- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6215

Discovering Undiscovered Gems With Potential In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating indices and economic uncertainties, small-cap stocks present intriguing opportunities amidst the broader volatility. In this environment, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and resilience to withstand competitive pressures, like those seen in the AI sector recently.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Nanjing Inform Storage Equipment (Group) (SHSE:603066)

Simply Wall St Value Rating: ★★★★★☆

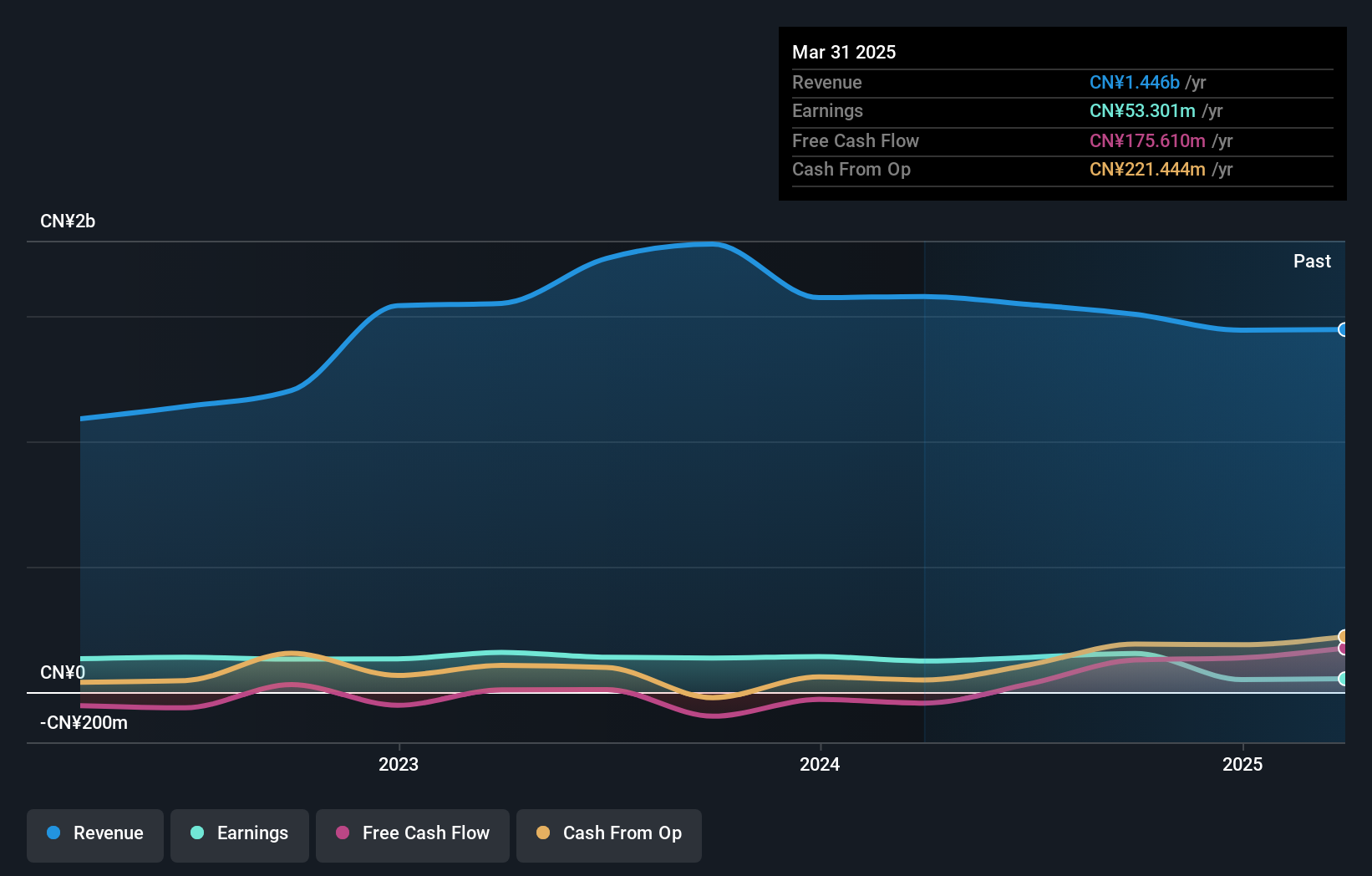

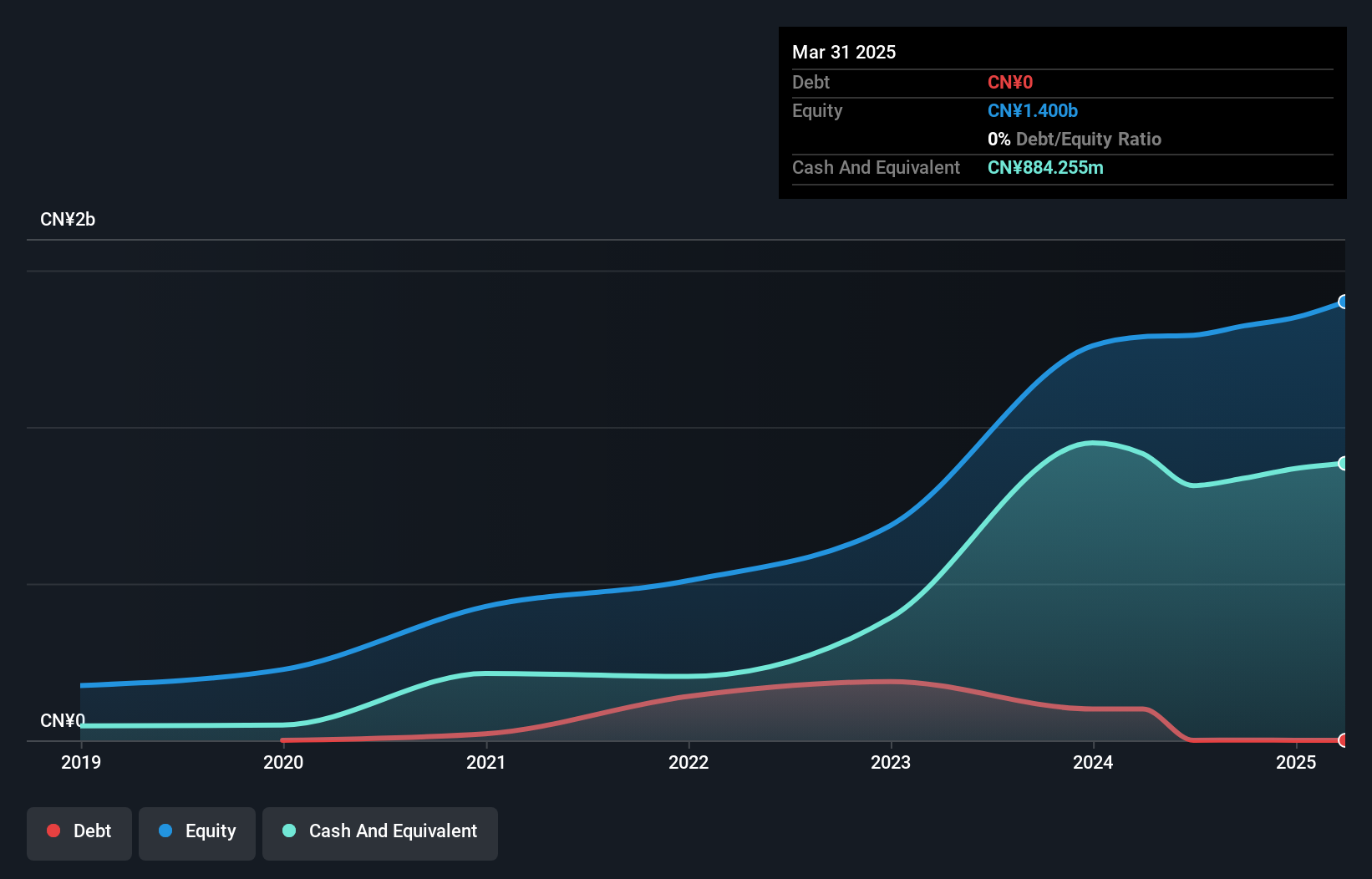

Overview: Nanjing Inform Storage Equipment (Group) Co., Ltd. focuses on the research, development, manufacturing, sales, and installation of shelf and storage equipment in China with a market capitalization of CN¥3.34 billion.

Operations: Inform Storage Equipment generates revenue primarily from its Furniture & Fixtures segment, totaling CN¥1.51 billion.

Nanjing Inform Storage Equipment, a smaller player in the machinery sector, has shown impressive financial health with its interest payments well-covered by EBIT at 28.6 times. Its earnings growth of 13.5% over the past year outpaced the industry average of -0.4%, indicating strong performance relative to peers. The company's price-to-earnings ratio stands at 21.6x, which is favorable compared to China's market average of 34.9x, suggesting potential value for investors. Despite an increase in its debt-to-equity ratio to 15.3% over five years, it maintains more cash than total debt and generates positive free cash flow.

Dalian Dalicap TechnologyLtd (SZSE:301566)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dalian Dalicap Technology Co., Ltd. specializes in the research, development, manufacture, and sale of RF microwave ceramic capacitors both in China and internationally, with a market cap of CN¥6.20 billion.

Operations: The company generates revenue primarily through the sale of RF microwave ceramic capacitors. The cost structure includes expenses related to research, development, and manufacturing. Gross profit margin trends can provide insights into operational efficiency and pricing strategy.

Dalian Dalicap Technology, a small player in the electronics sector, is showing promising signs with its high-quality earnings and a debt-to-equity ratio that has increased modestly to 0.07% over five years. The company’s earnings growth of 3.3% last year outpaced the industry average of 2.3%, indicating competitive strength. Despite recent share price volatility, it remains free cash flow positive, with levered free cash flow reaching US$92.71 million as of February 2025. A follow-on equity offering was filed recently, which could impact future capital structure and growth opportunities for this nimble enterprise in an evolving market landscape.

- Delve into the full analysis health report here for a deeper understanding of Dalian Dalicap TechnologyLtd.

Learn about Dalian Dalicap TechnologyLtd's historical performance.

Aurotek (TWSE:6215)

Simply Wall St Value Rating: ★★★★★★

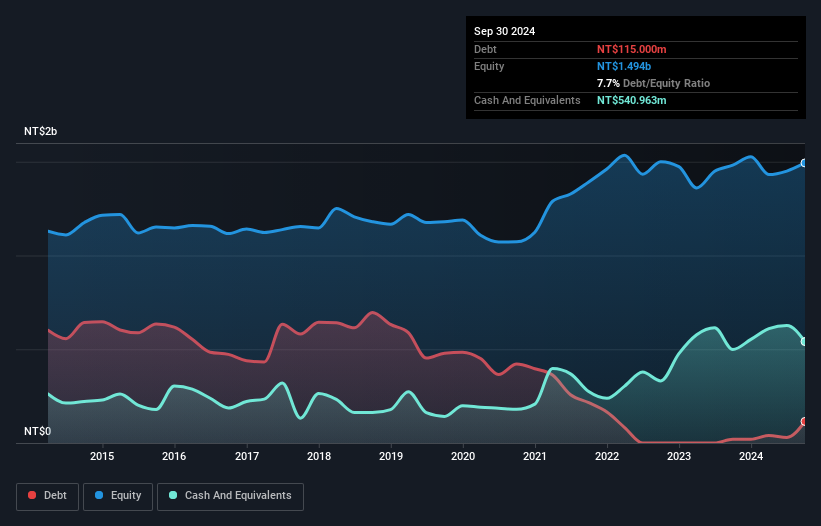

Overview: Aurotek Corporation focuses on the processing, manufacturing, and trading of automation equipment and system components across Taiwan, Mainland China, Japan, and other international markets with a market cap of NT$10.89 billion.

Operations: Aurotek Corporation generates revenue primarily from automated components and automation equipment, contributing NT$743.89 million and NT$661.50 million, respectively. The energy-saving security segment adds NT$96.71 million to the overall revenue stream.

Aurotek is carving out its niche with impressive financial strides. Over the past year, earnings surged by 28%, outpacing the broader electronics sector's 7% growth. The company's debt-to-equity ratio has impressively shrunk from 41% to just under 8% in five years, signaling robust financial health. Recent quarterly sales hit TWD 467 million, doubling from last year's TWD 223 million, while net income climbed to TWD 42 million from TWD 18 million. Despite a volatile share price recently, Aurotek's high-quality earnings and positive free cash flow underscore its potential as a promising player in its industry.

- Click here to discover the nuances of Aurotek with our detailed analytical health report.

Understand Aurotek's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 4724 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6215

Aurotek

Engages in the processing, manufacturing, and trading of various automation equipment, machinery systems, and components in Taiwan, Mainland China, Japan, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives