- China

- /

- Electrical

- /

- SHSE:601615

Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer sentiment and geopolitical developments, the Asian market continues to capture investor interest with its unique blend of growth opportunities and evolving economic conditions. In this context, companies with high insider ownership often stand out as they suggest alignment between management and shareholder interests, offering potential resilience amid broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.3% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Let's uncover some gems from our specialized screener.

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yang Smart Energy Group Limited focuses on the R&D, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China with a market cap of CN¥33.05 billion.

Operations: Revenue Segments (in millions of CN¥):

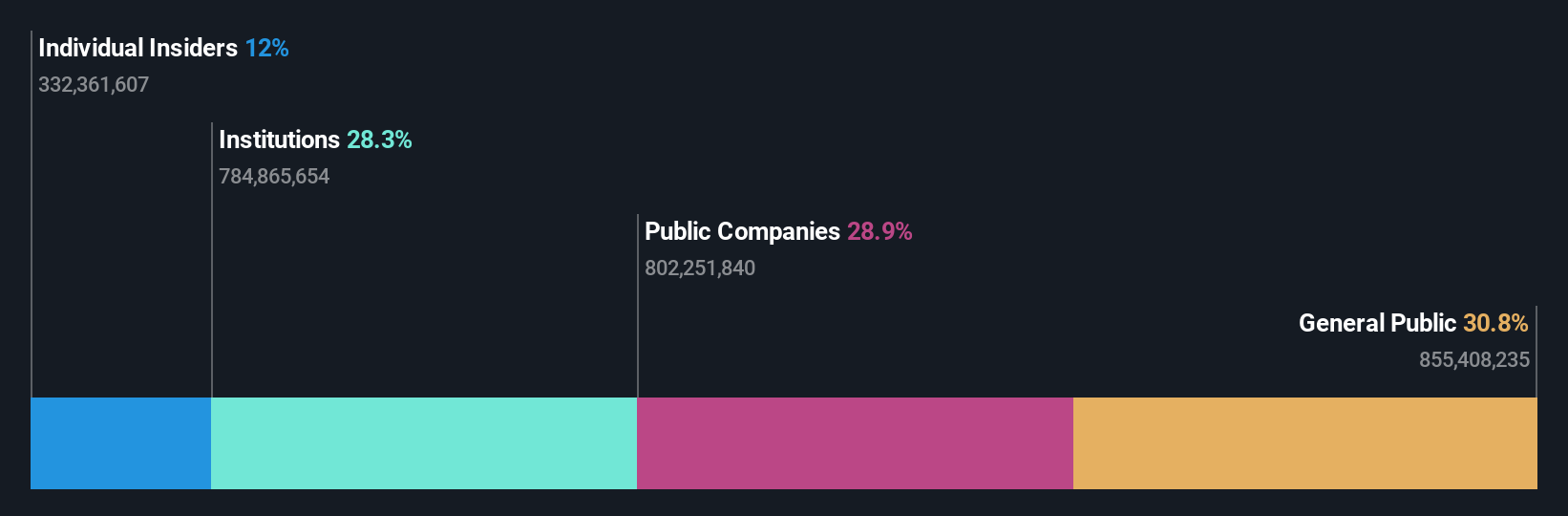

Insider Ownership: 14.9%

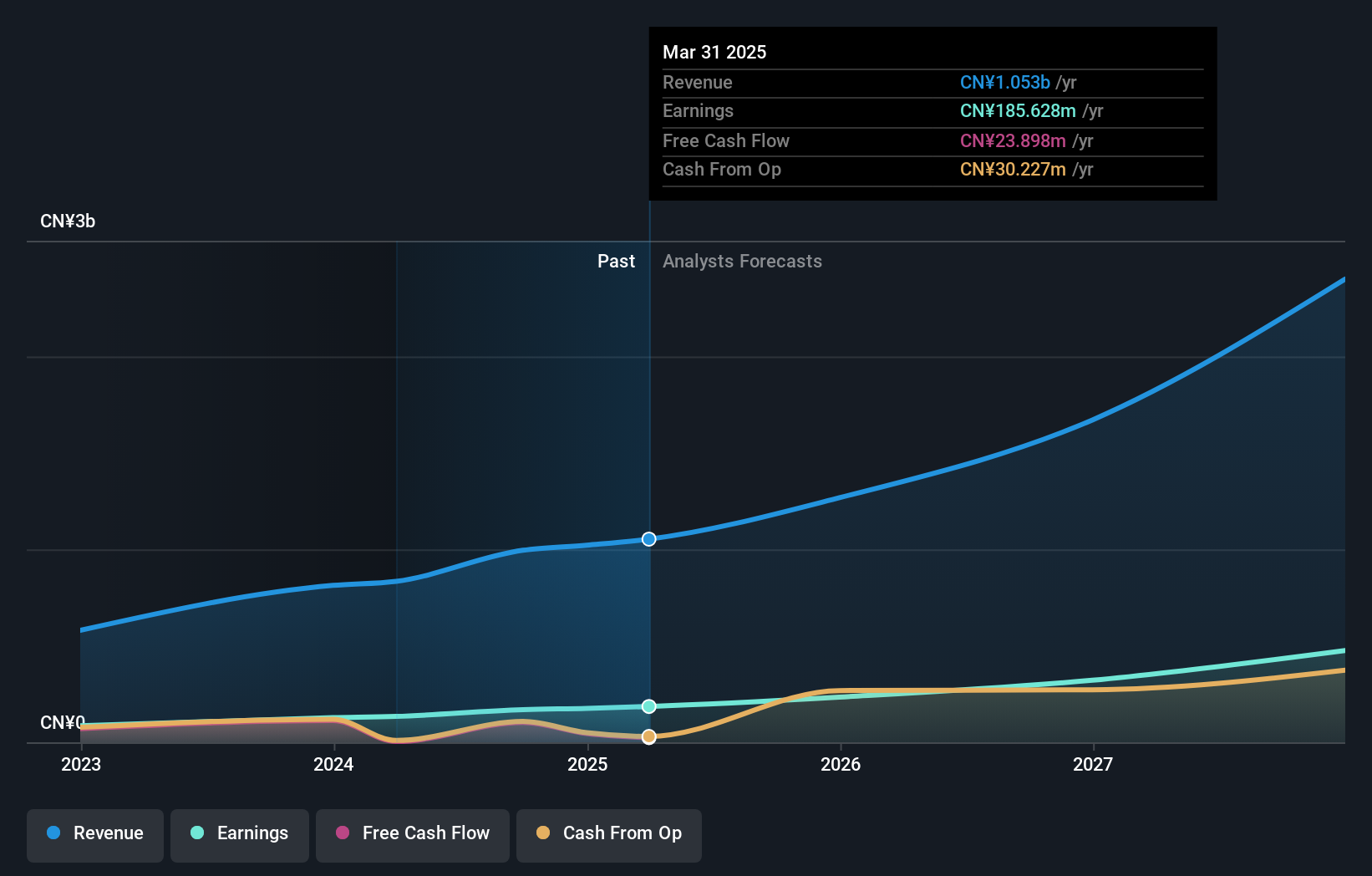

Earnings Growth Forecast: 66.7% p.a.

Ming Yang Smart Energy Group is expanding its global footprint with a GBP 1.5 billion investment in the UK's wind turbine manufacturing, aligning with its internationalization strategy. Despite recent earnings showing a slight decline in net income to CNY 765.76 million, revenue increased significantly to CNY 26.30 billion over nine months. The company forecasts substantial earnings growth of over 20% annually, although its return on equity is expected to remain low at around 9.7%.

- Click here to discover the nuances of Ming Yang Smart Energy Group with our detailed analytical future growth report.

- The analysis detailed in our Ming Yang Smart Energy Group valuation report hints at an inflated share price compared to its estimated value.

Shanjin International Gold (SZSE:000975)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanjin International Gold Co., Ltd. engages in the exploration, mining, and trading of precious and non-ferrous metal ores in China, with a market cap of CN¥58.55 billion.

Operations: The company generates revenue through its activities in the exploration, mining, and trading of precious and non-ferrous metal ores within China.

Insider Ownership: 12%

Earnings Growth Forecast: 27.4% p.a.

Shanjin International Gold's recent earnings report highlights robust growth, with net income rising to CNY 2.46 billion for the nine months ending September 2025. Despite trading at a significant discount to its estimated fair value, the company shows strong earnings growth potential of over 27% annually, outpacing market expectations. However, revenue growth is projected to be slightly below market averages. Recent buybacks and amendments in governance structures suggest active management engagement but no substantial insider trading activity was noted recently.

- Take a closer look at Shanjin International Gold's potential here in our earnings growth report.

- Our expertly prepared valuation report Shanjin International Gold implies its share price may be lower than expected.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. specializes in developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥13.53 billion.

Operations: The company's revenue is primarily derived from its wireless communications equipment segment, which generated CN¥964.25 million.

Insider Ownership: 35.5%

Earnings Growth Forecast: 41.6% p.a.

Flaircomm Microelectronics demonstrates strong growth potential, with earnings forecasted to rise significantly at 41.65% annually, outpacing the broader Chinese market. Despite recent volatility in its share price and a dividend yield of 0.77% that lacks coverage by earnings or cash flows, the company maintains high return on equity expectations. Recent earnings show stable net income despite a decline in revenue to CNY 677.14 million for nine months ending September 2025, indicating resilience amidst challenges.

- Get an in-depth perspective on Flaircomm Microelectronics' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Flaircomm Microelectronics' share price might be on the expensive side.

Key Takeaways

- Reveal the 625 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601615

Ming Yang Smart Energy Group

Engages in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment, wind turbines, and core components in China.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives