As global markets navigate a complex landscape marked by resilient labor markets and inflation concerns, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index dipping into correction territory. In this environment of economic uncertainty and fluctuating investor sentiment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 10.58% | 0.55% | 4.78% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| TOMONY Holdings | 68.34% | 6.88% | 13.82% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Techno Ryowa | 0.19% | 3.96% | 11.17% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

JDM JingDaMachine (Ningbo)Ltd (SHSE:603088)

Simply Wall St Value Rating: ★★★★★★

Overview: JDM JingDaMachine (Ningbo) Co. Ltd specializes in the production and sale of precision stamping parts both within China and internationally, with a market capitalization of CN¥3.74 billion.

Operations: JDM JingDaMachine generates revenue primarily from its Metal Forming Machine Tool Manufacturing segment, amounting to CN¥783.71 million.

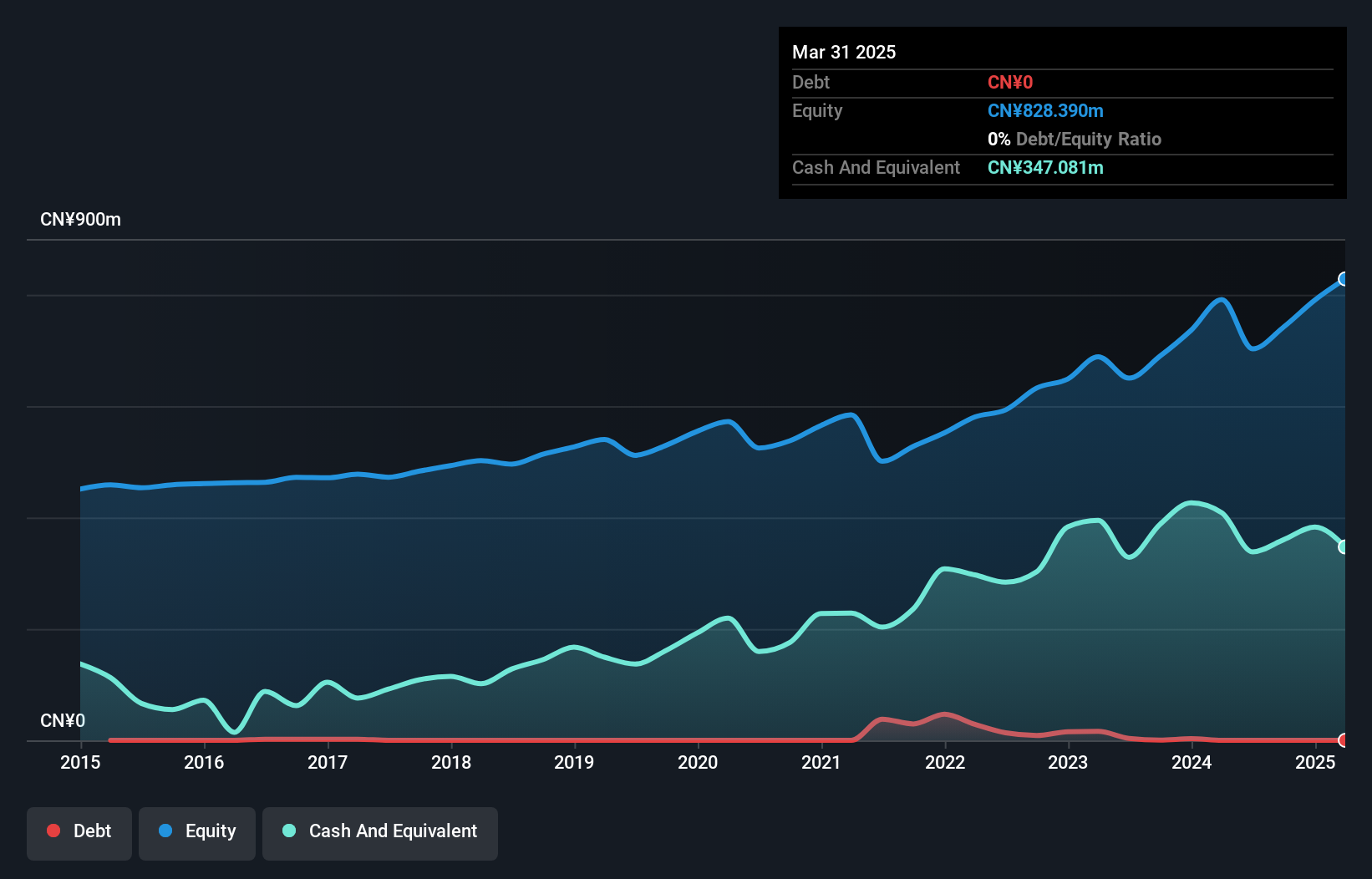

JDM JingDaMachine, a nimble player in the machinery sector, showcases solid financial health with zero debt and high-quality earnings. Its price-to-earnings ratio of 23.2x is attractive compared to the broader CN market's 31.8x, suggesting potential value for investors. Over the past year, JDM's earnings grew by 2.2%, outpacing the industry's modest 0.2% growth rate; looking ahead, earnings are forecasted to rise by an impressive 35% annually. Recent reports reveal sales of CNY 582 million for nine months ending September 2024, up from CNY 507 million previously, while net income stands at CNY 119 million compared to last year's CNY 117 million.

Nextool Technology (SHSE:688419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nextool Technology Co., Ltd. specializes in the research, development, manufacture, and sale of plastic extrusion tooling products, semiconductor packaging equipment, and molds globally with a market cap of CN¥2.46 billion.

Operations: Nextool Technology generates revenue primarily from the sale of plastic extrusion tooling products, semiconductor packaging equipment, and molds. The company focuses on these core product lines to drive its financial performance.

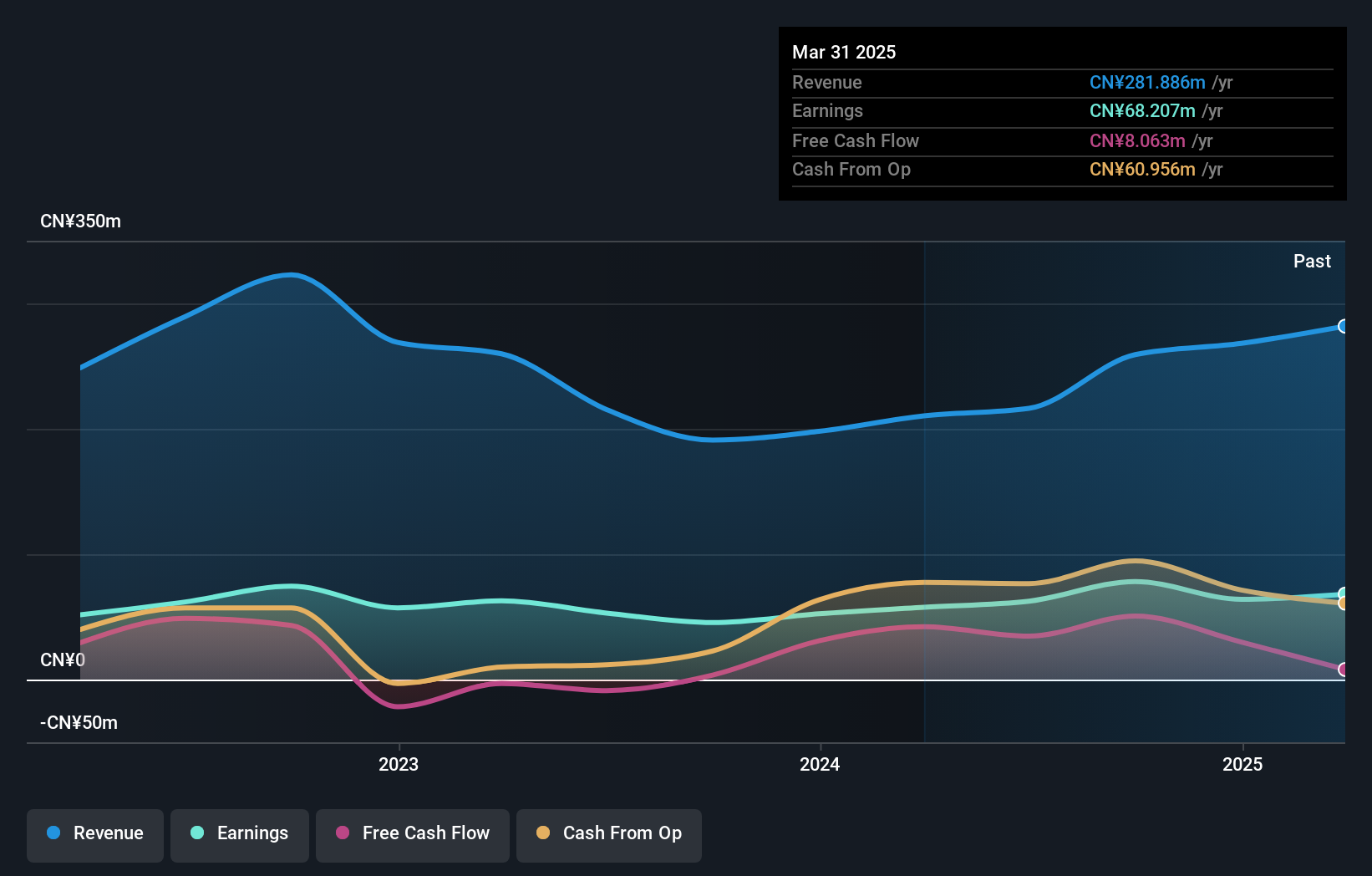

Nextool Technology, a relatively small player in the tech world, has shown impressive financial growth. Over the past year, earnings surged by 72%, significantly outpacing the Semiconductor industry’s 16.5% growth rate. The company is debt-free and trades at nearly 30% below its estimated fair value, indicating potential undervaluation. Recent buyback activities saw Nextool repurchase shares worth CNY 0.3 million, reflecting confidence in its market position. For the nine months ending September 2024, sales reached CNY 197 million with net income of CNY 57 million, highlighting robust operational performance and high-quality earnings without cash runway concerns due to profitability.

- Click to explore a detailed breakdown of our findings in Nextool Technology's health report.

Gain insights into Nextool Technology's past trends and performance with our Past report.

Googol Technology (SZSE:301510)

Simply Wall St Value Rating: ★★★★★☆

Overview: Googol Technology Co., Ltd. focuses on the research, development, manufacturing, and sale of motion control products both in China and internationally, with a market cap of CN¥9.30 billion.

Operations: Googol Technology generates revenue primarily from its Industrial Automatic Control System Equipment Manufacturing segment, which reported CN¥421.52 million. The company has a market capitalization of approximately CN¥9.30 billion.

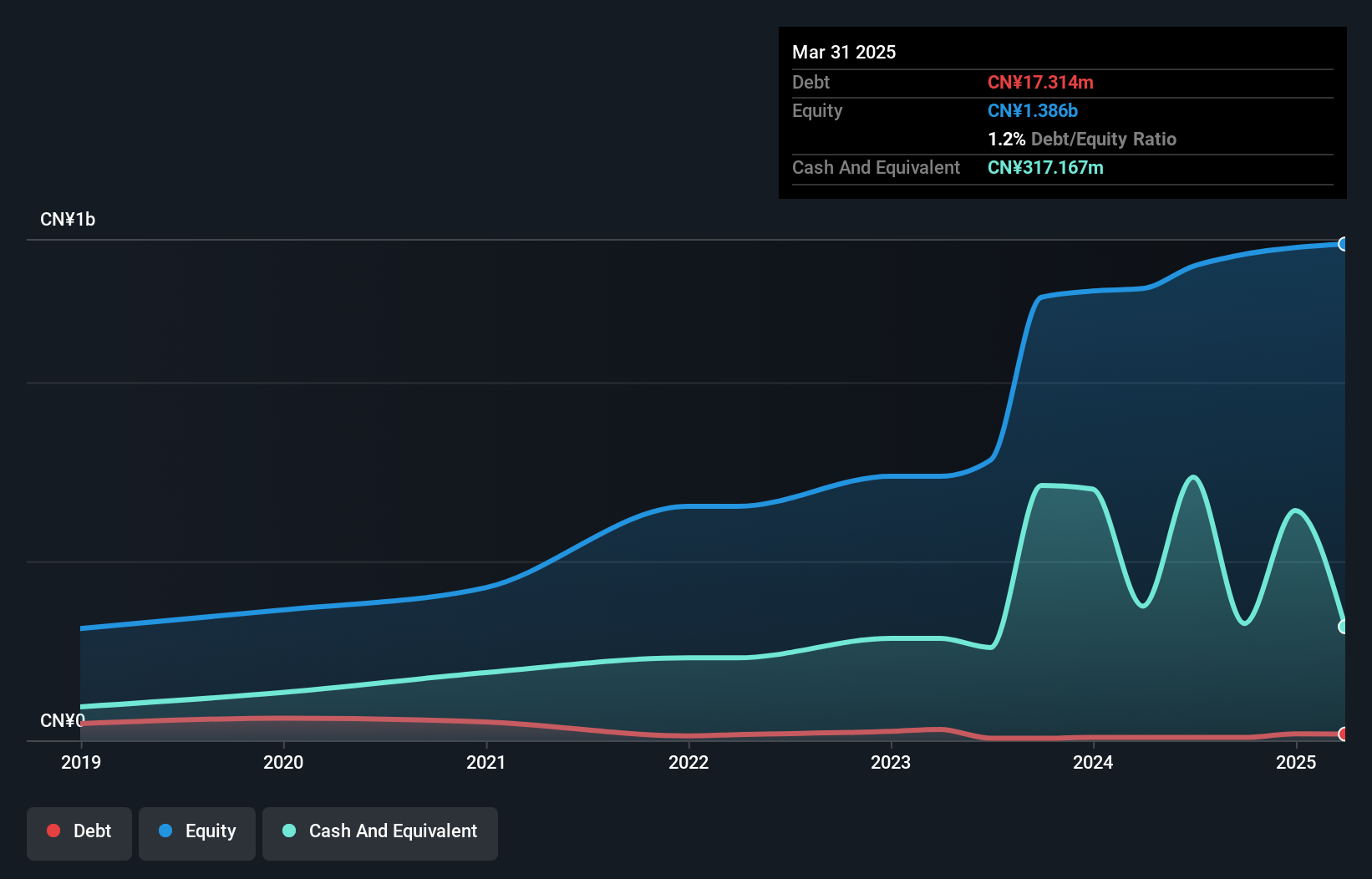

Googol Technology, a smaller player in the tech space, has shown promising growth with its earnings rising by 24.8% over the past year, outpacing the Electronic industry's 1.9%. Despite a large one-off gain of CN¥21.4M impacting recent financial results, it remains profitable and boasts a robust cash position exceeding total debt. The company's debt to equity ratio impressively improved from 16.6% to 0.6% over five years, although free cash flow is negative at present. Recent earnings reports for nine months ending September 2024 show sales at CNY295.6 million with a slight increase in net income to CNY29.22 million compared to last year’s figures.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4512 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603088

JDM JingDaMachine (Ningbo)Ltd

Produces and sells precision stamping parts in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion