%. Despite a large one-off gain of CN¥70.4 million impacting recent results, interest payments are well covered by EBIT at 29x coverage.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥3.84 billion.

Operations: Flaircomm Microelectronics generates revenue primarily from the sale of wireless communication modules, embedded software, and turnkey system solutions. The company has a market cap of CN¥3.84 billion.

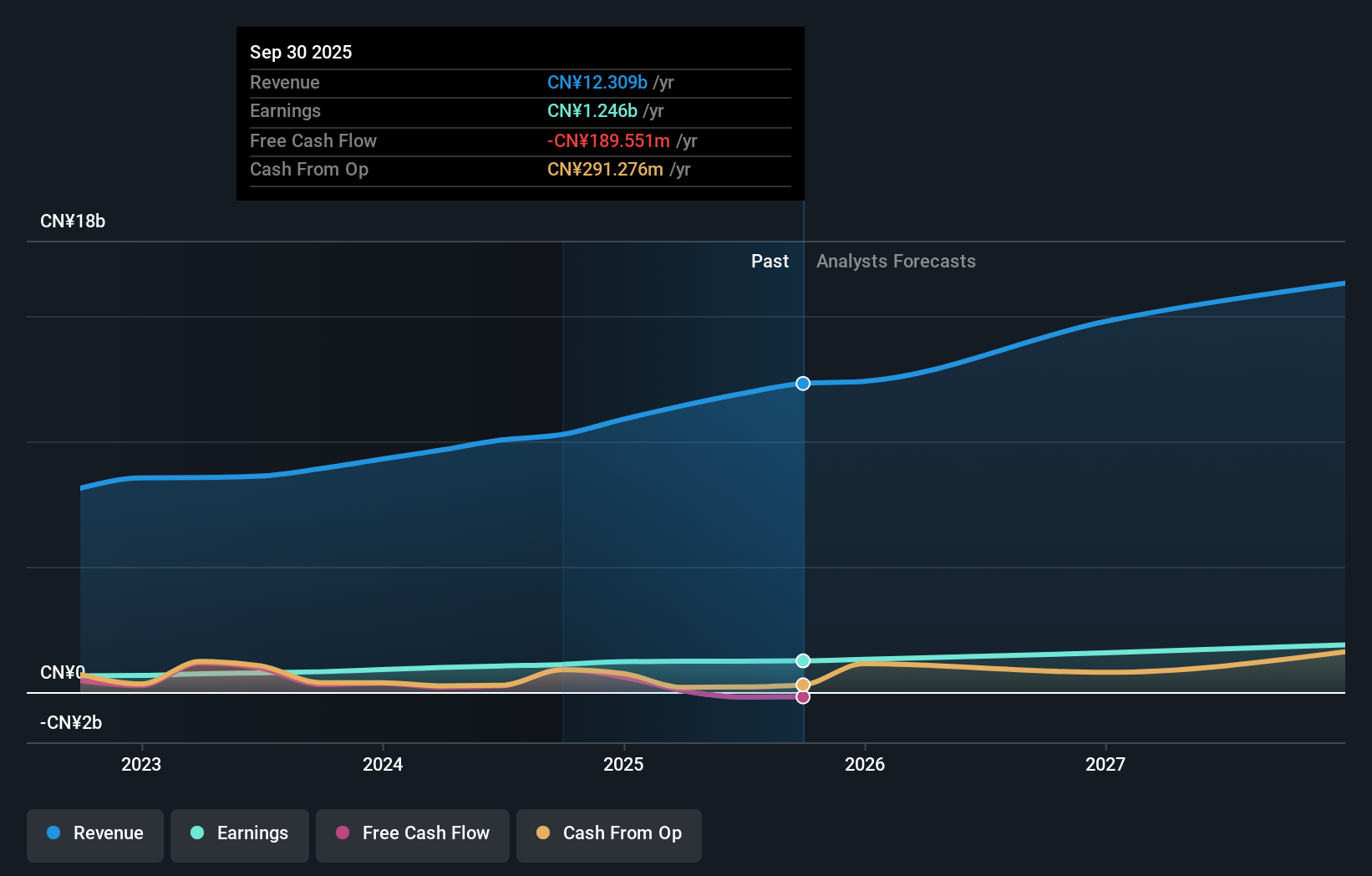

Flaircomm Microelectronics, a burgeoning player in the Chinese market, recently completed an IPO raising CNY 699.19 million at CNY 39.84 per share. The company’s half-year sales hit CNY 429.85 million, up from last year’s CNY 327.8 million, while net income rose to CNY 74.27 million from CNY 53.04 million previously reported. Additionally, Flaircomm has been added to the Shenzhen Stock Exchange A Share Index and Composite Index as of September 2024, signaling growing investor confidence and visibility in the market.

Next Steps

- Unlock more gems! Our Chinese Undiscovered Gems With Strong Fundamentals screener has unearthed 938 more companies for you to explore.Click here to unveil our expertly curated list of 941 Chinese Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601702

Shanghai Huafon Aluminium

Engages in the research and development, production, and sales of aluminum sheets, strips, and foils.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion